Monday, May 27, 2024

Advancing Time: The Economy Has Not Been Fixed, Big Problems Ahead

The Economy Has Not Been Fixed, Big Problems Ahead

In short, nothing has been fixed or repaired, we have not created a sustainable economy. Printing and creating new money is not fixing the problem, instead, it has created an economy addicted to printing and creating even more new money. We here in America need to focus on the American economy, if that is strong it will help galvanize the country's future.

An example of our failure is seen in how China got a big boost with the passing of Biden's 1.9 trillion dollar relief package and the American taxpayer is the big loser. Buying junk from China will do little good when it comes to creating jobs in America. When looking at the policies flowing out of Washington it is clear many politicians seem to have no idea that all consumer spending and purchases are not created equal.

Damn near every economist and analyst seem oblivious to the point that what and where consumers buy matters a great deal. An article that delves into spending and its impact on the economy claims, "Where

money flows and who it enriches is a key component of economics. The

failure to consider this is a blind spot many people have." Much of what

has been registered as growth over the last few decades does not necessarily transfer into economic

strength.

This point is something that has been covered time and time

again on this blog in articles such

as, Healthcare Spending Wrongly Feeds Our GDP, and Economic Growth Does Not Equal Economic Strength. Many of our economic problems stem from consumers making poor decisions. The least responsible

consumers tend not to fulfill

obligations but to take on new debt and squander every penny they

can lay their hands on. Online shopping and companies such as Amazon are

like heroin to an addict when it comes to promoting spending that

destroys real economic strength.

Another huge issue is that inflation is not just prevalent in manufactured consumer goods but inflation also occurs in the area of fees, tolls, and taxes. People tend to forget just how much of government spending is done on the local and state levels where simply printing more money is not an option for eliminating revenue shortfalls. This translates into a slew of revenue-driven schemes that come back around to become a huge driver of inflation.

When we look at where inflation has occurred during the last decade or so we find it centered in areas where the government has expanded its influence. Two that rapidly come to mind are in the areas of healthcare and education. The skyrocketing cost of even basic health tests and medicine, as well as tuition at universities, screams inflation. This dovetails with claims by politicians that leveraging local dollars to match federal and state resources is not always a win for the residents.

Many people fail to grasp just how much government has expanded over the years. Much of this growth has been masked by "outsourcing" a great deal of the work done by government workers. Another place this sneaks under the radar is in the huge growth of "quasi-government " entities such as airport authorities and downtown improvement districts which are able to levy special taxes. Utility companies, often monopolies carrying out government mandates under government supervision, also can be placed in this category.

The theory that a lot of future inflation will flow from governments is tied to local governments' need for revenue. Local and state governments have hidden and masked the size of its growth and financial promises from the public. Since state and local governments lack the federal government's ability to print money and buy back its debt they must pay higher interest based on their credit rating.

It is a fact that businesses and landlords eventually must pass on to consumers the added cost forced on to them often through higher prices. Another way to do this is by transferring responsibilities, limiting warranties, or reducing goods and services that had been previously provided. A city forced to cut costs or increase revenues often chooses to plow snow only when three or more inches fall, reduce the number of times it picks up leaves, or increase fines for such things as parking violations or ticketing drivers for violations caught on camera.

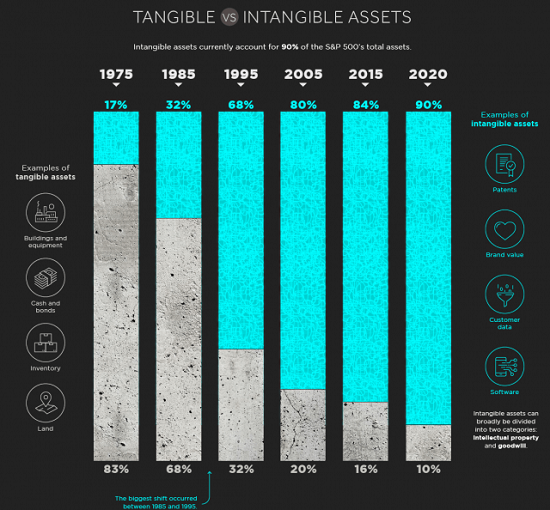

An unnoticed but very important part of the inflation puzzle is that so many people are willing to invest in intangible assets. The Fed should be ecstatic about this, in not increasing demand for tangible and real items they help to minimize inflation. Intangible assets are often "useful resources" that lack physical substance. Examples are patents, copyrights, trademarks, and goodwill. Such assets produce economic benefits but you can’t touch them and their value can be very difficult to determine.

