Sunday, March 31, 2024

Advancing Time: Stock Buybacks And Flash Crash Risk (Part 1)

Stock Buybacks And Flash Crash Risk (Part 1)

Two older postings that appeared on AdvancingTime in recent years have grown in importance as the markets have exploded upward. One of the articles focused on the dark-side of stock buybacks and how for years they were illegal. The other asked readers to consider, no matter how remote, the possibility we could at some point witness a flash crash so devastating that we see markets fall like they are on steroids. If such an event occurred the damage might be so severe that trading would be halted and traders trapped. These subjects intersect with other factors and events taking place over the years that have thwarted true price discovery. The widening disconnect between the financial sector and the real economy increases the risk of a major economic setback in the future.

An example of price manipulation is how over the years the BOJ's buying of ETFs has bolstered the Japanese stock market. This could be viewed as a path to nationalizing Japan's debt. In some ways, the actions of Japan's central bank could be considered nothing more than a new model of "stealth nationalization." Two enormous problems flow from such a policy, the first is while giving the appearance of economic growth, the higher valuations are not based on any real quality and the second even bigger issue is that under this policy eventually the central bank will control or pretty much own everything at a distorted value they determine best suits their narrative or purpose. With Japan's stock market now making new all-time highs this is of course no longer considered an issue or moral hazard. Still, it stands as a monument to the massive manipulation used to convince investors all is well.

The subject of growing market fragility and manipulation was recently addressed in a piece put out by "Thoughtful Money." It commented on how algorithms, often trading overnight, give the big boys

an unfair advantage. It then dove into how stock buybacks are playing into equities and skewing valuations. This centered on how many corporations

are starting to enter the blackout period preventing them from buying

back their stock until they've released their quarterly earnings and how

this temporarily removes a huge amount of important buying support for

shares. While the video rolls on for well over an hour, the first 26 minutes hit the hammer on the nail in how stock buybacks mainly benefit those at the top and destroy true price discovery.

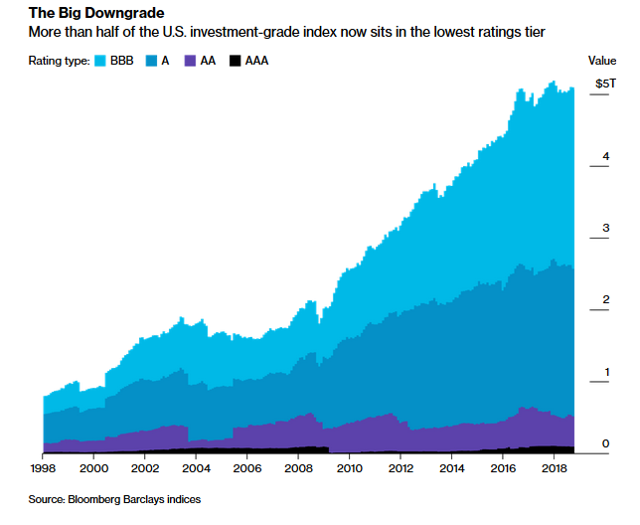

During the Trump era, the tax law that lowered corporate taxes also encouraged the repatriation of cash that had been stored overseas. This fed fuel into the share buyback frenzy. It is important to remember that much of the buyback craze taking place prior to Trump’s tax changes was financed from debt raised by selling corporate bonds with interest rates at historic lows. Another kick came from the Fed's massive injections of money due to Covid-19.

This

is where I remind you it is major investors that sit on the board or

hold executive positions and the same CEOs and other top managers that have received much of their compensation over the years in stock

options reap the largest benefits of stock buyback programs. Also, these

insiders have the advantage of being able to create a well-constructed exit

strategy allowing them to get out of or hedge their positions before

reality sets in and prices fall back to earth.

|

| Stock Buybacks - Financial Engineering |

It should be noted that corporations tend to retreat from buybacks at times of market uncertainty. Share buybacks proliferate when the market is rising but evaporates when the market collapses. In many ways, the decision way back in 1982 to again allow stock buybacks may highlight the true meaning of the phrase. "Been there, done that, learned nothing." The problem with this is many leveraged companies will not have the money to keep their stock flying if markets fall and stocks get hammered.

Footnote; Part two of this article which focuses on the possibility of a flash crash has now been published. https://brucewilds.blogspot.com/2024/04/stock-buyback-and-flash-crash-risk-part2.html

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Sunday, March 17, 2024

Advancing Time: The Plumbing Of The Financial System We Don't See

The Plumbing Of The Financial System We Don't See

This is why AdvancingTime has pounded away at the idea that where and what we buy has a major impact on the future of both communities and countries. I just finished watching "Thoughtful Money (with Adam Taggart) Good news!" The Zero Hedge team put this special Thoughtful Money's debate on the fate of the US dollar on the YouTube channel. This was a deep-dive discussion of over three hours.

