Elon Musk is one of those iconic figures the world occasionally conjures up to wow and entertain the masses. As media generated symbols of success go he ranks up there with the best of them. Much of the aura that surrounds Musk

comes from his success at PayPal. Musk co-founded X.com., an online

financial service and e-mail payment company, in March 1999. One year

later, in a 50/50 merger, X.com joined PayPal a company that operated an

auction payment system similar in size to X.com. Musk was instrumental

in organizing this deal due to his belief in emerging online transfer

technology.

The combined company at first adopted X.com as the corporate name, but

in February 2001 changed its legal name to PayPal Inc. Musk is credited

in driving the new PayPal to expand and focus on a global payment

system, in October 2002, PayPal was acquired by eBay for $1.5 billion in

stock, Musk, the company's largest shareholder, owned 11.7% of PayPal's

shares.

|

| Elon Musk, Visionary And Wonder-Boy? |

With his youthful looks and forward thinking the media latched on to Musk and propelled him into being viewed as a visionary and wonder-boy that turns everything he touches to gold. When talking about the CEO of Tesla Motors, Bloomberg News almost

always says "Billionaire Elon Musk", this happens so often that many

people probably think his first name is "Billionaire". As to the source of his success, it seems

Tesla Motors Inc., SolarCity Corp. and Space Exploration Technologies Corp., known as SpaceX, together have benefited from an estimated $4.9 billion in government support, according to data compiled by The Times. This figure includes a variety of government

incentives, including grants, tax breaks, factory construction,

discounted loans and environmental credits that Tesla can sell. It also

includes tax credits and rebates to buyers of solar panels and electric

cars. The

figure underscores a common theme running through his emerging empire: a

public-private financing model underpinning long-shot start-ups. He definitely goes where there is government money,” said Dan Dolev,

an analyst at Jefferies Equity Research.

An example of how deep these subsidies feedback into the numbers is that Tesla collected more than $517 million from

competing automakers by selling environmental credits. In a regulatory

system pioneered by California and adopted by nine other states,

automakers must buy the credits if they fail to sell enough

zero-emissions cars to meet mandates.

I have written several articles about Tesla and Musk over the years but as I continued my research for this update and a more in-depth piece my eyes literally began to glaze over at the magnitude of the subsidies. Government

support is a theme of all three of these companies, and without it, none

of them would exist. Then comes the issue of corporate incest, in August of 2016 Tesla formally

announced it would be acquiring ailing SolarCity in an all-stock $2.6

billion merger. At the time Musk owned 22% of SolarCity which was founded by his cousins. The merger was promoted on the idea that Tesla's mission since its inception was part of Elon Musk's overall "Secret Tesla Motors Master Plan" to expedite the world's transition to

sustainable energy and away from a fossil fuel economy. Musk called the merger a no-brainer and said it was an

accident of history that Tesla and SolarCity were

ever separate companies.

|

| Only About 1 In 5,000 Cars Is A Tesla! |

Tesla is in the

news far more than a company with such a small footprint would

merit. Much of its significance is derived from Musk who remains a master at getting press coverage, most of it "free"

and positive advertisement

. Please take note of how insignificant these

numbers really are. Tesla Motors announced in early August 2009 that it had achieved overall

corporate profitability for the month of July 2009 when it earned approximately

$1 million on revenue of

$20 million.

Profitability arose primarily from improved gross margin on the 2010

Roadster, Tesla’s award-winning sports car known for its designs and "very sexy lines", similar lines have been

on the drawing boards for years but were impractical because of the

internal combustion motor and all the mechanical junk

required to support it. Tesla, which like all automakers records revenue

when products are

delivered, shipped a record 109 vehicles at the time and reported a

surge in

new Roadster purchases. Even to date, Tesla's numbers remain small Tesla is said to have delivered 50,580 vehicles in all of 2015.

The value of Tesla's stock dramatically changed years

ago following the report where it made

its first quarterly profit, its market value soared to more than $10

billion. It should be noted a large part of the increase in the stock

price occurred when

people that had short positions in the stock were caught in a short

squeeze and forced to buy back their stock. At the time Musk said, “I thought it would be

quite difficult to raise the capital for

Tesla.” he went on to state his realization the electric-car maker

could retire its U.S. loan nine years early didn’t arise until Tesla

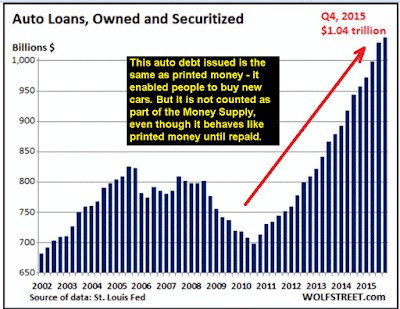

shares unexpectedly surged. Since that time Tesla's fortunes have moved in lockstep with a surging stock market. In an

upbeat article just published by Inside EVs, it was pointed out that Ford stock has fallen 23 percent from 2015-2017 and now sits at

$12.65 per share. Tesla stock is on the rise, approaching an all-time

high, at about $281 right now. This accounts for a market share of $43

billion for the electric startup, compared to Ford’s $49 billion.

