|

| Expectations Can Drive Inflation |

Up until now, the law of diminishing returns has required larger and larger amounts of stimulus to be thrown at the financial system each time the economy begins to turn down. The continued appointment of dovish and easy money advocates to positions in high finance does little to reinforce confidence in the fiat currencies on which we rely. The rising value and interest in precious metals and cryptocurrencies such as bitcoin stand as evidence investors are seeking alternatives to the fiat currencies issued by nations and central banks.

|

| At Some Point Inflation Will Raise Its Ugly Head |

In the past, I have put forth the idea that inflation could rule the day even if central banks are unable to keep the wheels on the bus and the economy collapses. This powerful force of inflation coupled with slow economic growth is known as stagflation. Like inflation, it can devastate those improperly invested when it moves onto play. It is important to remember the cost of all commodities, goods, and services do not move at the same rate or even necessarily in the same direction.

This means it is the overall rate of inflation we should be concerned about. Prices can rise for several reasons such as strong demand, a scarcity of goods, or even because of how things are taxed. Many people look at how much money or credit is being created as an indicator of what is to come. Of course, it is not just the amount of money but how fast it is moving through the economy that complicates currency expansion as a guide. This is known as the velocity of money which has been falling for years.

I contend a large often overlooked contributor for this falling velocity is rooted in the growing inequality of wealth distribution. Simply put, as wealth matriculated to a smaller share of the population at the top, the money they acquired has been put into investments where it just sits. This drags down the overall speed at which money is moving throughout the system. If this is correct, a case can be made that when money starts to be reallocated and shifted to other investments the effect on inflation could be quite dramatic.

|

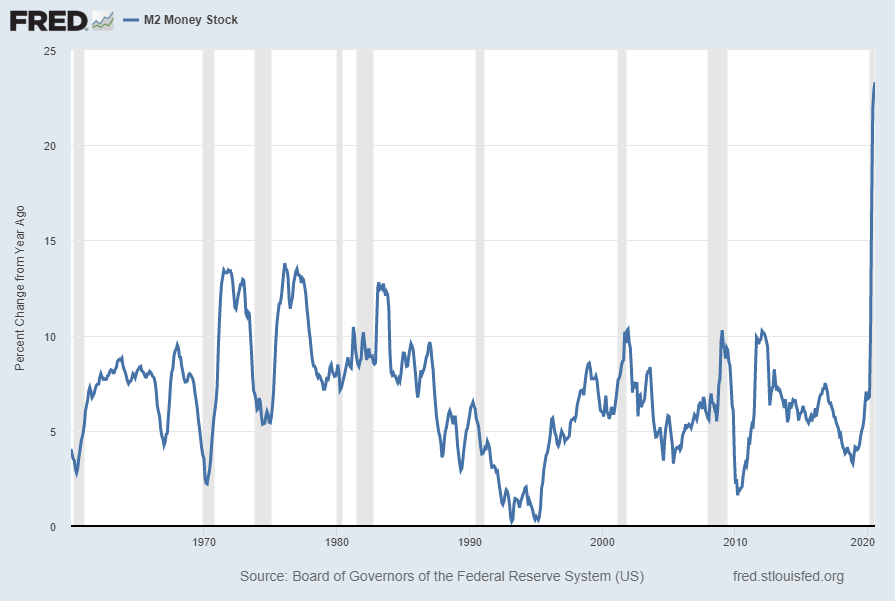

| M2 the broader measure of the money supply has soared |

By simply adding in the expectation that inflation is waiting in the wings to make a grand entrance a new threat is added to the financial system. Even investors beginning to shift towards assets that do well during times of inflation may be enough to set in motion a self-feeding loop or cycle. When fiat money that has quietly sat in paper promises begins to be exchanged for tangible assets and inflation hedges it will reverse the long falling velocity of money.

Inflation puts a spotlight on the difference between liquidity and solvency. It also brings with it a slew of other issues such as higher interest rates which generally hit many sectors of the economy such as construction very hard. Higher interest rates also result in people having a difficult time paying for or financing big-ticket items such as automobiles and homes. In short, it puts a great deal of stress on all parts of the economy including the government deficits that have exploded since the 2008 financial crisis.

Two often-overlooked factors support the idea we are headed down a path of inflation rather than deflation. The first is many laws have been set in place to raise the minimum wage. The second is the fact is so many Americans work for the government. These are mostly full time and workers seldom get laid-off without pay. Figures from the National Debt Clock show just under 150 million workers are in the workforce and nearly 24 million of them are employed by the government. That is almost one in six.

As for the potential for deflation taking hold when defaults rise as debt becomes unsustainable, this is far less likely than in the past. This is because several safety valves have been put into the system over the years. These are evident in the way bankruptcies take place, companies are now factoring in more bad debt in their price structure and last but not least an attitude governments and central banks should step in and save large businesses and institutions in danger of failure.

The government's oversized role in today's economy which is much larger than it was during the Great Depression tends to put a net under the ability of prices to fall. Many people see this as a good thing but it has also led to the perpetual zombification of problems that artificially low-interest rates will not solve. Masking the fact many companies and pension funds are insolvent does not garner a strong economy.

