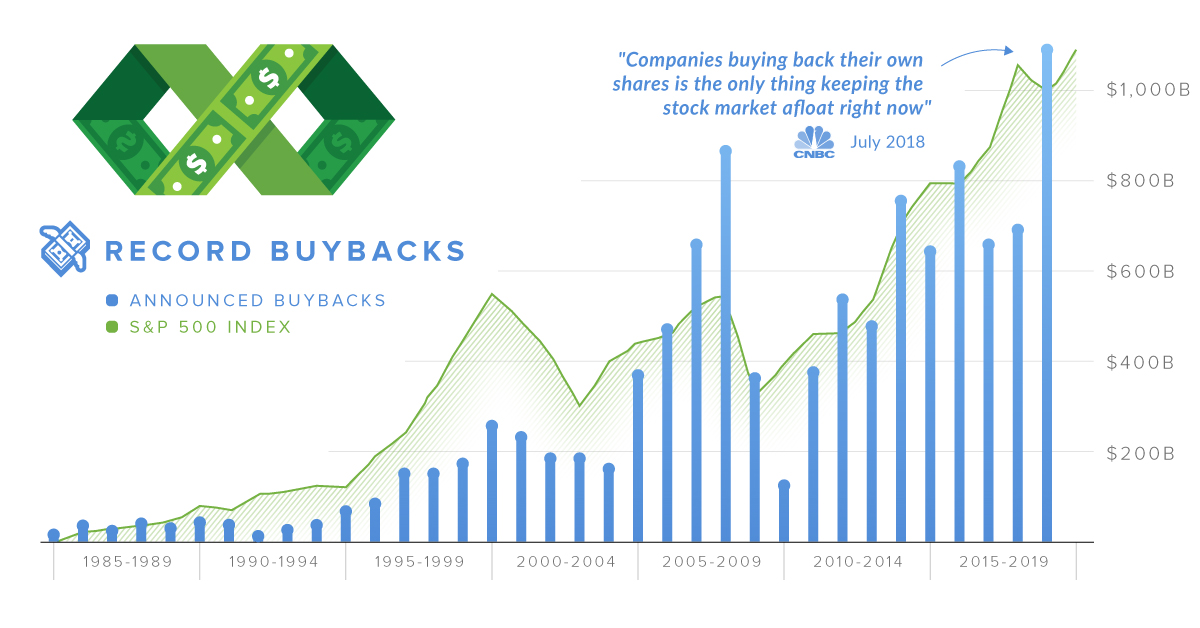

In today's market far too much has become based on financial engineering rather than making money. Prior to the Great Depression share buybacks and margin lending was a huge factor in lifting stocks to an unsustainable level. We must remember this today because for years we have seen a slew of stories and articles about how companies buying back their own stock are driving the market higher. I would be amiss not to comment on this and point out the impact and importance of stock buybacks and how they add to both low volatility and at the same time support "crazy high" valuations.

|

| Stock Buybacks Just Keep Coming |

Buybacks should be viewed as a double-edged sword with great power in that they reduce the number of shares over which earnings are divided at the same time they add to market demand. Buybacks can give the impression the companies earnings are increasing while in reality, overall earnings may be flat or even on the decline. The deregulation of buybacks years ago has returned to haunt us because it tends to create a dangerous illusion that draws less sophisticated investors into a market that is not nearly as strong as it appears.

Orders to buy back stock are insensitive to price and are set to purchase on any weakness. It is important to remember that much of the buyback craze taking place prior to Trump’s tax changes was financed from debt raised by selling corporate bonds. This trend has continued with interest rates at historic lows and the Fed's massive injections of money due to Covid-19. The problem with this is many leveraged companies will not have the money to keep their stock flying if markets fall and stocks get hammered. This situation will be exacerbated when interest rates begin to rise.

Buybacks are why we have been hearing so many analysts touting the line that stocks are not overvalued and how earnings are growing. What they are referring to is earnings per share, and how having fewer shares in play creates the illusion that the company is doing better and earning more money. This is where I remind you it is major investors that sit on the board or hold executive positions and the same CEOs and other top managers who have received much of their compensation over the years in stock options. Yes, these are often the shareholders in the company that have reaped the largest benefits of QE over the years and added to inequality.

