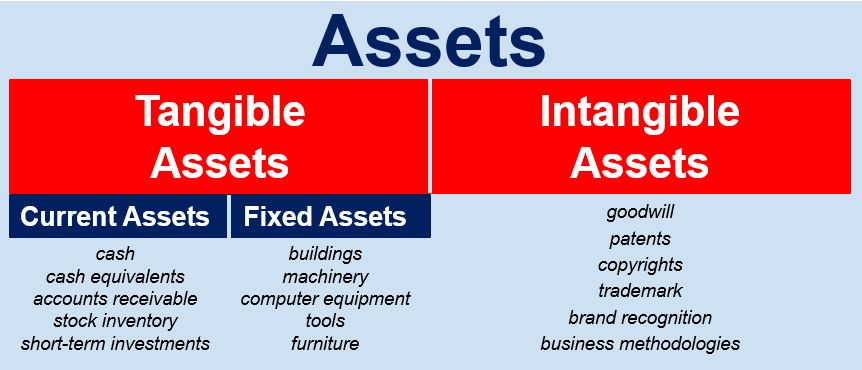

An intangible asset is a useful resource that lacks physical substance. Examples are patents, copyrights, trademarks, and goodwill. Such assets produce economic benefits but you can’t touch them and their value can be very difficult to determine. These intangible assets are often in sharp contrast to physical assets like machinery, vehicles, and buildings.

|

| This Does Not Tell The Whole Story |

Another example of quasi-intangibles is stock, when you buy stock what do you really have? You no longer get a certificate as in days of old, this should send the fear of God into those that worry about hackers. What you get is a glorified memo in a computer base somewhere, good luck proving what you have if things go bad. Most likely even getting a government official to listen will be a huge task. If you do get action most likely it would be years before you get any of your money back.

|

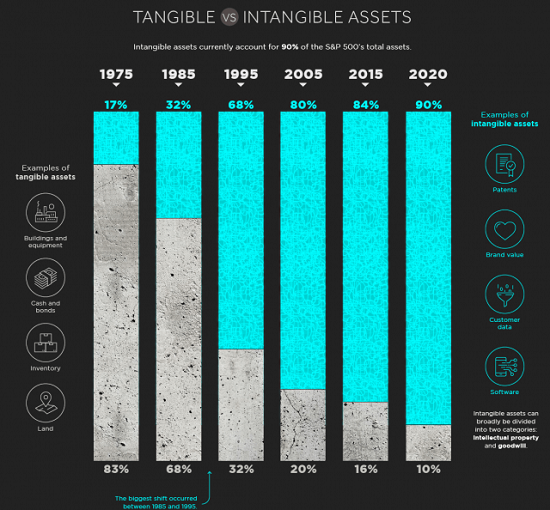

| This Chart Is Proof It Is All "Bullshit"! |

For a long time, I have taken the view that many "financial assets" have slipped into the intangible class. Assets such as stocks, pensions, and annuities harbor many of these qualities. These are things we can not touch and often live in the land of future promises. Today many are recorded on a computer somewhere and paper records of them are having a difficult time remaining current and in good order. Simply put, many people are not even sure where they have stored their wealth.

The theory that investments in intangible assets minimize inflation may be a chief reason government savings and wealth-building programs are centered on driving money into such assets. Over time, this has the potential to result in the collapse of the financial system. In our complex interdependent world, this would most likely hit the economy extremely hard, and the contagion from such an event could easily spill over and tear apart society.

To divert criticism of the fact no bona fide program exists which allows people to truly protect their wealth or preserve their purchasing power from inflation the U.S. government issues a type of Treasury security known as TIPS. This stands for, Treasury inflation-protected securities, these are indexed to inflation in order to protect investors from a decline in the purchasing power of their money. Sadly, even TIPS fail to hold up under scrutiny in that they are tied to the CPI which understates the true rate of inflation.

To be clear, I view the dollar as the best of the four fiat currencies,

however, I expect all of them to come under attack in the near future. Circling back to the growing danger resulting in policies encouraging people to invest in intangibles to lessen inflation. When money is created or printed it has to go somewhere, this has been fueling the "everything bubble." This is not the key driver of inflation. The main reason this newly created money has not resulted in massive inflation is rooted in the fact it is being diverted from goods everyone needs to live and into the intangible assets described above.

