Monday, June 26, 2023

Advancing Time: Syria Stands As A Mega-Embarrassment For America

Advancing Time: The Narrative Of Housing Shortage Beginning To Cru...

Advancing Time: Precious Metals Do Not Like Higher Interest Rates

Advancing Time: Inflation May Remain Around 5% For Years

Advancing Time: The Global Financial System Is A Rube Goldberg Mac...

Advancing Time: The Vulnerabilities Of A High-Tech Society

Advancing Time: Breaking News - Because It's Based On Science

Monday, June 19, 2023

Advancing Time: Investments In Intangible Assets Have Kept Inflati...

Investments In Intangible Assets Have Kept Inflation Low

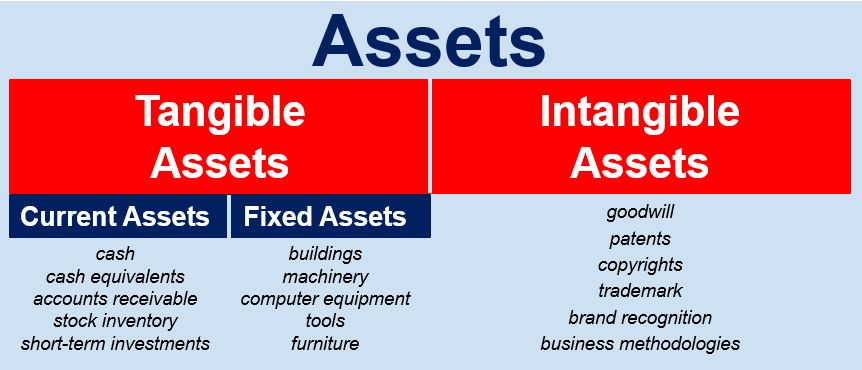

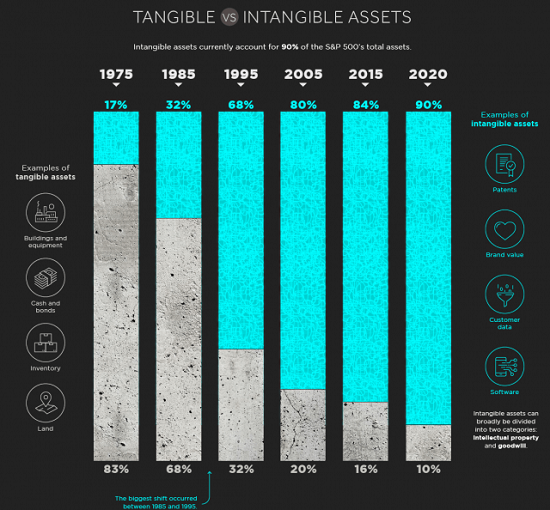

This is key to not only inflation but our future. The Fed should be ecstatic that so many people are willing to invest in intangible assets. By not buying tangible and real items they help to minimize inflation. An intangible asset is a useful resource that lacks physical substance. Examples are patents, copyrights, trademarks, and goodwill. Such assets produce economic benefits but you can’t touch them and their value can be very difficult to determine. These intangible assets are often in sharp contrast to physical assets like machinery, vehicles, and buildings.

|

| This Does Not Tell The Whole Story |

Some things fall into the middle ground between tangible and intangible assets. An example of quasi-intangibles is stock, when you buy stock what do you

really have? You no longer get a certificate as in days of old, this

should send the fear of God into those that worry about hackers. What

you get is a glorified memo in a computer base somewhere, good luck

proving what you have if things go bad. Most likely even getting a

government official to listen will be a huge task. If you do get action

most likely it would be years before you get any of your money back.

|

| This Chart Screams Much Of what We See Is "Bullshit"! |

For a long time, I have taken the view that many "financial assets" have slipped into the intangible class. Assets such as stocks, pensions, and annuities harbor many of the qualities of "soft assets." These are things we can not touch and often live in the land of future promises. Today many are recorded on a computer somewhere and paper records of them are having a difficult time remaining current and in good order. Simply put, many people are not even sure where they have stored their wealth.

