|

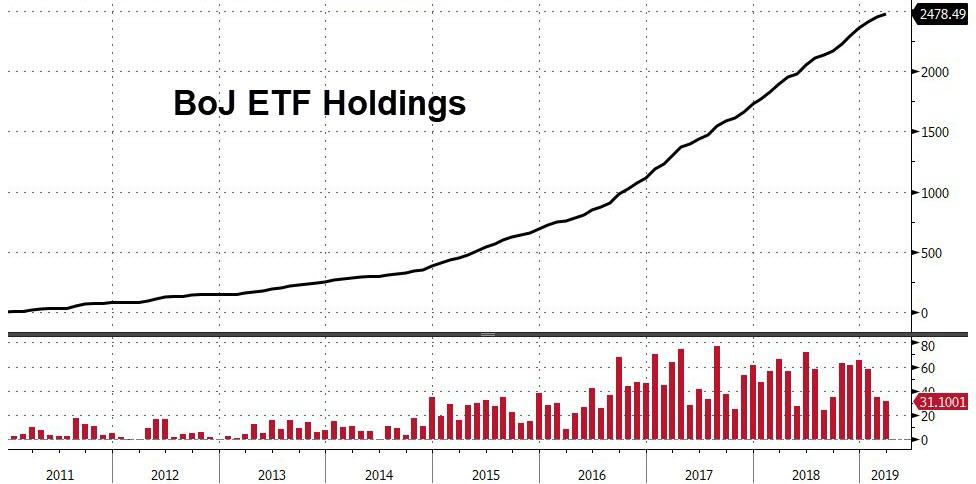

| The BOJ Buying ETFs Is Distorting Markets |

When true price discovery is lost or impaired management teams no longer can appreciate if any given executive decision is ultimately good or bad as the market's ability to reward and punish has been muted making any corporate decision, no matter how disastrous for the company, its employees, shareholders and peer companies, appear as positive and beneficial thus masking sings and warnings of a company's demise. In the case of Japan, the state, through the BOJ's intervention has ventured far down a slippery slope. Its actions have morphed into a program that seems to share a key focus on doing "whatever it takes" to keep the economy moving forward or nationalize its soaring debt.

Japan is past the point of no-return considering that a sharp or sudden downturn in Japanese stocks would damage the BOJ's net worth and could shake confidence in the yen. This has huge implications that could lead to a long overdue collapse in the yen which could end Japan's economy as we know it. The fall of great empires throughout history shows that states of unsustainable equilibrium cannot continue forever. When central bank involvement is no longer possible everything will inevitably crash. With the first and last price backstop gone, shareholders will rush to liquidate in a wholesale panic.

Global capital markets have been delighted by the recent U-turn of central banks in their endeavor to pursue monetary tightening and restore normalcy. Investors have chosen to ignore the reality this will make the eventual day of reckoning much more painful. At some point, it will become clear the only way for authorities to preserve current values is for further manipulation of our capital markets. Unfortunately, this type of last-ditch effort and other attempts to prop up the market by actions such as halting short selling to establish a false floor under market valuations and preserve the illusion of value where it no longer exists makes selling impossible and never works.

|

| The BOJ Soaring Presence In Market Equals Fraud |

Real momentum seems to ebb shortly after each new wave of stimulus and another fix seems to constantly be needed. The flaw with using this strategy as a long term solution is it runs directly into a wall known as the law of diminishing returns. The money and credit poured into the system often fails to flow to where it will be most productive and at the same time lessens the incentive to correct structural problems in the economy. Today's low interest and easy money environment breeds malinvestment, risk-taking, punishes savers, and breeds new debt at an incredible rate. This all tends to feed into a self-feeding loop that drives the development of a "false" economy.

What we see today is the evolution of what became known as the "Plunge Protection Team" a group given the job of swooping in and supporting the market and stabilizing it whenever a sell-off occurred. At the time this policy was conceived it was viewed as problematic because it tended to be a one-way road full of moral hazard that risked incurring huge losses if not successful. The answer to making it work has been never to let the market slip but put it on a path ever upward until what? Needless to say over the years this coupled with changes in taxation and stock-buybacks has greatly distorted stock prices and valuations bringing us new high after new record high. It is only logical that at some point disillusion and doubt will set in ushering in the endgame and panic.

What I want to make perfectly clear is that to hold and move the market upward keeping the illusion alive that central banks must all continue expanding credit and debt so the wheels do not come off the economy. It would be rather hard to sell the illusion all is well if unemployment soars and defaults skyrocket. This means the central banks remain trapped in a box Ben Bernanke built, Janet Yellen has reinforced and handed off to Jerome Powell. We must remember that Japan remains the poster child and living proof that low-interest rates do not guarantee economic growth and prosperity. The whole world is now on a path that mirrors the same unsuccessful path taken by Japan since its bubble economy popped decades ago. It is a path that avoids real reform and bails out the very people that caused many of our problems.

Powell's problem is complicated by the dollar's role in global currency markets. This means a misstep could easily bring down the global economic system. The Fed's actions have become responsible for not only what happens in America but the whole world. Because the stimulus created by any of the central banks can easily flow across porous borders asset distortion doesn't only occur in the country where credit originates. While a person can interpret all this as proof the markets are indeed rigged it also signals that any fall in prices is merely a signal for central banks to double down and rush in to buy more feeding into a self-fulfilling loop of speculation. This falsely accomplishes two things, it bolsters and supports current holdings while reinforcing the image markets are climbing higher because our economic future is getting brighter which is a narrative our complicit mainstream media is glad to provide.

In simple terms, the whole world is on a path that mirrors the same unsuccessful path taken by Japan since its bubble economy popped decades ago. It is a path that avoids real reform and bails out the very people that caused many of our problems. We are not creating real productivity growth or real wealth but simply driving up the value of certain markets and assets. This drives inequality by benefiting those who own or have assets but does little or even hurts the poor or those who have nothing. You could say this lessens or reduces the relationship of debt but in reality, this is only true if we see massive inflation causing wages and income to soar. In this "high stakes" game central banks have a strong incentive to continue on this course because pension funds around the world are in serious trouble and any fall in their assets would be a disaster.

As we continue down the path to nationalizing debt two enormous problems exist, the first is the economic growth lacks any real quality and the second even bigger issue is that under this policy eventually central banks will control or pretty much own everything at a distorted value they determine best suits their narrative or purpose. The good or bad news depending on how you look at it is this "great manipulation" will not work indefinitely, eventually, it will come crashing down around those in charge. All this is akin to a doctor telling a patient to double or triple his dosage when the medicine does not work. Policymakers across the world have captained our economic ship into uncharted waters that are full of peril and we are passengers on this trip where lifeboats will prove to be in short supply.

This blog is not written for money

or profit but as a way to share ideas

and thoughts. If you liked this post

feel free to E-mail it to a friend

or click the follow button

No comments:

Post a Comment