| And Its Gone! |

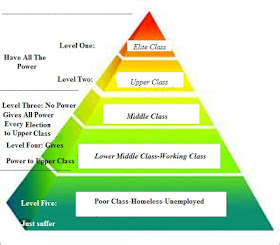

As the financial pain from the pandemic and government restrictions placed on businesses continue, much of the money thrown out to ease our pain has rapidly flowed into the hands of Wall Street and big business. The reality that most small businesses close in failure underlines the risk involved in loaning money to such concerns. Still, it is difficult to deny the importance of small business in the overall economy. It plays a major role in communities by both creating jobs and allowing individuals to better their lot in life.

During a recent exchange between House

Financial Services Committee Chairwoman Rep. Maxine Waters of

California and Powell, it became evident that Powell was not rushing to implement changes in the way things are done in an effort to aid small businesses and level the playing field. Waters suggested the Fed and

Treasury Department lower the minimum size of the loans under the Main

Street Lending Program to $100,000 from the current $250,000 to help a larger number of small companies that have been hurt by the

pandemic. Powell even went so far as to claim there was little demand for loans below $1 million.

A business owner struggling to pay his three workers would dispute Powell's statement about little demand for smaller loans. Both Powell and Treasury Secretary Steven Mnuchin have also voiced concern about the commercial real estate sector and how they both indicated it is not easy for the federal government to craft an aid program to blunt the damage growing in this part of the economy. Mnuchin said the PPP program has played a role in enabling firms to continue paying their rent so landlords can pay their mortgages. There is fear building in the area of commercial real estate that defaults will send property values into a downward spiral.

Sadly, the same policies that dump huge money into larger businesses because it is an easier and faster way to bolster the economy give these concerns a huge advantage over their smaller competitors. A big problem is that this often is enough to put smaller companies out of business. The damage this is doing to society is something that will be difficult to remedy. Once businesses close a series of negative events generally unfold such as buildings going empty and debts not being paid. This tends to impact the economy and communities for years.

On Thursday Powell and Mnuchin appeared before the Senate Banking Committee and answered even more questions about the hardship the coronavirus has brought upon the economy. While they see significant support for legislation that supports jobs and extending the PPP the recognized the gap between the House and Senate negotiations. Still, they gave little doubt more money and fiscal support will be needed and they are ready to act. This includes looking at ways to expand the Main Street lending facility and make the programs more flexible. This means we will probably see more money flowing into a forgivable loan or grant programs. Both indicated the need to get more PPP money to businesses with decreased revenue saying it would be very important in the effort to save jobs.