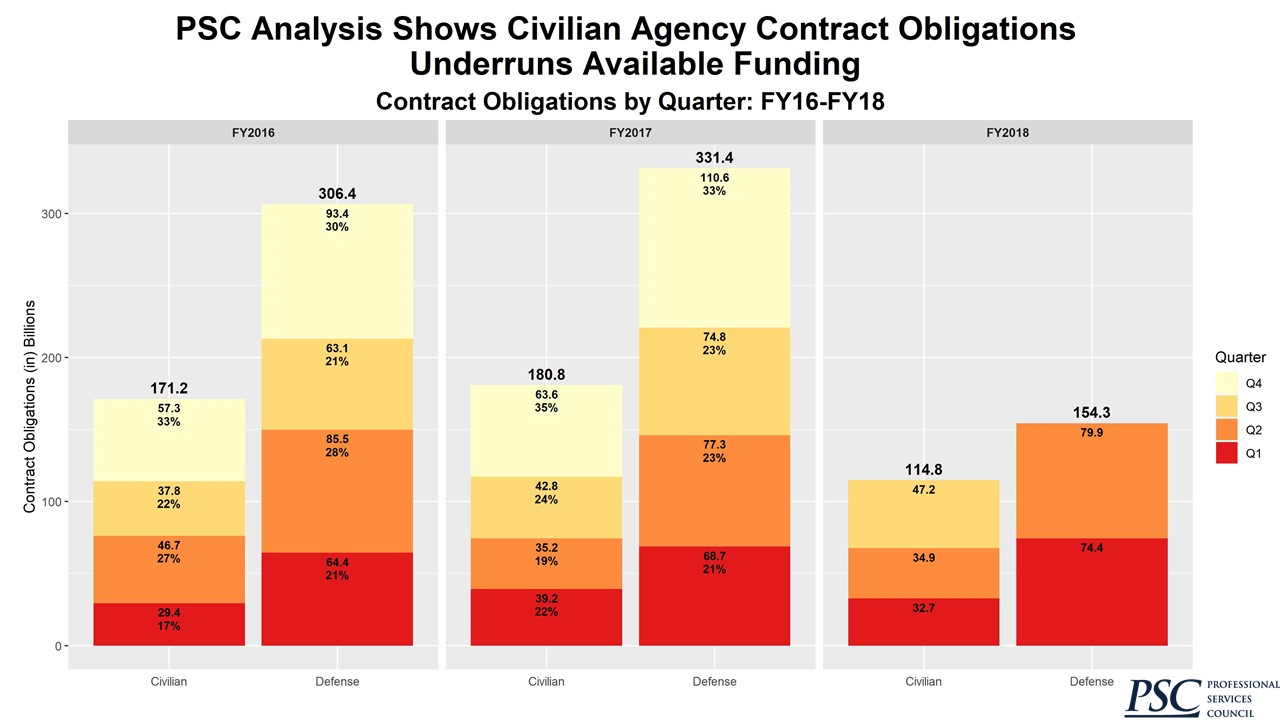

Wisdom is a valuable commodity and tends to be in short supply in Washington thus when Congress passed and President Trump signed the omnibus spending bill little thought was given to exactly how the spending would play out. I'm referring to the fact that over the final seven weeks of fiscal 2018, the government is slated to embark on a spending spree of historic proportions as federal agencies look to spend $140 billion more than they expected to receive prior to the bill being passed. For many agencies, this translates into spending as much as 40% of their annual budget in the final two months of the fiscal year. Faced with seeing these funds returned to the Treasury if not spent analysts believe the federal market will see a monumental effort among procurement officials to rapidly spend as much on contracts as possible.

|

| Omnibus Bill Has Resulted In "Must Spend Money" |

Circling back to the Obama Center Article that stated, "When Barack Obama announced he would forgo a presidential library, the news was trumpeted as a win for good government." That was because instead, Mr. Obama would open an official center funded entirely with private money. One author at Politico, who called presidential libraries a “scam,” wrote that Mr. Obama “will rip off the band-aid, removing government from what it has no business paying for.” Sadly as with many of these projects, the devil is in the details. It has now been revealed that the financially battered taxpayers of Illinois will put up at least $174 million for roadway and transit reconfiguration needed to accommodate the Obama Center. With eighty percent of such spending is generally reimbursed by the federal government, Illinois officials expect to receive $139 million of this money from Washington.

|

| Proposed Obama Center Sucks In Taxpayer Money |

As for the road and transit money a Chicago public television station questioned if Illinois could afford to cough up $100 million to “assist” the Obama Center: “How could a public financing proposal fly in a state that is bleeding red ink, especially when the Obamas have promised 100 percent private funding?” In response, a spokeswoman for the Obama Foundation insisted that “construction and maintenance will be funded by private donations, and no taxpayer money will go to the foundation.” It seems that Illinois’s machine politicians dropped the spending appropriation for this into a 1,246-page budget bill, which was then presented to rank-and-file legislators only hours before the vote. When a few Republicans objected to spending state money for the Obama Center, they were told not to fret: Federal reimbursements were on the way.

It is my fear that the rush to spend by government agencies this "windfall of funding" that is ballooning the national budget and deficit will flow into funding a slew of questionable projects such as the one above. In the past, I have attempted to dispel and chip away at the myth "Public-Private Partnerships" have a great deal of merit. while they are often used to propel forward projects by adding an incentive for the private sector to undertake projects they might choose not to do alone it is often because the numbers often simply don't work. These collaborations between government and a private-sector company touted as our salvation tend to create boondoggles and white elephants. For a number of reasons, these projects are often haunted by problems that go from one extreme to another ranging from over-engineering to shoddy work with little oversight.

Needless to say, following our recent jump in the GDP the federal government going on a spending spree should become a driver of the American economy in coming months adding to the illusion our economy is on sound footing. As a bear, I look forward to the coming months with a bit of trepidation. When coupled with a huge number of stock buyback programs triggered by the Trump Tax Bill the forthcoming wave of spending and a huge number of misconceived public-private projects currently in the pipeline could carry the economy forward for a quarter or so. This is by no means an endorsement of the economy or enough to make me reconsider how this will end, it would be wise to recognize that markets are vastly overvalued and this positive scenario could rapidly be derailed by a tsunami of bad news from a number of sources.

E-mail this blog post to a friend

No comments:

Post a Comment