Another example of quasi-intangibles are stocks, when you buy a share of stock what do you really have? For a long time, I have taken the view that many "financial assets" have slipped into the intangible class. Assets such as stocks, pensions, and annuities all harbor many of these qualities. These are things we can not touch and often live in the land of future promises. Over the years the growth in such assets has exploded. Intangible assets stand in sharp contrast to physical assets like machinery, vehicles, and buildings.

|

| This Chart Could Be Considered Very "Troubling"! |

The growing danger resulting in policies encouraging

people to invest in intangibles does lessen inflation. When money is

created or printed it has to go somewhere, and this has been fueling the

"everything bubble." Yes, the wealth effect creates more spending but it is not the key driver of inflation. The

main reason all the newly created money has not resulted in even more inflation is rooted in the fact it is being diverted from goods most people need to live and into intangible assets. The theory that investments in intangible assets minimize inflation may

be a chief reason government savings and wealth-building programs are

centered on driving money into such assets.

Many people and even economists have real misconceptions as to how the economy works. Where money flows and who it enriches is a key component of economics. The failure to consider this is a blind spot many people have. Fans of Keynesian economics that encourage government spending to stabilize the economy tend to discount the importance that savings plays in a balanced economy, or that small local businesses are the heart and soul of the economy. Where and how money is spent matters a great deal. In the end, we will all be forced to pay the price of this "cost-shifting" by suffering a lower standard of living.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Wednesday, May 15, 2024

Advancing Time: The Powerful "Think Tanks" We Seldom Think About

The Powerful "Think Tanks" We Seldom Think About

Sometimes are lack of pure attention or simply misreading a headline or title results in taking us down a road we might have not taken. Recently, I misread the title; "WTF Do You Think Tanks Actually Do?" Thinking it was referring to the use of tanks and their role in warfare I decided to take a closer look. I expected to find something about tanks being used as line breakers, like shock troops or heavy cavalry in ancient/medieval times. Instead, I found information about Think Tanks and their role in creating public policy.

It was reported near the end of 2021 that the United States now has 2,203 think tanks, a more than two-fold increase since 1980. These institutions generate new ideas for policy-making, assess existing policies, and draw attention to neglected issues. Much of the work Think Tanks do is done behind the scenes, off the record, or in briefings that are not touted publicly. Part of the reason many avoid the light of day is they operate to simply justify every and anything for money.Think tanks take donations and then generate the reports and studies that inform and influence the government and those making our laws. Their expensive studies could be described as "vetting the truth in the name of profit." This is a slippery slope. The reports, data, and information they generate often dominate the laws Washington imposes upon us. This should be apparent from the fact they often write a great deal of the legislation.

In some ways, Think Tanks are, the government lobbying the government. Many of those people taking jobs in Think Tanks are paid very well and are former government employees or politicians. It could be argued that Think Tanks are, the government lobbying the government. With reassuring names such as the. "Institute For The Study Of" or The "American Foreign Policy Council" these groups formulate road maps going forward.

Their input shapes the future of society and our culture carrying with them huge ramifications. Think Tanks are often used as weapons in the battle for our hearts and minds. About eight and a half minutes into the video that took me down this road, the producers of the piece give an excellent example of just how much this matters. Big Pharma, agriculture, the fast food industry, and weapon manufacturers, all huge sectors of the economy, use Think Tanks to skew information that promotes their goals.

|

| Sounds Like, "Power And Money" |

The material these groups generate flows directly into the media, in fact, it is often their job to pump it out in a way that promotes an agenda whether right or wrong. The material is often presented to intentionally skew or create conflict that can halt positive change. Much of this is rooted in securing or maintaining the financial position of those funding the studies.

