According to Reuters, the Euro-zone inflation rate surged to yet another record high in May. Inflation accelerated to 8.1% in May from 7.4% in April. A big part of the problem is that it is no longer just energy pulling up the headline figure. Looking past the headline figure, we find excluding food and energy prices, inflation rose to 4.4% year-on-year from 3.9%. This puts pressure on the European Central Bank to increase rates further. The timing of such a move is horrible in that Europe's dust-up with Russia has brought to the forefront just how weak Europe is.

Lurking in the background is the strong possibility that the Ukraine conflict will drag on and Russia could completely cut off gas to Europe. Currently, it appears Russia intends to keep Europe from filling storage, this will substantially increase Russia’s leverage in the winter months. Already talks of gas rationing are being floated if we see further cuts to Russian gas supplies. In the past three months, Russia cut off supply to several European countries that refused to pay for gas in rubles and has also substantially reduced the flow through the Nord Stream. This has cut off supplies to France and reduced flows to Germany by some 60 percent.

With inflation running at 4 times the ECB's 2% target, ECB policymakers are facing the toxic mix of raising rates at the same time the economy is shifting into reverse. The choice between galloping inflation, and political instability due to economic misery, is difficult. Hoping to tame inflation and thread the needle, ECB President Christine Lagarde is moving to raise rates. Some policymakers and economists doubt small moves will be enough, especially since underlying inflation is showing no signs of abating.

Due to supply chain problems following the pandemic, then as a result of Russia's war in Ukraine, prices have been soaring across Europe. This suggests that a new era of rapidly rising prices is now sweeping away a decade of ultra-low inflation. What many economists tried to blow off as a transitory jump in prices is now becoming embedded into the economy. The fear is that once high energy prices flow into the economy, inflation will get entrenched and eventually perpetuate a price-wage spiral. A jump in negotiated wages to broadening core inflation remains a growing risk.

Data from the European Union's statistics agency, Eurostat, is only adding to the euro-zone's woes. It shows the euro zone's trade balance swung to a record deficit in January from a surplus a year earlier as the cost of imported energy increased sharply. The euro-zone's trade deficit in goods, the difference between exports and imports, was 27.2 billion euros ($30.17 billion) in January, compared with a EUR10.7 billion surplus the same month a year earlier.

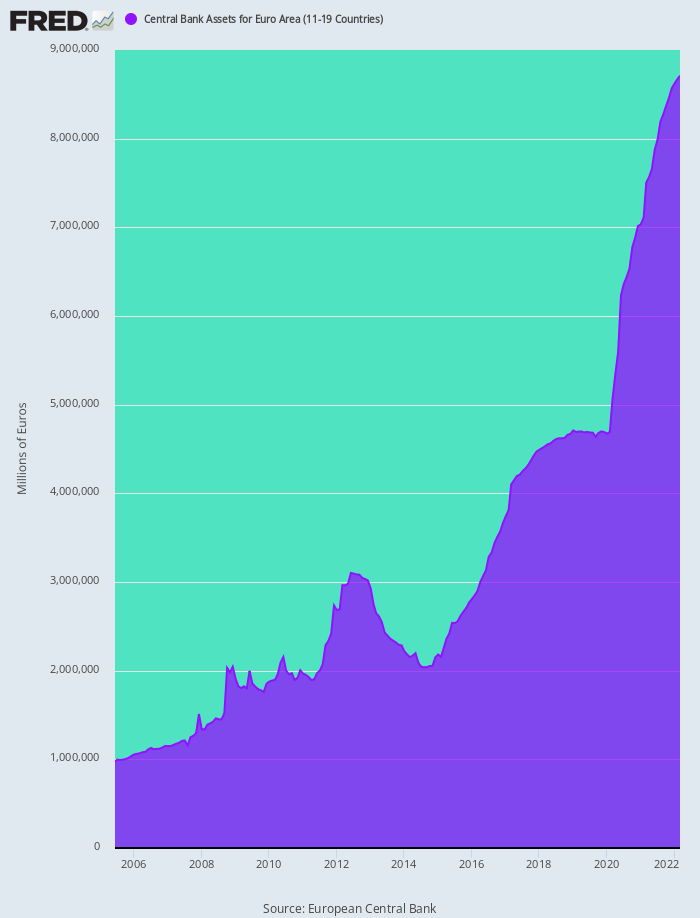

The Euro-zone has already endured a lot of problems what it does not need is another refugee crisis this time caused by food insecurity across North Africa or the emergence of an energy-scarce winter as 2022 comes to a close. The EU abandoned all structural reforms in 2014 when the ECB started its quantitative easing program (QE) and expanded the balance sheet to record levels. Considering the above, it is difficult to remain optimistic that The European Union is on the right track.

