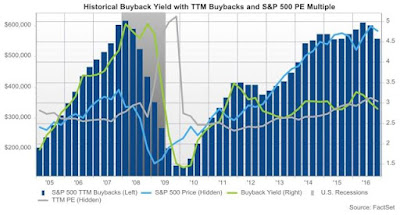

A research report from JP Morgan published last week revealed that S&P 500 companies will buy back a record $800 billion of their own shares in 2018, far exceeding the current high of $530 billion that was recorded in 2017. David Stockman thinks the number may be low and projects the current buyback rate at a record $1 trillion this year but just as important Stockman doesn’t see this rate as being sustainable. If indeed, "The later stages of the 2009–2017 bull market are a valuation illusion built on share buyback alchemy" then we can only speculate as to the downside potential of this market.

|

| 2018 Slated To Blow Away Past Stock Buyback Record |

When a person accepts the idea share buybacks are a major contributor to the low volatility regime because a large price insensitive buyer is always ready to purchase the market on weakness they also have to recognize how this has added to distorting and disrupting true price discovery. As more proof buybacks are sustaining this market, since 2009, the largest equity drawdowns that occurred in August 2015, January to February 2016, and two weeks ago all took place in or right after the share buyback blackout period. Even less surprising, after February 5, 2018, corporations stepped in and bought the dip which immediately suppressed volatility. If more confirmation is needed consider that Goldman Sachs’ unit that executes share buybacks for clients had its busiest week ever, seeing roughly 4.5x its average daily volume over 2017. According to BofA CIO Michael Hartnett, a record $43.3 billion was put into equities this week as investors shrugged off trade war risks that had initially sent stocks reeling, even as those very risks returned.

|

| Suddenly It All Becomes Clear! (click here) |

As of 2015, just 30 firms accounted for half the profits of all publicly-listed U.S. companies, down from 109 in 1979. Only by accumulating debt have many laggards been able to afford the buybacks necessary to keep stock appreciation stable. The IMF warned last year that 22% of U.S. corporations are at risk of default if interest rates rise. History has provided countless examples of inopportune, if not reckless buybacks as they put the short-term benefits of buybacks before debt-management. Ironically or as expected like deer caught in the headlights corporations tend to retreat from buybacks at times of market uncertainty. The only year in the last 14 in which big U.S. companies spent less on buybacks than dividends was 2009. Reuters reported recently that “Share buybacks proliferate when the market is rising but evaporate when the market collapses.” In many ways, the decision way back in 1982 to again allow stock buybacks may highlight the true meaning of the phrase. "Been there, done that, learned nothing."

If you missed the first part of this series and would like to read it, CLICK HERE.

Footnote; It is logical that these so-called bright spots that have pulled the market higher also have the most room to fall when valuations do retreat. The article below explores why the FANG stocks may suffer most. Other stocks sometimes considered as part of this category of high flyers are stocks like Tesla. The bottom-line is that unless a company is loaded with cash caution is in order.

http://brucewilds.blogspot.com/2018/02/the-fang-stocks-have-potential-to.html

No comments:

Post a Comment