The comments below were under the video I watched. While slightly altered they represent the thoughts of other viewers;

- Think tanks are like corporate consultants: they may have started as an independent insight, but have since gotten co-opted into inventing justifications for their sponsor’s predetermined decisions and act as a hired scapegoat if those decisions don’t pan out.

- Finding out that big pharma and big food are fighting is the kind of good news I didn’t know I needed today. This is a "Proxy war" of sorts and we are the pawns.

- Think tanks get money from the military-industrial complex. This is why somehow defenseless countries with weaker weapons are threats.

- The fact scientists could look at the same data about lead in the environment over time, and some arguing lead in gasoline was fine with others arguing it was a catastrophe waiting to happen. All this makes a person think that 'trust the science' and just listening to one lab, school, think tank, or organization means you're ultimately listening to the opinion of someone who has money linked to things going their way.

- Think tanks take a medium amount of money from big business and talk to

the Government.

Then, they convince government authorities to contract with big

businesses for massive contracts. Also, a medium amount of money flows

to government authorities in this step.

This all results in big businesses making disgusting amounts of money

producing expensive parts, maintaining heavy equipment, or providing a

"service" for the government that the people never asked for.

In the end, we, the people pay absurd amounts of money to the

government.

Considering how much Think Tanks influence government policy, they

deserve much more thought. Things like, where they get their money or

funding matters. Who they employ, and who employs them is also

important. Think Tanks are tied to the hip with lobbyists, big companies,

power, and more. Whether working for a foreign government, big pharma,

or the military-industrial complex, the bottom line is Think Tanks are not

working for you and me. A final thought, life is odd and the people determining our fate are scary.

Wednesday, May 8, 2024

Advancing Time: Difference Between Fair Trade And Free Trade Hits ...

Difference Between Fair Trade And Free Trade Hits Home

It is finally being acknowledged by main stream thinkers there is a difference between fair trade and free trade. Those who have taken for granted the notion they benefit from low-price exports usually pay a high hidden price for that gain. Today we are looking at a huge geopolitical shift that has the potential to crush countries such as China that are hugely dependent on exports.

Throughout history, trade policies have had massive long-term

ramifications on the strength of a nation's economy. The promise that

moving from producing products and increased trade will

create wealth has turned out to be largely a

myth for most Americans. Still, we hear the narrative spun by politicians and those profiting from exploiting unfair trade.

On Thoughtful Money, Michael Every, a Global Strategist at Rabobank, makes a compelling argument the world is at or near a tipping point. Every delves into the issue that the world is continuing to fracture geopolitically. Every gives the

impression that the only way out of the global economic mess created by insane trade policies is to do

"protectionism right" and that will not be easy to implement.

A radical shift has been taking place in the way people think about trade and its long term impact on our economy. This has been a long time coming. The election of Donald Trump in 2016 unleashed this debate and the Genie can't be put back in the bottle. Despite his faults, Trump brought front and center the undeniable truth that America as a country was allowing some countries to massively abuse its trade policies.

History shows that planned economies often run into a wall. We witnessed this in the Soviet Union in 1990 and are now seeing it in China. Planned economies tend to be inflexible and unresponsive to supply and demand. That should be their problem and not ours. They should not be able to benefit by wrecking our economy. In the last 24 hours, CNBC put out a video about why American automakers are failing in China. This is a subject I have written several articles about, and hits on a much larger problem and that is, how China conducts business.