The massive growth in negative-yielding debt across the globe has reached a record $18 trillion. This effort to extend the pretense the growth in debt can be sustained has been led by the euro-zone and Japan, is not a sign of confidence, but rather a huge risk of secular stagnation. The chickens may soon come home to roost is an old saying that means, you cannot escape the consequences and repercussions of your actions. In this case, when applied to the Fed and other central banks it means they have put the world's financial system in a precarious position.

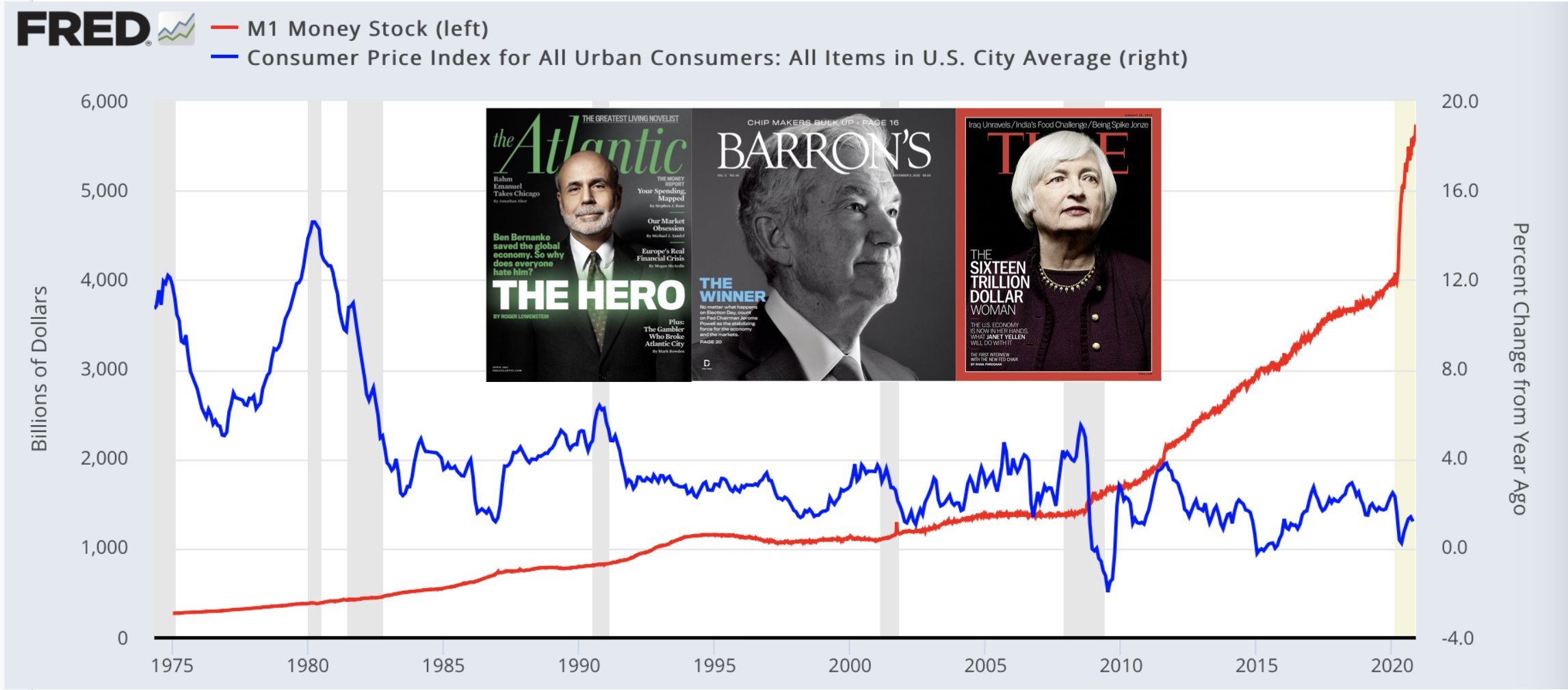

The policy of Modern Monetary Theory has failed in places like Venezuela and Argentina. In these countries, “money for the people” policies have-resulted in rampant inflation. While these small countries have little effect on the overall global financial system, the Fed does and it has massively increased the US M1 money supply. In the last two weeks of November, the M1 money supply jumped by over 14%. This would constitute an annualized rate of 367%. More important is this has allowed the other major central banks to follow suit and increase their money supply without debasing their currencies.

While the blame for this is being solidly placed on the back of Covid-19, it could be argued the financial system and the economy has been skating on thin ice for over a decade. This is not the first time the Fed and other central banks have been forced to pony up liquidity in an effort to shore up a sagging stock market. The oversized deficits governments have been running are also a sign all is not well. As far as returning to what many people see as normalcy, that seems to be a mirage that continues to move away every time we think we are getting closer.

Across the globe, the growth in the money supply, paper promises, and credit has far outpaced the growth in tangible assets. This includes pensions and a slew of other unsustainable Ponzi scheme like investments. Instead of stimulating economic activity, the current expansion in the money supply has the strong potential to unleash inflation across the globe. If this happens, far more countries will slip into hyperinflation than in the past. Restoring faith in fiat money following such an event will be painful and difficult.

Republishing this article is permitted with reference to Bruce Wilds/AdvancingTime Blog