Politicians are in the business of keeping things looking as good as possible while they are in office. This is why they always kick the can down the road and generally support anything geared to keep the party going. Much of what they do is to delay the public from pain and suffering until they are out of office. The trick employed for over a decade since its emergence and acceptance of Modern Monetary Theory, has been to continually expand the monetary base and government spending. This has turned our

economic system upside down and caused inequality to surge.

|

This Chart Is Based On Hope

|

Those of us skeptical of the substance and

sustainability of MMT have been brushed aside. Still, most of us expect this monetary experiment to collapse and end in ruin. To us that believe in old-school

economics, debt matters and is tied directly to interest rates and

inflation.

With every trillion dollars of debt representing an additional 3,000 dollars of spending for each man, woman, and child in America this is too big to ignore. For years, central banks across

the world claimed a lack of inflation was the key

force driving their QE policy and permitting it to continue, however,

now that inflation has raised its ugly head, much of their flexibility is gone. Adding to the problem is the fact that as interest rates rise governments are being forced to pay higher interest rates on their debt.

With

America's national debt having blown past 31 trillion dollars, nothing is as

sobering as

looking at future budgets. Those of us rooted in the tried and true

economics relied upon in the past are worried. For

years the argument that "

This Time Is Different"

has flourished but history shows that periods of rapid credit expansion

always end the

same way and that is in default. This also lays bare the grim reality that

any claims Washington makes about the budget deficit being under control

is a total lie.

America is not alone in spending far more than it takes in and running a

deficit. This does not make it right or mean that it is

sustainable. Much of our so-called economic growth is the result of

government spending feeding into the GDP. This has created a

false economic script and like a Ponzi scheme, it has a deep

relationship to fraud.

