|

| The Mind Of The Common Millionaire Is Worth Studying |

One of the best ways to gather ideas that will move you forward is to read and what you read is important. I was moving around some books the other day and opened a book by the name of “The Millionaire Mind”. The author Thomas Stanley also wrote the book “The Millionaire Next Door” which was a best-seller a few years back. The people he studies are financially secure. This book takes a deeper look into how these people think and make their money. It slashes through the false images of wealth often portrayed by mainstream media of private jets and homes on remote islands and deals with the real world.

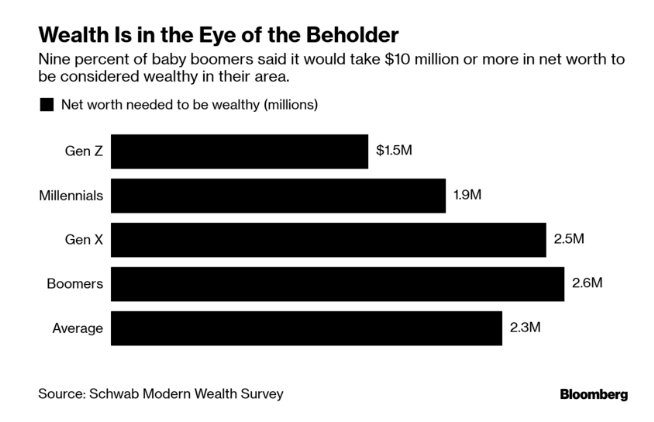

Unfortunately, it would be disingenuous not to mention that a major stumbling block to becoming rich today is the force of inequality washing over the world. When I look back at what many older Americans have accomplished over the years a strong argument could be made that their feats would be far more difficult to pull off in the economic environment we have today. Also, we should note that the term "millionaire" used to be thrown around as the definition of the "wealthy" in the United States, but that line is or has since been redrawn. According to Charles Schwab’s annual Modern Wealth Survey which sampled 1,000 Americans between the ages of 21 and 75. it appears many people now feel that in order to be "rich", they need to be worth an average of $2.3 million.

|

| How Much Money - To Be Wealthy (click to enlarge) |

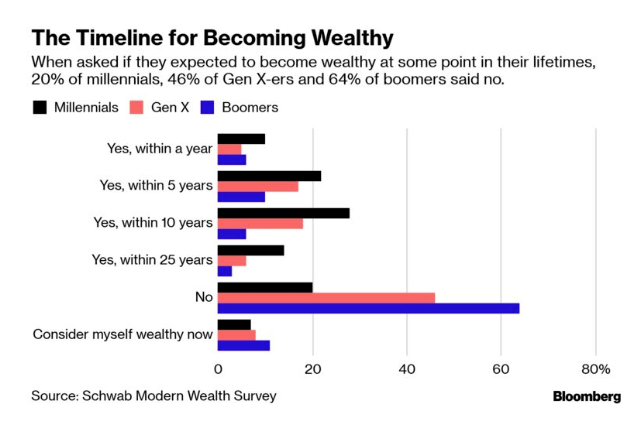

Many millennials, those roughly age 22 to 37, are now at the point in life where the "fickle" topic of wealth, what it is, how much you need, and such has become very important to them. Interestingly more than 75% of this group surveyed indicated their personal definition of wealth was "really about the way they live their lives, rather than a discrete dollar amount." Another sentiment they voiced was their desire to own real estate. Unfortunately, it is difficult to reconcile the fact that 60% of the millennials say they believe they will be wealthy "within 1 to 10 years" considering that 59% of those surveyed said they still live paycheck to paycheck.

|

| Expectations For Becoming Wealthy Are Often Unrealistic |

Circling back to the book, “The Millionaire Next Door.” far from what many of us might think after a great deal of study and research Stanley found the huge majority of millionaires are a real down to earth people. In his book, Stanley looks at where these people live, their favorite leisure activities, and the different factors that make them wealthy. Somewhat obscure and not just off the press this book is an excellent read and a manual for those of us wanting to get ahead. While it is not full of razzle-dazzle get rich quick schemes it is packed with a realistic view of how people build wealth and how they don't.

While the world is full of hype and false images, in his book, Thomas Stanley reminds us how people really become wealthy. He also advises us to remember that you can’t judge a book by its cover and that the fella you see mowing his yard or sitting next to you as you fly in coach may be a multi-millionaire. The book is about making and saving money the old fashion way, not through winning a lottery. Accumulating wealth does not mean a person is greedy but often a reflection of hard work, planning, and being responsible. The picture painted in Stanley's book is a far more realistic look at the rich and wealthy in America than the hyped and unhealthy fixation the media has which is often focused on billionaires.

Being wealthy is about common sense and managing expectations. Spend less than you earn. Keep yourself healthy. Cater to your needs and not your wants. learn to laugh and "look on the sunny-side of life" and finally.... realize you are going to die someday so enjoy the present.

ReplyDeleteAnother good book is " God Wants You to Be Rich" bestselling author Paul Zane Pilzer provides an original, provocative view of how to accumulate wealth and why it is beneficial to all of humankind. A theology of economics, this book explores why God wants each of us to be rich in every way

ReplyDelete“Thrift and industry” are the two keys to material success in life.

ReplyDeleteAdvice once given by Thomas Mellon to his son, and future Secretary of Treasury to three US presidents, Andrew (c. 1870).