During the Trump era the tax law which

lowered corporate taxes also encouraged repatriation of cash that has

been stored overseas, this also fed fuel into the share buyback frenzy. We should not forget that buybacks are a tool corporate boards and CEOs use to manipulate the prices of their own shares higher. In effect, insiders can use stock buybacks to create a well-constructed exit strategy allowing them to get out of or hedge their positions before reality sets in and prices fall back to earth.

|

| Stock Buybacks - Financial Engineering |

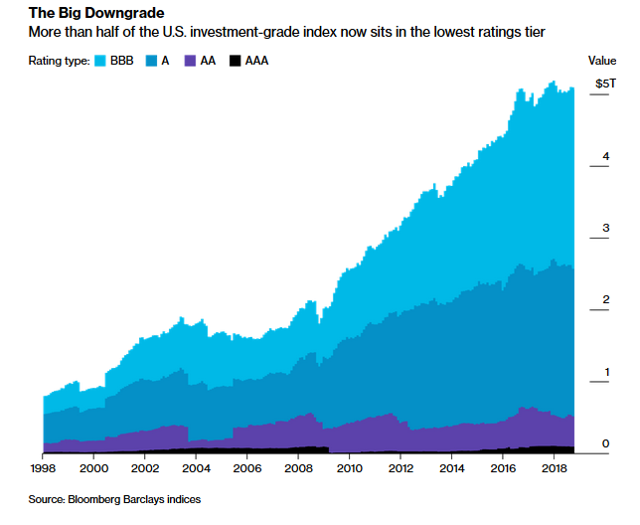

Higher debt ratios relative to the underlying value of a corporation can put the firm at greater risk of defaulting on its debt obligations. This means lenders demand higher interest rates. In the game of financial engineering, corporations calculate their optimal level of debt leverage based on that trade-off between the tax benefit of debt and higher costs of more debt. the problem with this is that business was never intended to be based on financial engineering but rather on making money.

Instead what we have seen and continue to see is that companies are plowing money into stock buybacks. All this reinforces what I and many others thought regarding the strong tilt of Trump's tax bill towards rewarding America's wealthy. The bill was not about real reform and has only added to the trend of growing inequality. Trump's tax reform may have boosted earnings per share growth by more than twice what U.S. economic growth would have but, has generated little in the way of real or new economic growth.

A combination of factors has led to companies issuing bonds and borrowing money. Whether there is a U.S. corporate bubble is an issue that has been explored for years. Many economic watchers seem to think it exists and the reason it never seems to collapse is because rates have continued to move lower at the same time credit expansion has grown. While credit bulls contend that the U.S. corporate credit remains an attractive place to invest, digging into U.S. corporate credit figures, a different, more concerning picture appears. Credit fundamentals, particularly in U.S. speculative-grade are in a questionable state as lower quality firms have been structurally increasing debt faster than earnings as interest rates fell.

Recently, a Global Macro strategy research note from UBS looked at the thesis that there is a bubble in speculative-grade credit. This hypothesis originates from the fact that easy money policies from central banks have kept 'zombie' firms afloat and QE programs have triggered substantial inflows into credit funds, igniting a material reach for yield since 2012. This has translated into eased credit standards and encouraged the massive issuance that has taken place. Only by accumulating debt have many laggards been able to afford the buybacks necessary to keep stock appreciation stable.

UBS's analysts go on to speculate that as much as $1 trillion of corporate credit could end up as 'distressed debt' during the next credit cycle. Way back in 2015, just 30 firms accounted for half the profits of all publicly-listed U.S. companies, down from 109 in 1979. The IMF has warned that corporations are at risk of default if interest rates rise. History has provided countless examples of inopportune, if not reckless buybacks when the short-term benefits of buybacks are placed before managing debt.

Ironically, or as expected like deer caught in the headlights corporations tend to retreat from buybacks at times of market uncertainty. The only year in recent history that big U.S. companies spent less on buybacks than dividends was 2009. Share buybacks proliferate when the market is rising but evaporate when the market collapses. In many ways, the decision way back in 1982 to again allow stock buybacks may highlight the true meaning of the phrase. "Been there, done that, learned nothing."

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)