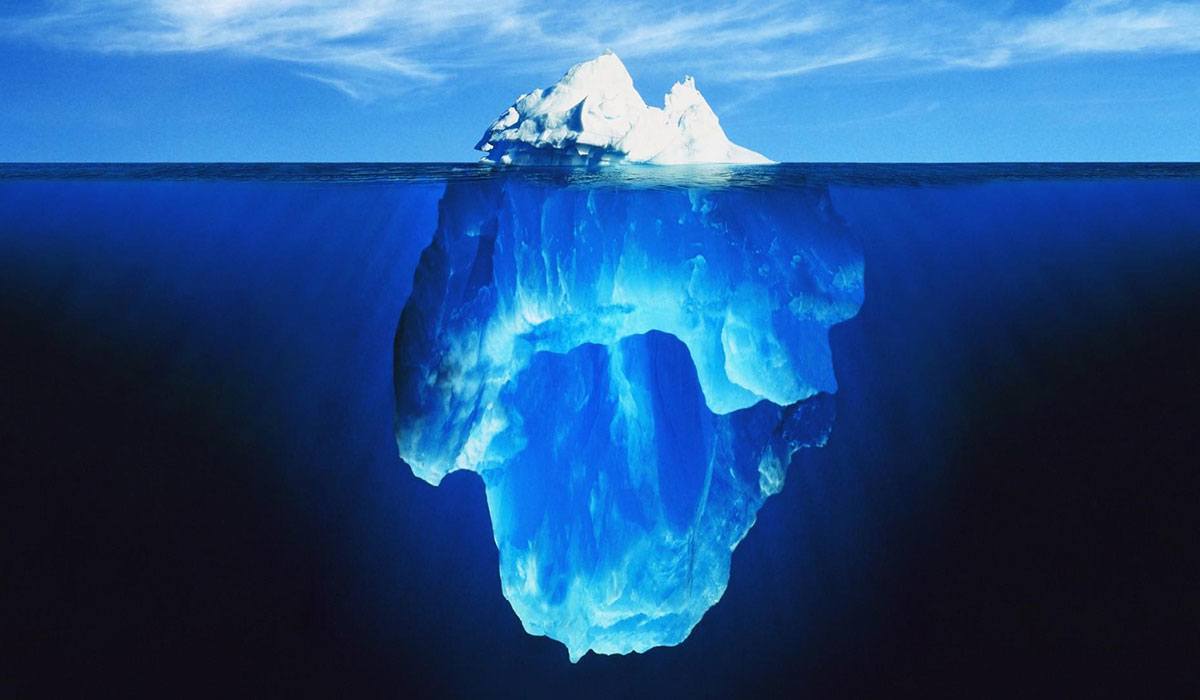

Global debt has surged since 2008, to

levels that should frighten any sane investor because history shows that debt has always

had consequences. Much of the massive debt

load hanging above our heads in 2008 never really went away, it has

merely been transferred to the public sector where those in charge of

such things feel it is more benign. A series of off-book and backdoor transactions by those in charge has

transferred the burden of loss from the banks onto the shoulders of the

people, however, shifting the liability from one sector to another does

not alleviate the problem.

Years ago some Washington optimists were

forecasting that deficits would begin to decline in 2020, but boy they were wrong. Some even predicted a small surplus of 16 billion in 2026. Back then, the summary

that began on page one of the Mid-Session Review came across as

a promotional piece using terms like MAGAnomicics. It praised and

touted the Trump administration for its vision and great work. Since then, the wild

spending those in charge have justified due to Covid-19 has blown the

lid off the budget and replaced it with

more trillion-dollar deficits going forward.

While numbers don't lie we should remember many of the people using them do. Reports like those flowing out of Washington years ago are an example of how they can re-frame a colossal train

wreck into something more palatable. As

a result of the American economy having survived

with little effect what was years ago described as a "financial

cliff" the American people have become emboldened and now enjoy a false

sense of security. Today

instead of dire warnings we hear news from Washington and the media that everything is expected to return to normal and everything will be fine.

|

| In 2019, National Debt Hit 23 Not 12 Trillion dollars |

The chart to the right that was published years ago predicted that by 2019 the national debt would

top 12 trillion dollars, instead it hit 23 trillion.

Projections

made by

the government or any group predicting budgets based on events that may

or may not happen at some future date are simply predictions and not facts. This means that such numbers are totally