The theory that investments in intangible assets minimize inflation may be a chief reason government savings and wealth-building programs are centered on driving money into such assets. Over time, this has the potential to result in the collapse of the financial system. In our complex interdependent world, this would most likely hit the economy extremely hard, and the contagion from such an event could easily spill over and tear apart society.

To divert criticism of the fact no bona fide program exists which allows people to truly protect their wealth or preserve their purchasing power from inflation the U.S. government issues a type of Treasury security known as TIPS. This stands for, Treasury inflation-protected securities, these are indexed to inflation in order to protect investors from a decline in the purchasing power of their money. Sadly, even TIPS fail to hold up under scrutiny in that they are tied to the CPI which understates the true rate of inflation.

To be clear, I view the

dollar as the best of the four major fiat currencies,

however, I expect all of them to come under attack in the near future.

Circling back to the growing danger resulting in policies encouraging

people to invest in intangibles to lessen inflation. When money is

created or printed it has to go somewhere, this has been fueling the

"everything bubble." This is not the key driver of inflation. The

main reason this newly created money has not resulted in massive

inflation is rooted in the fact it is being diverted from goods everyone

needs to live and into the intangible assets described above.

When you consider the amount of interest in cryptocurrencies and other inflation hedges it is easy to argue many investors are losing faith in the central banks and fiat currencies. A monetary crisis and the chaos that comes with it may very likely be coming down the road. The fact that over the decades, growth in intangible assets and the money supply has vastly exceeded the growth in real and tangible assets is problematic.

There has been little resistance to moving investors into intangible

or quasi-intangible assets because it is easier to own intangibles than

deal with taking care of "real things." This could account for part of the

mismatch in growth between these two kinds of assets. Currently, the

gap

is so large that even if you allow for a great deal of the wealth

stored in intangible assets to be washed away there will still be enough

cash and credit available to create inflation. Ironically a huge

washout in the value of this type of asset could become a driver of

inflation by igniting a shift into hard assets.

All this can be a difficult concept to grasp. When looking at soaring house prices, we should view the cause as more driven by inflation than because of a falling dollar. The important point is that everything is relevant and values and prices change. With this in mind, the one thing we as individuals should try to avoid is putting our wealth into something intangible that could vanish during the night.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Saturday, June 17, 2023

Advancing Time: Many Economic Comparisons Are Now Obsolete

Many Economic Comparisons Are Now Obsolete

One man that has proven he knows what he is talking about is Charlie Munger. He is well aware of how fast things can change. As

a vice chairman of Berkshire Hathaway and the right-hand man of Warren

Buffett, Charles T. Munger has a net worth of around $2 billion. He is

worth listening to when it comes to investing, the psychology of wealthy

people, rationality, and life experience. Munger recently warned we may be about to experience the biggest inflationary bubble in world history and shared his thoughts on how it is going to unfold. Munger also elaborated on the difficulty of building wealth for the young generation of today compared to his.

Having seen a lot of twists and turns in the economy over the years, Munger reminds us the recent past is far from normal. With time, things change and evolve, this transformation can be seen in both society and the economy. We are constantly bombarded with charts showing where things are going based on historical references but a question we must ask is just how relevant today's comparisons are with prior economic cycles.

Over the decades we have

moved from an agricultural-based society to an industrial-centered

economy where manufacturing and services have become the dominant way of

making a living. As we rapidly move towards technology becoming the main driver

of the economy a huge cultural change is taking place. The economy is

again undergoing a

metamorphosis. Over time, we tend to forget or minimize

in our minds that throughout history the growing pains flowing from such

a change tend to batter society from every direction. These

transformations also create a great deal of noise making it difficult to

understand what is happening.

Please consider the possibility the important adjustments the economy must make are lagging far behind our current "financial culture" or that the economy has evolved in a way that simply no longer works. Much of this has yet to become apparent to the masses and is masked by institutions papering over problems. A tradition of optimism has served mankind well, however, it has become clear something seems to be broken or out of kilter.

