|

| Our Economy Is Full Of These! |

Boondoggles are an economic distraction that in the end creates little of quality. The fact is when money is plentiful and interest rates low economic growth is fueled by projects that never should of, or would never have been conceived during normal times. For decades the government in an effort to put a bright face on the economy has spread a message that we need economic growth to move forward. This propaganda has been accepted and institutionalized. With it comes the idea such growth will result in "economic strength," it is implied that without such growth we will wither on the vine.

|

| Quality Is Very Important! |

Circling back to the article that claimed we need immigrants for growth, the problem I had with it is that it was based on two myths. The first being economies are held captive to population growth, part of the quantity argument that more is good. More troubling is the second myth which is built around the idea the average immigrant, or person, is a plus to the community and country ignoring the fact they can also be a drain on social services. This is often based on claims they are needed in the workforce and have skills that will allow them to rapidly be assimilated into the community. This can be spun into a more people, more demand for goods and services scenario or bigger is a better way of viewing the economy.

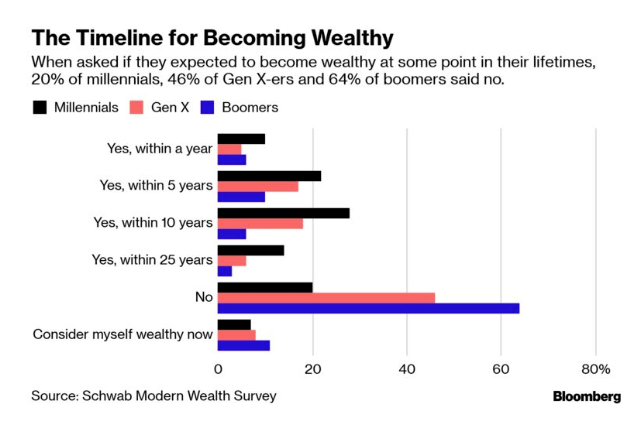

The trend towards replacing workers through automation and with robots means that human labor will most likely drop in value in coming years. This makes the argument that simply adding more people to grow our economy far less is logical. It is important we question this view and we should be troubled when our growth is created by money flowing from the government in the way of entitlements, however, immigration policy is a subject for another article. The false narrative that simply growing the size of an economy even by using deficit spending undercuts the importance of a solid economic and the long-term stability of the financial system. We must question whether the numbers work in the long run and whether when people retire the money will be available to fund their pensions and fulfill other promises made to them by society.

This article is to highlight and point out that we are forgetting the important element quality plays when it comes to economic growth while ignoring the many structural issues that haunt America's competitiveness. These roadblocks to growth far outweigh the benefits of lower taxes over the long-run. Currently, American companies have little reason to bring jobs home. The logic that lowering corporate income tax will create a massive flow of jobs to our shore is flawed. The tax bill Trump served up did little to level the playing field between low wage countries and predators such as China. It merely encouraged companies to spend money doing stock buybacks driving their share value ever higher. Issues such as healthcare cost and over-regulation continue to act as barriers to doing business in America.

|

| The Ugly Legacy Of Growing Debt! |

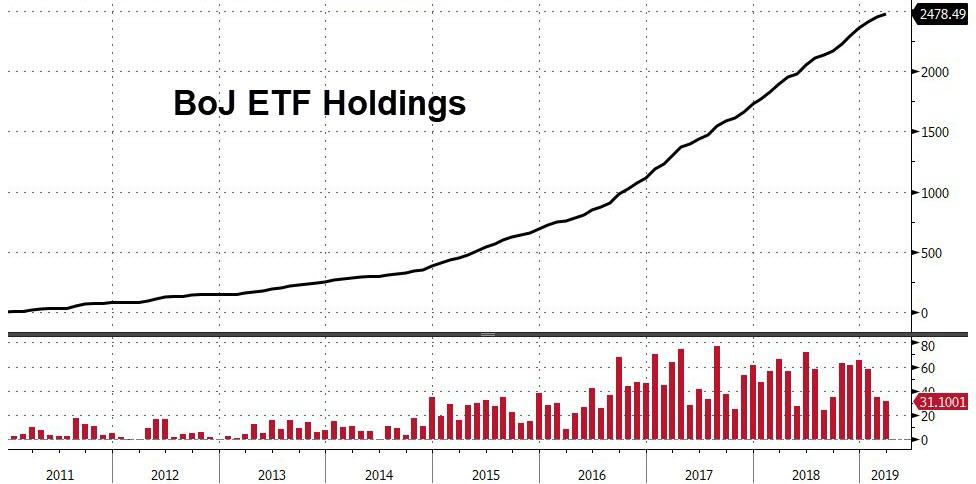

This tends to become another method of borrowing growth from the future. After criticizing Obama and the Democrats for taking us down this road we find Trumponomics is little different. The ugly reality is that Trumponomics like Obamanomics is built on perception rather than substance. This will become obvious over time as we continue to witness political preferences feeding money into large sanctioned concerns such as Amazon and away from small local businesses. This trend of government driving demand is a huge reason inequality has continued to worsen.

It is dangerous to confuse the notion that getting bigger will balanced budgets and that financial restraint can simply be cast aside. In fact, government policies of austerity have been given a bum rap and gained the reputation of being the "flawed medicine" for out of control spending. Again, we must focus on the quality of economic growth. Quality becomes apparent when we look at a failed project versus a successful one that cost the same to build but pays dividends for many years. Sadly, much of the money being spent in the American economy flows into the area of greasing the wheels of commerce rather than creating real growth. By not properly directing more of our spending into areas that return long-term benefits and maximizing prior investments we are squandering our resources.

Governments across the globe have gone to embracing an attitude of borrowing from future growth by financing current projects by a series of Ponzi schemes that delay paying for them until some future date. Any notion that as a no-nonsense businessman Trump would halt wasteful government spending and go about setting our house in order is gone. The problem disenchanted Trump supporters have with the current state of the union is that they have no real alternative to him. Voters were asked to choose the "least miserable choice" and he is what we got.