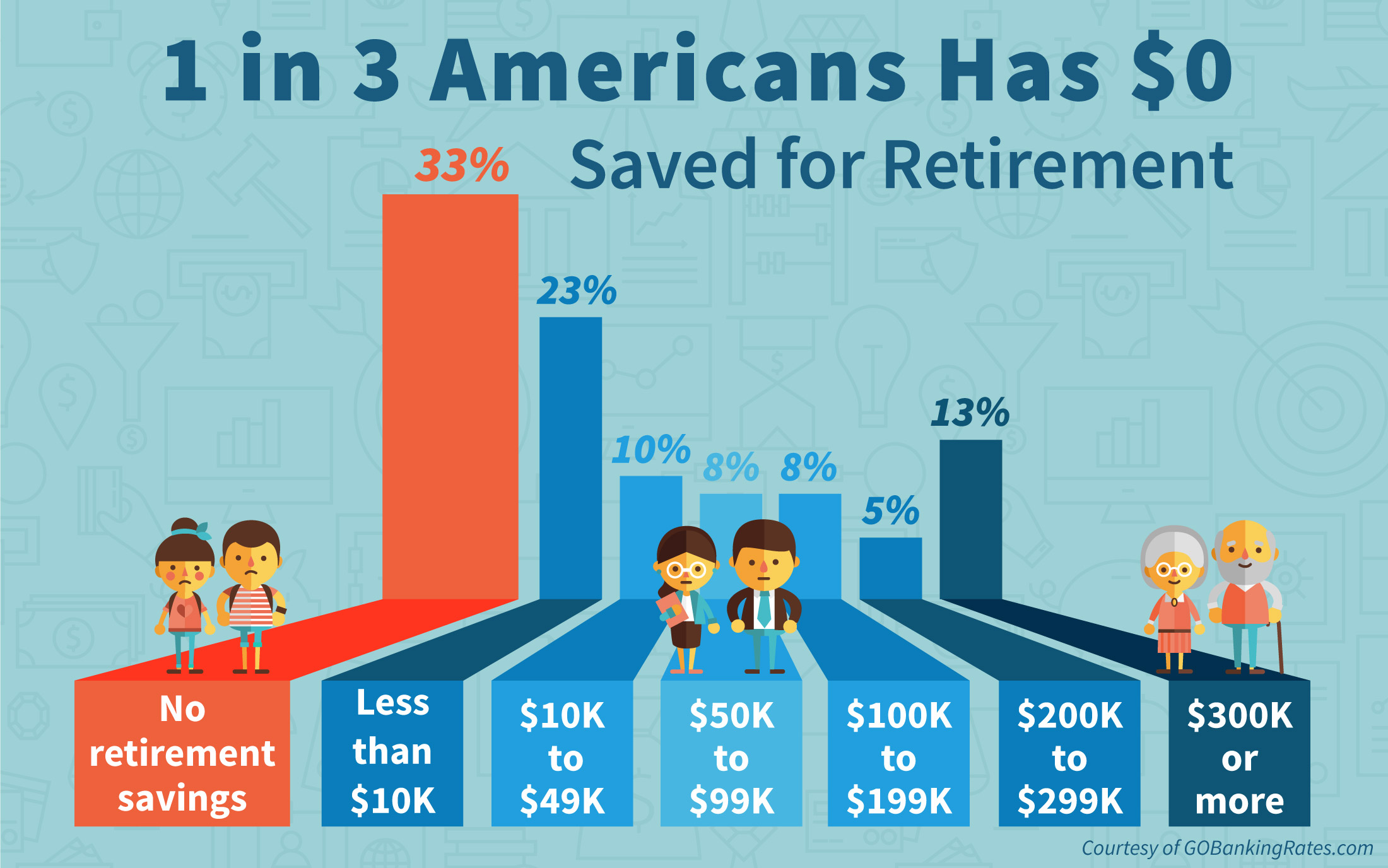

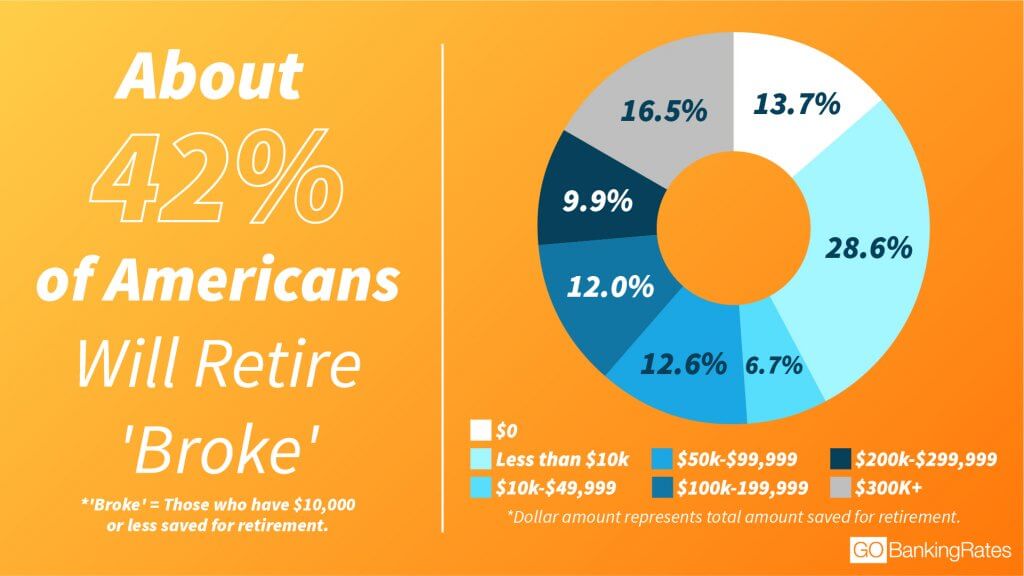

unreliable. The ugly truth many

people ignore is that starting in 2018 entitlements became the driving

force carrying the deficit higher and into

nosebleed territory. This is why we should expect the

deficits in our future to be dramatically worse

.