Tesla currently has a market cap that is 88% of Ford its much large competitor. It is important to note that

in January 2016, Ford Motor sold 173,723 vehicles in January 2016 while Tesla made a little over 80,000 cars in all of last year and has sold only about

191,000 vehicles to date. Ford built over 6.5 million vehicles in just the last year alone. As for

Tesla's stock which continues trading at incredibly high multiples, much of that

can be contributed to the historically low-interest rates and the luck

of being in the "QE moment" rather than the company's financial success.

Bears and those that doubted if the company could hold together

ironically have pushed up the stock adding to the image that Musk

lives a charmed life. Remember the company had received a huge

government low-interest loan to kick start its existence, also note that

it has no legacy cost or issues that plagued so many of its

competitors. Now thanks to the gobs of money looking for any kind of

return, Tesla can borrow cheaply. Like several other high flyers lead by

self-promoters and propelled forward by media hype Tesla has been on a roll.

While it has not received the attention Tesla has garnered it should be noted that

most automakers have placed fuel cell electric vehicles with customers,

and many plan to introduce a Fuel Cell Electric Vehicle better known as

an FCEV

to the early commercial market over the next year or so. By 2020,

automakers expect to place tens of thousands of fuel cell electric

vehicles in the hands of California consumers. Among the automakers which are trying to bring this technology closer

to customers are Honda, Toyota and Hyundai Fuel cells could derail Tesla's vision of a world

where its battery-powered vehicles fill our roadways. Currently, lithium-ion battery technology powers Tesla’s electric vehicles.

It could be argued that Tesla could do a "switch-a-roo" and simply

change out its power source from battery power to fuel cells.

Adoption of the

fuel cell as the most desirable way to power not only vehicles but other

power hungry devices would be a big setback for Tesla because the

company has invested a huge five billion dollars in a new battery

factory. If fuel cells rule the day this would

spell big problems for Tesla.

It does not take much research to see public subsidies for Musk’s companies stand out both for the

amount, relative to the size of the companies, and for their dependence

on them. No effort has been spared to spin Tesla and Elon Musk as a

finished success, of course, the "proof will be in the pudding" when we

look back years from now. Time will most likely determine whether Musk

is viewed as an unabashed promoter or a serious visionary. Using

government programs and loans as well as money from investors Musk has

built a pulpit from which to position himself for praise and at times ridicule.

David Stockman wrote in May of 2015, In a world saturated with

excess automotive capacity and dominated by some of the most formidable

engineering, manufacturing and marketing organizations on the

planet—Toyota, BMW and Ford, to name just three–

There is no way that an amateurish circus barker like Elon Musk will ever make a profit selling electric vanity cars to the 1%. Stockman went on to state, You might describe Tesla as $30 billion of capitalized hopium, but

that would be too generous. In an honest free market, Tesla would have

long ago been carted off to the chapter 11 junk shredder.

Tesla enters 2017 with the goal to launch a new car, open a large battery factory, and perfect autonomous driving. When all the hoopla ends,

the question is whether larger competitors will simply overwhelm and

crush Tesla, or will Tesla instead position itself to grow and maybe

take over a competitor to help propel it forward. Remember this is a

field where many have failed, one great example was the Delorean. I have

become predisposed to discount, and have actually grown a massive

aversion to "media hype", this is one reason you should color me

skeptical. The city where I live, like other cities across the world,

have a long list of bold men herald and declared to be "gods gift to

business," many in the end flew too close to the sun only to crash and

burn. In any case, what has happened at Tesla Motors and to Elon Musk's

other ventures up until this point might be enhancing the meaning of the phrase, "I would

rather be lucky than good!"

Footnote;

Another company that was not so lucky and saw its fortunes fall was Fisker Automotive, for

more on this folly read the post below. Other related articles may be

found in my blog archive, thanks for reading, your comments are

encouraged,

http://brucewilds.blogspot.com/2013/04/fisker-automotive-another-government.html