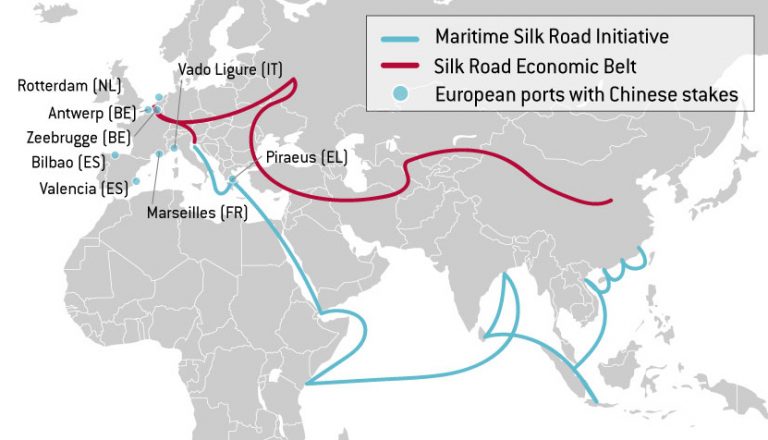

|

| China's Economy Based On Exporting Cheap Goods And Labor Exploits Trade Partners |

Free trade is given far too much credit for bringing prosperity to all, in fact, when it is not fair, trade can hurt the quality of overall growth. Trade between countries is not as big an economic driver as many people claim. The world can be divided into several trade sectors or groups. Every makes an effort to break it into the West, Europe, and the rest. The so-called rest constituting China, Russia, and a slew of underdeveloped countries.

How Europe ultimately decides to with the coming changes in how trade is conducted will make a difference in the global economic landscape. Until now Europe has appeared to be giving in to the seductive promises cast out by China. This has placed Europe in a position where it may become subservient to China. Going forward, the most important factor, when all is said and done, may be recognizing there is a glaring difference between fair trade and free trade.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Sunday, May 5, 2024

Advancing Time: Chinese EVs are piling up and blocking European Ports

Chinese EVs are piling up and blocking European Ports

The mania over replacing fossil fuel powered cars with electric vehicles is beginning to wane. Several news agencies have reported that masses of unsold Chinese EVs are piling up and blocking European Ports. Interestingly the timing of this coincides with an announcement by Tesla that sparked another rally in its stock. Following a weekend visit to China Elon Musk reports that the company will partner with Baidu (BIDU) on mapping data collection.

The news China has approved Tesla's program intersects with China's push into the EV market as its housing market explodes. In short, China needs a new spark or something to kick-start its economy. With enthusiasm for EVs on the wane, approving Tesla's program may be another propaganda campaign to tie EVs with the image, and idea, it will lead to an idyllic future. The Chinese EV sector wants and needs the "Tesla development" to generate the sign that the U.S. and China can work together in the EV space.

Automobile manufacturing is a huge market and the Chinese have made a huge investment in the EV sector by subsidizing its growth. In doing so they have set in motion the machinery to destroy auto manufacturers in other countries and thus dominate global auto production. Diminishing demand in China for their products is a huge contributor to Europe's top two car manufacturers' downturn which the Financial Times reported recently.

Not only has China heavily subsidized its EV sector, but it has even gone to outlawing the sale of fossil fuel automobiles. It now appears China has gone down this path with the intention of taking over the world auto market. It could be argued Tesla is no more than a pawn in this strategy. Embrace China early on, then when it becomes convenient, throw it under the bus, but not yet.

In a video, The Electric Viking, delves into the issue of Chinese EVs piling up in European Ports.

It seems from the number of new auto transport ships under construction

or being planned in China this is only the start of a full-court

press. This is where it should be noted that, abusing free trade is not fair trade. China's form of capitalism is predatory. Many of the comments below the Electric Viking video indicate viewers agree something is wrong and offer several solutions to the problem.

China Is Targeting Europe

As for Tesla's stock, while it has moved much higher, Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, said. “This has not been a short squeeze,” Dusaniwsky said as S3 has “actually seen short selling into this rally with over 2 million new shares shorted over the last week.” Tesla is the third largest U.S. short behind Nvidia and Microsoft, he said.

It seems that Wells Fargo analyst Colin Langan was also surprised by the

big share price move. Langan warned that there could be restrictions on

sharing data, which could limit Tesla's (TSLA) ability to leverage the

tech progress it has seen in the U.S. There is also the glaring point

that Chinese electric vehicle makers are undercutting Tesla when it

comes to pricing.

