Over the years, we have seen a tremendous shift in risk from companies offering pensions to workers in the private sector. According to the LBS, 401(K) and other defined pension plans have rapidly been replacing traditional pension plans. From 1980 until 2008, participants in pension plans fell from 38% to 20% of the workforce. During the same time, employees participation in defined-contribution plans rose from 8% to 31%.

This has been great for many of these workers providing they made it through the 2008 financial crisis. Since then the stock market has soared. Unfortunately, Wall Street has been ripping off many of these investors by charging them fees at every turn. Adding to the problem these workers face is that there is a good chance America is about to drop into recession.

This means stocks may be about to head downward. This could take a big toll on the retirement savings of many Americans. Of course, those in retirement and nearing retirement would feel the most pain. It does not help that Americans have been encouraged over the years to spend and incur debt rather than save. This encouragement came from politicians hooked on the idea consumer spending creates a strong economy.

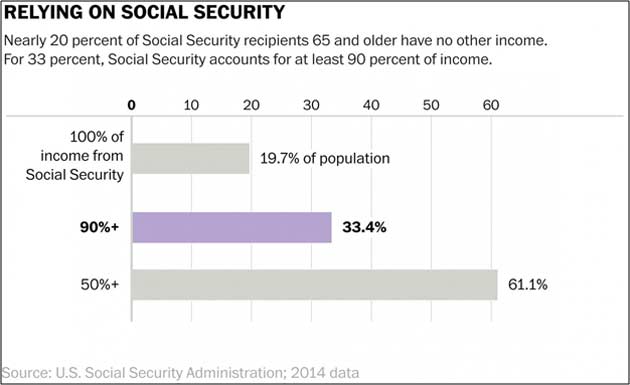

This and low-interest rates for savers have resulted in many people retiring with little savings. This will leave them dependent on the government which is already deep in debt to care for them in their older years. Those of us that have studied the numbers don't see any easy way forward. Simply put, something has to give and most likely promises will be broken.

|

| While This Is An older Chart, Little Has Changed. Reality Is Not Pretty |

In our busy world that is full of distractions, many holders of 401 accounts have put them on autopilot figuring that when they need it the money will be there. All in all the factors mentioned above, including the fact that inflation is not dead, come together in a way that will leave many older Americans behind a financial eight-ball. Those in charge of such things have created a situation where with the high level of debt that exists defaults on loans could soar.

In such a situation, both businesses and investors will incur big losses. This threat to 401Ks and pension plans is real and would make many boomers collateral damage in any effort they make to correct the mess they have created. Those in or nearing retirement should make an extra effort to reduce risk and keep their savings safe.(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

No comments:

Post a Comment