|

| OROB Could Result In Creating Massive Conflicts |

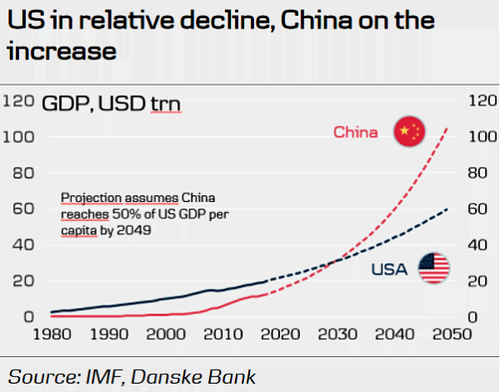

The article below is a summery of China today. China has been moving away from its dependence on America but its path

forward may be more difficult than people imagine. China has huge

problems that make this planned decoupling a risky gambit. Still, this move has already started

and that is unlikely to change. Over the years China has invested

heavily in its One Belt One Road (OBOR) initiative. The brainchild of Chinese President Xi Jinping, OBOR is an all-encompassing and confusing "work in progress" that, as it unfolds

will reshape world trade and the relationships China has with many

countries.

Now that the Chinese Communist Party has finished holding its 20th National Party

Congress, things can move along as planned. OROB consists of two major parts or

projects that are known collectively as One Belt, One Road, Belt and

Road, or the New Silk Road. According to Chinese state media, some $1

trillion has already been committed to OBOR, with several

trillion slatted to be spent over the next decade. The plan aims to pump

this huge sum of money into railways, roads, ports, and other projects

across Asia, Africa, and Europe.

OBOR is so overpowering it has morphed into a "philosophy" or "party line," rather than

anything concrete. This massive endeavor includes more than 68 countries and impacts 4.4 billion people, or around 60% of the world's population. This means it touches just over a third of the world economy. Its boosters tout its

massive economic promise and claim it could benefit the entire world

by lifting millions out of poverty. Still, for all its rhetoric about trade and development, OBOR is primarily a political project.

China's state media claims OBOR will benefit: the Middle

East peace process, start-ups in Dubai, currency trading, global

poverty reduction, Xinjiang's medical industry, Australian hotels,

nuclear power, Polish orchards, and, darn near the entire world. This clarifies and extends a trend that has

been going on for years. It should be noted, in the past, several Chinese overseas investments have also

earned China a bad reputation when it comes to delivering on its promises. This includes some local

economies claiming allegations of exploitation.

Emboldened by an influx of wealth over the last few decades, China has played fast

and

loose with creating and loaning out new funds. As debt service

rises, this can create a serious balance of payment challenges. OBOR to

move forward

has to provide the financing for infrastructure that many countries

desperately want and need but will they be able to repay the loans in

coming years?

The Center for Global Development, a Washington-based think tank, has

highlighted in a report entitled Examining the Debt Implications of the

Belt and Road Initiative from a Policy Perspective,

the underlined the problems of extending credit to poor or unstable

countries. It has been pointed out that as many as 23 countries could be

prone to “debt distress.” This group includes Pakistan, Djibouti, the

Maldives, Laos, Mongolia, Montenegro, Tajikistan, and Kyrgyzstan which

were rated in the “high risk” category. This brings us to the question

of whether OBOR

will become a massive expensive bridge to nowhere.

