|

| To Clarify, Main Street Is Not Wall Street |

History shows that misguided financial policies often end in a crisis, in this case, it is likely to play out in massive inflation. Milton Friedman knew a bit about this, he said; The government benefits the first from new money creation, massively increases its imbalances, and blames inflation on the last recipients of the new money created, savers and the private sector, so it “solves” the inflation created by the government by taxing citizens again. Inflation is taxation without legislation.

| https://www.youtube.com/watch?v=PeIeFUJ9EY |

The Fed's actions have not demonstrated a thorough understanding of the economy. About to add to the problems on Main Street, anyone

watching the news should be well aware that President Biden has come

out during the last few days talking about a big tax increase. With

the Internal Revenue Service already swinging in the wind and in utter

disarray due to the massive number of lane changes it has been forced to

make over the last year can the IRS even manage another huge rewrite of

the rules without a year or so to catch up? What we are witnessing is insanity at the highest level.

The

mind-boggling stupidity of those at the Fed suggesting negative

interest rates might solve our economic woes should stop us dead in our

tracks. The only thing dumber was the idea put forth in an

article questioning whether the government should mandate

people to save money. Two important issues come head to head here

resulting in a massive explosion, first, the Fed's artificially

low-interest rates are obliterating savings at a time of growing

inflation, and second is that when people retire without savings, it

will fall upon the government to support them until they die. This does not bode well for the national deficit.

|

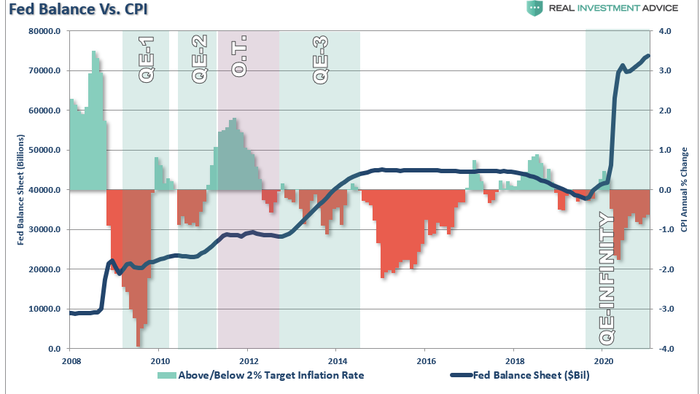

| The Fed's Balance Sheet Has Exploded |

To be perfectly clear, the problem we face is that poorly spending even trillions of dollars does not necessarily create a strong economy. The idea we can simply throw money at our problems is flawed. As small businesses close their doors forever, many of these jobs won't be coming back. This translates into far higher deficits going forward as many more Americans exit the workforce. Simply throwing money at a problem does not guarantee it will halt the formation of a self-feeding loop.

While many investors talk about the link between low-interest rates driving the economy and markets ever higher this correlation is very weak. Japan is proof that low-interest rates do not guarantee a booming economy. The current low-rates combined with our massive government deficit is creating a false economy. It is also baking in a higher overall cost structure. Want to know where the real cost of things is going, just look at the replacement cost from recent storms and natural disasters.

The Federal Reserve and the government does not have a better or more accurate understanding of the needs and demand for goods and services or the productive capacity of the economy than Main Street. Instead, the Financial Government Complex has a huge incentive to overspend and transfer its inefficiencies to everyone else. People like Powell and Janet Yellen are insulated from the real world and the suffering of those who watch helplessly as their lives are upended and destroyed. We have entered uncharted waters and sadly, we have damn fools at the helm.

Massive liquidity injections may temporarily mask a multitude of sins but is not a long term solution. It defies logic to think if the economy is really strong that the Fed, "must do more" and all the jawboning Powell does won't change the ugly reality we face. Even if Powell stands on the rooftop and shouts, "All is well!" we have little reason to trust him. He has turned investment rules upside down and like those before him, his actions have benefited those deemed too big to fail and the crony capitalist tied to the government.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Wake up Americans!

ReplyDeleteYour Fed, CIA and other 3 letter govt agencies have sold you down the river and around the globe for 100 years, printing money and chasing phantom commies.

its time to pay, and its gonna hurt.