Volkswagen CEO Herbert Diess told the FT in a recent interview that a prolonged war in Ukraine would be "very risky" for the European and German economies. According to the FT, Diess said the economic damage from the war could be "very much worse" than the pandemic. A slowing economy combined with inflation produces stagflation. If the economy crashes, it will crush savings and cause European corporates to default.

A big factor I fear many economists are not honing in on is that the Euro-zone region simply isn't competitive. The EU lacks technological and intellectual property and is falling further behind the U.S. and China. Germany, the regions manufacturing powerhouse continues to skirt along narrowly escaping recession while France, Spain, and Italy face years of large unemployment levels. The ugliness is exacerbated by the fact that roughly 80% of the Euro-Zone's real economy is financed by a banking sector that carries more than 600 billion euros in non-performing loans.

As of 2017, not a single European company ranked among the top fifteen technology companies in the world and only four of the top 50 global technology companies are European. This is why skeptics are concerned that if the politically directed "Green New Deal" agenda doesn't boost growth or reduce debt the Euro-Zone will remain economically stagnate. At the beginning of last year, to generate the impression of hope, the EU's leaders in Brussels tried to pull a rabbit out of the hat by strengthening ties with China.

The EU-China comprehensive investment agreement clearly signifies a significant shift in EU policy towards Asia. The proposed deal dovetailed with Beijing's "One Belt, One Road" (OBOR) initiative and follows the signing of an agreement made with Italy which is viewed by many as bankrupt. Last year, in what was considered a bold move the Italian Prime Minister signed a historic memorandum of understanding with Chinese President Xi Jinping in Rome. The agreement made Italy the first founding EU member, and the first G-7 nation, to officially sign on to OBOR in hopes it would shore up its weak prospects.

The

ramifications flowing from Italy's deal with China may, in the end,

prove to be a deal with the devil. The key motivation behind

China working to reach a deal with poor, weak, but lovable Italy was its

desire to exploit Italy and use

it as a backdoor into the broader Euro-Zone market. The deal China and

Italy inked contained development deals

covering

everything from port management, science and technology, e-commerce,

and

even soccer. The fact that China now has control of entry

points into the European Union that can be lawfully expanded upon does not bode well for the region.

According to data from Eurostat, the EU has for years enjoyed a trade surplus with the U.S. (meaning it exported more to the U.S. than it imported) in 2019. The problem the European Union faces is that it imports far more from China than it imports. Imports from China to the EU surged by more than a fifth last year to 472 billion euros ($522 billion) compared to 2020. This widened the bloc's trade deficit with China to 249 billion euros. The deficit with China is not an outlier but highlights a trend that has been growing. Expect the surplus with America to drop in the future and the deficit with China to grow.

It could be argued Brussels is leading the EU into an ambush, Europe cannot hold its own against China. Both the United States and the European Union have a long history of complaining that China wants free trade without playing fair. To think China is a tiger that has suddenly changed its stripes borders on insanity. The EU is likely to find this is not the first time that China signs such an agreement without respecting it. Europe which has seen its manufacturing sector debased by cheap knockoffs from China and other low-wage countries will gain nothing by bringing more of these goods into their market. China exploits its trading partners by exporting goods at slightly below cost in order to draw manufacturing jobs from other countries. This has the potential to hasten the demise of Europe.

|

| The ECB’s Balance Sheet Grew From €1.0 Trillion In 2005 To €8.7 trillion. |

Still, the Euro-zone's biggest problem remains its massively flawed currency and banking system. Because many countries and economies share the same currency when a country fails to keep its budget in line or falls on hard times, they become a burden the others are forced to carry. The EU abandoned all structural reforms in 2014 when the ECB started its quantitative easing program (QE) and expanded the balance sheet to record levels. Making matters worse, the ECB has come up with several schemes over the years to kick the can down the road by adding liquidity to this insolvent system.

|

| European Households Tend To Hold More Of Total Assets In Currency And Deposits |

In short, when you look at the situation, not only are many of the people living in the Euro-zone politically opposed to Brussels exerting more power, on top of that, the banks are up to

their eyeballs with bad debts and holding worthless paper. Simply put,

the whole system is rotten to the core. Circling back to soaring

inflation, the ECB has little choice but to raise rates in lockstep with

other central banks. The Fed rate hikes are toxic to both the euro and

the yen. The people of both Europe and Japan face losing a great deal of

their wealth if the euro and yen continue to fall.

Below are two links to other articles relating to China and the situations contained above. https://brucewilds.blogspot.com/2019/11/chinas-state-driven-business-model.html https://brucewilds.blogspot.com/2019/03/italy-picked-off-by-china-folly-of-it.html Republishing this article is welcomed with reference to Bruce Wilds/AdvancingTime Blog |