|

| More Debt Has Failed To Speed Up Growth |

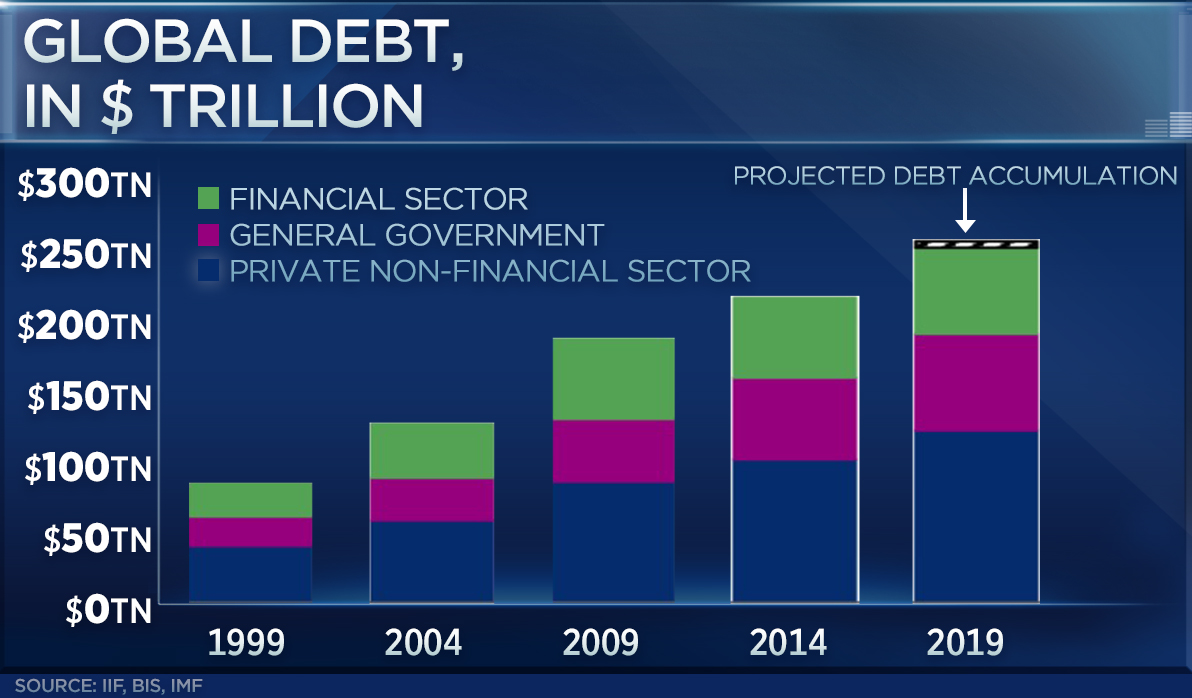

Many China skeptics argue that China continues to prop up the unpropable, and yes, while no such

word exists, when it comes to China's economy it should. Unpropable describes China's financial collapse that can only be postponed

but not stopped.

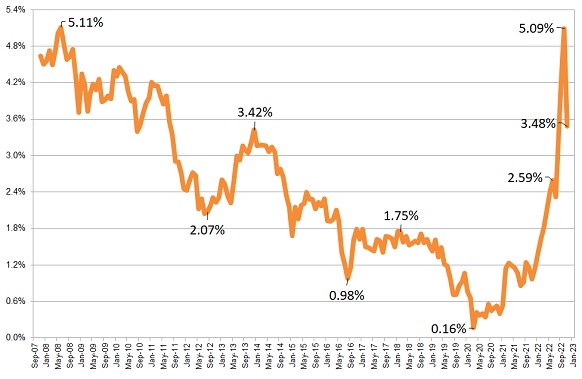

A major problem for China is that it has become addicted

to debt and any slowing of the economy places tremendous pressure on

those already having difficulty servicing debt. The fact is most Chinese companies fund through bank credit so

the stock market in China is not as large a factor in their economy as

we might expect.

Another issue is all this debt plays a role in

lowering the value of China's currency. A lower yuan is a double-edged sword. While it

helps exports, it makes importing raw

materials more expensive and tends to raise the ire of trading

partners. Still, more important may be whether a falling yuan causes

more wealth

to exit China in search of a safe more stable environment. The lack of good investment opportunities in China has caused more and more money to leak across the border inflating

asset bubbles in other countries.

It could be argued that much

of what is occurring in global currency markets is getting scrubbed

away by our complex financial system. While many Americans tout that China has us by the throat it is not true. Considering

how rapidly debt and credit have increased over the years, it could be

argued that the trillion dollars of debt America owes China is not nearly as relevant as it

was a decade ago.

|

| China Only Holds A Small Percentage Of US Debt |

The main reason China bought up so many U.S. Treasuries over the years is that it wanted its currency pegged to the dollar.

Dollar-pegging has in the past added stability to the yuan since the dollar is viewed as

one of the safest currencies in the world. It must be pointed out that even though China owns these U.S. Treasuries, China is running a

massive U.S. dollar shortage both on a

corporate and a national level.

Much of China's problem stems from its companies having roughly $3 trillion or more which it owes to international investors.

Loans of this type are not uncommon, especially in

developing nations. This "global debt" being denominated in U.S. dollars means the

companies owing it needs to pay both the principal and the interest payments to

their lenders in U.S. dollars. This demand for dollars creates a constant flow of dollars out of the country.

Remember, like all politicians, even those in China, tend to go to extreme

efforts to avoid taking responsibility for the

problems they create. History shows that one way a country can kick

its gross domestic product higher is to

build a false economy based on infrastructure or war. The OBOR

initiative and China's growing space program may be an extension of this

idea.

Up until now, China's big misallocation of resources has been in housing.

One of the biggest challenges china has going

forward is that, in some ways, the Chinese residential real estate

market could be called a Ponzi scheme of massive

proportions. It is the most overvalued asset class in the world. Much of China's so-called wealth is tied up in poorly constructed overpriced homes. Chinese leaders knew this was a problem and tried to slow and halt growing valuations over the years but failed to follow through.

China's

real estate bubble is apparent in its bizarre housing market and

"ghost cities." This is where 75% of its peoples' wealth is stored. The excesses in China's real estate market have not yet

been resolved. After becoming an estimated 30 percent of China's economy, housing is now an albatross around the neck of economic growth. With housing prices falling the wealth effect it created is varnishing, when all is said and done, it is very likely the process will be

deflationary.

While

many people think China has become the most important player in world

trade, they are discounting America's role as a major consumer of its

goods and capital investment. China is an export-driven economy and the numbers it puts out are

suspect. The money from trade flowing into China from the west is the

biggest factor keeping China afloat. Played fast and

loose by creating and loaning out new funds will only mask China's dilemma for so long.

Footnote: Part two has now been published. It looks at several other problems currently playing out in China. Following is the link to that post. https://brucewilds.blogspot.com/2022/12/chinas-future-remains-cloudy-and_18.html

This blog is not written for money

or profit but as a way to share ideas

and thoughts. If you liked this post

feel free to E-mail it to a friend.