Adding to the distortions we are witnessing are things like stock buybacks and outright fraud. These have created a situation that could at any minute spin out of control. Making matters worse is that the general population is oblivious to this. they have been conditioned to accept whatever they are told. To many people, this is the new normal. The elephant in the room is that when we look behind the curtain it is difficult to ignore the numbers simply do not work going forward.

|

| The Titanic Was Herald As "Unsinkable" |

Much of the economic distortions we are experiencing today are tied to President Richard Nixon's decision on August 15, 1971, to close the gold window. It changed everything. While US citizens had been forbidden from owning gold or from redeeming their gold certificates for gold coins since the early 1930s, foreign governments still had the privilege of redeeming their dollars for gold. Nixon's decision untethered the dollar from gold and released it from the promise dollars could be redeemed in gold, this resulted in opening the floodgates and allowed credit to explode from $1.7 trillion to $65.5 trillion at the end of 2015.

|

| Exploding Credit Will Have Massive Ramifications |

During Covid-19, we broke many of the financial

system's ties with the past. We cast aside all budgetary and money

supply restraints. The situation today is in many ways "historically

unique" due to the rampant expansion of credit. This expansion has ramped up in recent decades.

How do you even begin to compare or factor in the amount of stimulus

America's "trillion-dollar-plus" deficits have added to the economy?

These amounts boggle the mind and are hundreds of times larger than what

we were seeing before 2008.

It could be argued that much of what we are witnessing today is rooted in Nixon's

decision to close the gold window. That move unleashed many forces that are greatly responsible for the

rising income inequality that has occurred in recent decades. After

inflation soared in the late 70s America found the cost inflation in

goods could be reduced by buying these things from low-cost producers

located in other countries. This means imports soared. Adding to the problem is that America has adopted a de facto policy of placing no restraints on trade

deficits.

Nixon's actions coupled with America's decision decades ago to make China into a formidable ally that would act as a counterbalance against Russia and the Kremlin have shaped the world. Back then, we offered economic incentives to help China's economy, looking back this was a watershed event that changed the way American companies conducted business. It has resulted in American companies outsourcing production and the mass exodus of manufacturing jobs from America to distant lands where labor was both cheap and abundant.

Our free trade policy

was sold to

America's middle class as a "win-win situation" by Republican and Democratic Presidents alike. We were told the

American worker would move up the economic food chain towards

better-paying jobs that would be more fulfilling and require less toil.

This did not happen, the large companies that shape legislation have

indeed benefited to a great extent while the average American has not.

|

| Many Comparisons With The Past Now Obsolete |

Returning to the main theme of this article, the massive expansion of the financial system has rendered many comparisons with the past obsolete. It has also resulted in the economy embarking on a roller-coaster-like experience where it encountered a series of events such as the dot-com bubble, which burst in 2001. In reaction, the Greenspan Fed stepped on the gas blowing the biggest housing bubble on record. In response to that asset bubble popping, we saw the Fed bail out the banks, the asset holders, and the wealthy.

The sorry fact is that this chain of events left the average American worse off than before. During all this time debt has grown, and to service that growing pile of debt the Fed had to keep slashing interest rates. Instead of allowing consumers to benefit from technological advances that tend to be inherently deflationary, the Fed has sought to increase inflation by declaring inflation in the range of 2% to be in our best interest. This has benefited the banks and those already wealthy while at the same time massively increasing inequality.

|

| This Headline Is From 2021 |

Recently I found myself pondering the line, "outwit and outlast" that is often used during the popular hit television show Survivor. It occurred to me the winners in both life and investing often reflect these qualities and that this game is far from over.

In 2022 the total global debt passed the 300 trillion dollar mark. While investors are often urged to be cautious the excesses of today are in many ways not as "sector" oriented as those experienced during certain periods we have seen in the past. The everything bubble makes staying anchored more difficult. It seems everything is encouraging and causing both savers and investors to take far more risk than they should in the quest for higher returns and yields. The "fear of missing" out is again running rampant and with the strategy of buying the dip having proven successful over almost a decade, investors have become far too complacent about the risk they face.