Yes, the cars China produces must go somewhere, but that does not mean into my country! Remember price is not everything and there is a hidden price embedded in these cars. That is the destruction of local jobs. Again, I'm forced to ask whether EVs are the answer to global climate issues that governments and EV proponents claim. The fact that I'm not a fan of these vehicles aside, one thing is certain and that is China is all in and plans to crush automakers across the world.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Thursday, May 2, 2024

Advancing Time: Looking At Financial "One-Offs" Driving The Economy

Looking At Financial "One-Offs" Driving The Economy

Those of us accused of promoting doom porn and claiming history indicates markets revert to the norm have been wrong for a long time. In our defense, distortions in the markets can go on for a long time. Still, if history is any guide this time will not be different. Simply put, trees do not grow to the sky and at some point, the numbers do not work. Not all things move in a linear fashion or extend along a straight or nearly straight line, they can go parabolic, or collapse before our eyes.

Lately, many people have forgotten the lesson the economy tried to teach us in 2008. Massive intervention halted that collapse, but this is not about the Fed, it is about the economy. Looking back through history, many of the things that have impacted the economy are now viewed as "one-offs" or in some ways a one-time event with a huge impact. This is one reason many comparisons between what is and what was have now been rendered obsolete. Still, certain laws of economics should and do, over the long term remain intact.

Don't forget, that much of the financial machine runs on autopilot and not on a day-to-day basis. This means markets become complacent and tend to assume a trend will continue. After a decision is made as to how money will be invested over the next year or two investors have a way of turning their attention elsewhere. This is a key reason so much money is passively invested and discounts the long-term ramifications of reality.

Also, important is the velocity of money. This is the speed at which money moves through the economy. It is important to remember a very small percentage of rich households at the top hold much of the money cast out into the world. This is often parked in investments and does not get "spent." This might explain why the speed at which money moves through the economy has been slowing. Meanwhile, no moss grows on the money poor people get into their hands.

Liquidity and leverage also play a large role in economic growth. Leverage is often tied to loose and easy money policies. While people seem obsessed with small changes in interest rates, a far greater concern is liquidity. Without liquidity, markets can not function and true price discovery does not take place. There is a yin and yang aspect to the economy that short term can be forgotten putting investors at great risk. This centers around the opposite but interconnected self-perpetuating cycle that results from bad policies.

To get a handle on where the economy is headed investors are

generally forced to turn towards the news and the most recent data.

Sadly, incompetent bureaucrats, people with agendas, and governments

have a way of skewing data. Financial strength is different from the

illusion of growth often touted in the GDP that results from a slew of

methods to boost consumption. Below are examples of a few things

investors fail to see as the "one-offs" they are.

- Recently we have seen many new Employer Identification Numbers (EINs) being requested, this may be mistakenly seen as a sign of new business formations. In truth, many have existed for a long time and others not be viable. New regulations are driving this and it does not mean small businesses are thriving.

- In December of 2023, companies plowed over $18 billion into constructing manufacturing plants in the US ($220 billion annualized), up 64% from a year ago. This is up by 170% from December 2019. Even with government incentives, this cannot go on forever.

- A matter that has not garnered enough attention is how economic problems from China may spill over and directly impact Japan. Over the years China and Japan have become major trading partners. Japan's direct investments surged as technology used to develop China's global supply chain exploded. The current problems haunting China are likely to spill over and damage Japan's fragile recovery.

One of the most underrated drawbacks in our world full of people is that with a large population also come large problems. People have to be fed and taken care of. Cycles of population growth may generate ever more opportunities and new demand, but this is only part of a much larger economic equation. It can lead to quality not quantity being greatly underappreciated. Capital flows and factors such as brain drain due to taxation and legal protection are a big deal.

The goal of all investors should be to look out long term and not to lose a lot of capital until we get there. Capital preservation is job one while at the same time positioning ourselves to benefit during the final inning of an unending game. Considering the number of people that have made a fortune and then lost it, good luck with that.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

.