When you consider the amount of interest in cryptocurrencies and other inflation hedges it is easy to argue many investors are losing faith in the central banks and fiat currencies. A monetary crisis and the chaos that comes with it may very likely be coming down the road. The fact that over the decades, growth in intangible assets and the money supply has vastly exceeded the growth in real and tangible assets is problematic.

There has been little resistance to moving investors into intangible

or quasi-intangible assets because it is easier to own intangibles than

deal with taking care of "real things." This could account for part of the

mismatch in growth between these two kinds of assets. Currently, the gap

is so large that even if you allow for a great deal of the wealth

stored in intangible assets to be washed away there will still be enough

cash and credit available to create inflation. Ironically a huge washout in the value of this type of asset could be become a driver of

inflation by igniting a shift into hard assets.

All this can be a difficult concept to grasp. When looking at soaring house prices, we should view the cause as more driven by inflation than because of a falling dollar. The important point is that everything is relevant and values and prices change. With this in mind, the one thing we as individuals should try to avoid is putting our wealth into something intangible that could vanish during the night.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Intangible assets can now be thought of as being part of the money supply. The major asset classes (equities, bonds, real estate) are now understood to be too big to fail, and will be monetized, if necessary, to save the financial system. From this perspective, we now have two types of currencies: 1) cash and low-yielding bonds comprise the unwanted currencies that are only good for holding short periods of time 2) stocks and real estate are the currencies that keep up with the 6% inflation rate. Although individual stocks or homes may become worthless, but any diversified basket of stocks or homes is money good. Cryptos and precious metals are not currencies because they are still small enough to fail.

ReplyDeleteWhile real estate is tangible on the surface, neither land, nor the materials that are used to make it are very scarce, so the value stems mostly from the intangible characteristics. A deed is primarily a contract that bestows upon the holder the exclusive right to tax a tenant through rent. In return for some property tax, the government will use its guns to enforce rent payment to the owner of the deed. Stocks and real estate are basically the same. They are both rent extraction schemes that are now held as substitutes for cash and government bonds.

The money supply increases at around 6% per year. The same holds true for treasuries, world stock market capitalization, global bond market capitalization, or global real estate. Over many decades, they are all inflating at around 6% per year as documented in the Global Wealth Report by Credit Suisse. With cash and treasuries yielding near 0%, it would be foolish not to bid up stocks and real estate to the point where they are expected to yield less than the historical 6%.

The question is now: As we bid up all these intangibles to absurd levels, is there a point at which people will begin to rush into tangible assets instead? This is the same as asking whether people will ever change their attitude towards working and consuming. As long as their attitudes don't change, the ability to extract rent through equities or real estate is far more valuable than a physical thing. You can always produce more physical things and most likely at a lower cost in the future using better technology. With stocks and real estate, you can have people work for you forever, as long as they accept that arrangement.

Assuming attitudes don't change, is there any valuation limit or debt limit that a financial system can sustain? Is a 2500% debt-to-GDP plausible? A stock market with an average PE ratio of 500? Up until now, we've been able to tell workers not to worry about how much the 1% own. All they need to worry about is whether their wages are keeping up with CPI inflation. This seems easily sustainable forever. After all, we could give everyone food stamps at a minimal cost. That would give us -100% food inflation.

I consider stocks in real businesses, which have cash flow and capital, to be tangible investments. Having a paper certificate would be nice I suppose, but nowadays almost everything financial in nature has been converted to digital electronic data. Even the money in a bank account is simply an entry in an electronic database, so for all intents and purposes we have already switched to digital currency. I can only hope that financial institutions have a lot of backups of their account data, and that they are working hard to keep that data secure. IMO, the best way to minimize risk is to have a well diversified portfolio and to keep enough cash to get by for a few years and then later buy back in at bargain prices should the market crash. Folks who surround themselves with gold and silver bars thinking they are safe really amuse me.

ReplyDeleteIt is only a matter of time before all wealth can be broken down into units of work . Could the erg become the new one world order currency? 1 erg could equal a pound of unobtanium, Each erg could be twenty units of hope and each unit of hope could be twelve units of potential. The only problem is that the super rich might think they own everyone one else.

ReplyDeleteNot so different from today, eh!