Republishing this article is permitted with reference to Bruce Wilds/AdvancingTime Blog

Wednesday, June 7, 2023

Advancing Time: Is China Failing In Its Effort To Reignite Its Eco...

Is China Failing In Its Effort To Reignite Its Economy?

It is difficult to ignore China's is failing in its effort to reignite its economy. Proof is pouring out of China that its problems go far deeper than most people ever imagined. China is in a period of economic contraction. The era of large-scale concentrated consumption may be over. Following the pandemic and lockdown unemployment is soaring. Simply put, the country seems to be entering into a post-Japan bubble era or even worse a situation similar to what America faced in the great depression.

Sun Liping a professor in the Department of Sociology at Tsinghua University and a doctoral supervisor in economics revealed the reason for China's malaise. The authorities' important resources are all concentrated on infrastructure, and high technology, including the advanced manufacturing industry to solve the "bottleneck." China's focus is on the military industry, government financing platforms, etc. While the number of people employed in these areas is decreasing.

This means the rest of the population is getting less support and people are struggling to survive. Add to this the collapse of the housing bubble and you have a disaster. The fact that most of the wealth of Chinese households was held in housing equity and prices are falling has created a reverse wealth effect. This has caused consumer spending to grind to a halt, Many Chinese homeowners are now upside-down on their investments and owe more than the property they bought is worth.

China Observer has released a video claiming that the latest annual reports of Shanghai’s three long-standing department store companies - Jiubai, Xujiahui, and New World are grim. All these chains have experienced a significant decline in their sales. Shanghai Jiubai's revenue fell by 30.51% year-on-year, and the net profit attributable to the parent company fell by 48.95%. Xujiahui's revenue fell by 22.33% year-on-year, and its net profit attributable fell by 76.30%. New World's revenue in 2022 fell by 27.07% year-on-year, and its net profit attributable to the parent company fell by a staggering 174.90%.

A survey conducted by the Industrial Research Center of the Beijing-based "Finance and Economics" magazine, in 2022, gave credence to why we should believe these numbers over some of the numbers being issued by the Chinese Communist Party (CCP). It indicates that over 1.94 million companies were deregistered in China's 40 wealthiest cities, accounting for approximately 7% of the total. These 40 cities have a permanent population of 427 million, approximately 30% of the nation's total population.

The original title for this piece was, ' Does China Have Six Million Buildings?' China Insights reports that the Ministry of Housing and Construction announced that there were nearly 600 million residential buildings in China. This shocked the public. That is 600 million buildings, not 600 million homes. That is just over one building for every two people in China and one building contains multiple homes that usually accommodate 3-4 people or more.

This highlights the overbuilding and bundling of local finance in the real estate sector. It is a problem the CCP will not easily address. It has been estimated the housing sector has become so oversized that in recent years it accounts for 25% or more of China's GDP. Far too much of China's wealth has been placed into poorly built empty housing. for more on this subject see, https://brucewilds.blogspot.com/2021/10/china-housing-market-is-on-life-support.html

Supply chain issues have also created another problem for China. The big move away from companies producing goods in China means China is losing its position as the world's factory. Several other countries such as Vietnam and Mexico are rapidly pulling jobs away from China and it shows. All of the above factors create a real challenge for the CCP.

Today, many governments are heavily engaged in propaganda. They even pay people to post positive stories supporting their narratives. China excels in this making it extremely difficult to know what to believe. While positive stories continue to flow out of China, it is important to ask what is real and what is CCP paid for propaganda. I'm under the impression this post represents the true picture of China better than most.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Sunday, June 4, 2023

Raising The Debt Ceiling Solves Very Little

Harvard professor and former IMF chief economist Ken Rogoff appeared on 'Squawk Box' to discuss the debt ceiling and why a last-minute deal does not solve America's underlying problem. Our challenge is rooted in government spending and politics. Rogoff went on to say he thinks interest rates are going to stay high or go up over the next year. He clarified that several factors indicate upward pressure on real interest rates remains.

Raising the debt ceiling does nothing to make the massive albatross of debt hanging around the neck of America go away. Instead, it merely allows for bills to be paid and more obligations to be heaped upon us. As Yellen begins to issue new bonds to refill government coffers expect money and liquidity to be drained from the financial system.