It is very disturbing that so many people have forgotten or never

taken the time to learn about recent financial history.

By recent, I'm referring to the last fifty to one hundred years. Back

in September of 2012, I wrote an article reflecting on how the

economy of that time had been greatly shaped by the actions that took place

starting around 1979. The most important event was Fed Chairman Paul Volcker crushing inflation by raising the fed fund rate which averaged

11.2% in 1979 to 20% in June 1981

Interest rates, inflation, and debt do matter and

are more significant than most people realize. Rewarding savers and

placing a value on the allocation of financial assets is important. It

should be noted that many Americans living today were not even born or

too young to appreciate the historical importance and ramifications of

the events that took place back then. The impact of higher interest

rates had a massive positive impact on corralling the growth of both

credit and debt. It acted as a crucial reset to the economy which lasted

for decades. Below is an abbreviated version of that article.

A Time For Action, 1980?

In his book "A Time For Action" written in 1980 William Simon, a former

Secretary of the Treasury tells how he was "frightened and angry". In

short, he sounded the trumpet about how he saw the country was heading

down the wrong path. William Simon (1927 – 2000) was a businessman and philanthropist. He became the Secretary

of the Treasury on May 8, 1974, during the Nixon administration, and was

reappointed by President Ford and served until 1977.

I recently picked up a copy of the book that I had read decades ago and while re-reading it I reflected on and tried to evaluate the events that brought us to today. It is hard to imagine how we have made it this long without finding long-term solutions and addressing the concerns that Simon wrote about so many years ago. Back then, much of the talk was about billions of dollars, today it is about trillions of dollars, something has gone very wrong.

|

| We Cannot Underestimate The Importance Of The Reset By Paul Volcker In 1980 |

By the end of the 70s inflation started to soar. Only by taking interest

rates to nosebleed levels was then-Fed Chairman Paul Volcker able to

bring inflation back under control. Paul Volcker, a Democrat was appointed as Federal Reserve chairman

by

President Carter and reappointed by President Reagan. Volcker is widely

credited with ending the stagflation crisis where inflation peaked at

13.5% in 1981. He did this by raising the fed fund rate which averaged

11.2% in 1979 to 20% in June 1981. This caused the prime rate to hit

21.5% and slammed the economy into a brick wall.

This also affected and shaped the level of interest rates for decades.

|

| 2012 Rates Appear Ready To Fall Off The Chart! |

This action and the increased interest rates in the following years are

credited by many to have caused Congress and the President to

eventually balance the budget and bring back some sense of fiscal

integrity and price stability to America.

As the debt from the Vietnam war and soaring oil prices became

institutionalized we moved on. Interest rates slowly dropped and the

budget came under control. In recent years spending has again started to

grow and at the same time taxes have been cut. This has slowly occurred

over years and has been ingrained in the system.

Summary of the current situation; Today, with our debt at 23 trillion and growing, the path has again become unsustainable. We stand at the abyss, yet no one sees or feels threatened by a "financial cliff." Insane spending has become the new normal. The debt of the past has been replaced with larger numbers. What we are witnessing today is insane. It is time to revisit the issue of how interest rates, inflation, and debt all come together. While this is not what those in charge want, it will happen. Simply put, there will be a reckoning, this time is not different.

Republishing this article is permitted with reference to Bruce Wilds/AdvancingTime Blog