Another issue is that it most likely blows away Biden's false promise to many of the people owing student debt that always was tenuous at best. This means borrowers will have to begin paying back their student loans at the end of the summer which will further reduce consumer spending. Still, the package maintains Biden’s plan to provide up to $20,000 in debt relief for qualifying borrowers, which is before the Supreme Court that should be ruled on in the coming weeks.

This passed just days before the Treasury Department would have run out of funds to pay all of the nation’s obligations in full. It contains provisions that many lawmakers didn’t support but that did not slow the Senate from passing the bill. The legislation suspends the nation’s $31.4 trillion debt limit through January 1, 2025. This mutes some of its impact as a potential issue in the 2024 presidential election.

The deal is that non-defense spending will remain relatively flat in fiscal 2024. It will increase by 1% in fiscal 2025. After fiscal 2025, there are just non-enforceable appropriations targets rather than solid caps. Still, the "House GOP fact sheet" claims that non-defense discretionary spending will be rolled back to fiscal 2022 levels and top-line federal spending will be limited to 1% annual growth for the next six years.

This legislation does little to roll back any of the waste thought to exist in the Inflation Reduction Act. This is a law Republicans had sought to repeal because it contains many economy-distorting clean energy tax credits and subsidies. The fact the debt ceiling bill requires agencies to complete environmental reviews in one year, or two years for the most environmentally complex projects will most likely only muddy the picture of where we are headed.

Also, it does not stop the roughly $80 billion increase in IRS funding over 10 years contained in the Inflation Reduction Act. This bill merely 'repurposes' $10 billion from fiscal 2024 and another $10 billion from fiscal 2025 appropriations to be used in non-defense areas. This provision does not even appear in the text of the bill but it is said, both sides have agreed to it. Other than that, the legislation will also rescind $1.4 billion in IRS funding from the act. Still, this does not limit the IRS from requesting additional money from Congress while the bill is in effect.

Raising The Debt Ceiling Is A Poor Way To Deal With Expanding Debt!

The pathetic excuse for reductions put forth in this bill does not even amount to putting lipstick on a pig. For example, the adjustments will bring the resources available for

spending outside of veterans’ medical care to $637 billion for the

coming fiscal year, compared to $638 billion for the current one. The fact is shifting a few billion here or a few billion there when talking about such huge numbers generally means very little. How efficiently a specific part of our government functions determines how well the funds are spent.

Being hailed as wins are the package calls for temporarily broadening work requirements for 'certain adults' receiving food stamps. Yet, it could be argued these gains vanish as the bill also expand exemptions for veterans, people who are homeless, and former foster youth in the Supplemental Nutrition Assistance Program, or SNAP. Work requirements will not be introduced in Medicaid as called for in the House Republicans' debt ceiling bill.

Clawing back roughly $28 billion in unused funds from the massive Covid-19 relief packages that Congress passed should not impress us either. This is out of roughly $4.6 trillion in Covid-19 relief funds Congress approved since the pandemic began in early 2020. Remember that many local and state governments have gone to great lengths to spend this money but simply ran out of ways.

As sort of a footnote, this bill will also speed the creation of the Mountain Valley Pipeline, a natural gas pipeline in West Virginia. This again stands as another monument to how dysfunctional our government has become. All this is a drop in the bucket and poor-quality political theater. Consider that Congress appropriated over 112 billion dollars to support corrupt Ukraine in 2022.

It should be pointed out that not only has the 'Ukraine thing' dramatically raised the risk of a nuclear war, but to make matters worse, this so-called aid has been so poorly accounted for. When you add in prior funds and a slew of other 'off-the-book sources' it is said money going to Ukraine may be approaching the 200 billion dollar mark.

Still, the world rejoices as the can is again kicked further down the road. With this hovering in the back of your mind, I would like to remind you that even though it has been talked about for what seems like forever, the economy and the financial system have not reset. The Great Reset has yet to occur, and when it does it is likely to be a doozie.