This important video did nothing to change my mind about where the world is going. In short, I liked Brent Johnson's line, "certainty is death." He claims he is not certain about anything. The footnote under the discussion title makes it clear that Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves risk of loss. Loss of principal is possible. Also, some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic, and currency risks and differences in accounting methods. In short, it underlines Johnson's uncertainty.

|

| The Financial System Is Built Like This |

More than one economist, big wig CEO, and Fed watcher have admitted the problems haunting the financial system have very deep roots. These people often contend governments and central banks have not fully rectified the problems causing the great financial crisis of 2008. Instead, they have merely papered over our failures by printing money and flooding the system with liquidity.

In truth, the financial system is a rickety cobbled-together mess of poorly fitted pieces. Overall, the financial system is not a well designed machine. Instead, it is glued together in a haphazard way to get the job done. To make matters worse, this system is greased by the greed of those who benefit from stealing a little from here and there.

In the real world,

things are usually not intentionally designed to be complicated but the

reality is that they just are. Part of getting a clear picture of where we are headed stems from the reality this is not all about economics but politics plays a major part in our future. Recessions have always had the effect of cleansing the economy of weak noncompetitive companies to clear the way for new stronger companies. The efforts of those in charge of such things to remove recessions from the economic cycle has created a new hazard.

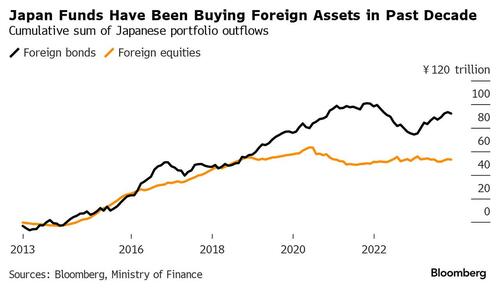

An excellent example of "hidden plumbing" is the Japanese carry trade. An article by Bloomberg reporter Masaki Kondo that appeared on Zerohedge on February 1st titled, "Aozora Delivers Grim Reminder Of Japan Carry-Trade Risk" details some of these issues. It details how Japanese investors as a whole have boosted their overseas investment since the BOJ expanded monetary easing in 2013. This includes Japanese banks. This puts them at risk if the cost of borrowing in yen should rise. He point out this could trigger an unwinding of Japan's massive carry trade.

While many people have focused on the losses US banks have incurred on long-term US bonds and American Banks' exposure to commercial real estate, little attention has been paid to Japan's exposure to these items. Not only could Japanese banks take a hit on both these investments but Japan's exposure to the downturn and losses in China is another area for concern. Yes, it is possible that China's economic problems will spill over and negatively impact Japan. Still, this is an area many financial gurus claim is an opportunity for Japan to expand into and exploit, in short, they claim economic chaos in China is a plus.

We should be aware that clogs in the system could create liquidity issues and even a change in the velocity at which money moves through the financial system could cause problems. The "slowing in the velocity of money" is rooted in where it is being placed. The speed at which money flows through the economy in some ways is tied to the speculation about the future of inflation.

Behind the scenes, a lot of things are occurring that we don't recognize as important until they are unveiled as being so. Trade deficits, reshoring of manufacturing, changes in how taxes are accessed, man made and natural disasters, and more all flow into this mix. This translates into "nobody really knows what the future holds." The so-called, often self-proclaimed experts, included.

Another thing we should be worried about is "financial one-offs" These are one-time events that may prove unable to propel the financial system forward over the long haul. In a world void of financially nutritious content, an individual has to really go out of their way to become educated in the way to avoid ending up as financial road kill. The less you know may increase your feeling all is well but does little to ensure your financial future.

(Republishing this article is permitted with reference to Bruce Wilds/AdvancingTime Blog)

Sunday, March 3, 2024

Advancing Time: America's Immigration Crisis, Due to Biden's Faile...

America's Immigration Crisis, Due to Biden's Failed Policy

Even some of those formerly advocating the loosening of immigration standards and open borders are coming to a place where they are untenable. Sadly, with the flow of more immigrants has come a slew of problems. Part of the problem is that many of the people streaming over our borders are not workers, this inflow includes people needing expensive healthcare and criminals. Yes, with the good come the bad unless restrictions are in place. More people are not the answer to crafting a strong economy, quality is far more important than quantity.

Remember, this immigration fiasco is occurring while American citizens are forced to stand in long lines with passports in hand. Anyone who has traveled knows you can't just walk into any country without any questions asked. All this highlights the fact that immigration has been an issue for decades and not properly addressing it will not make it go away. A reasonable solution to solving our immigration problems has eluded both Republicans and Democrats time and time again and reduced those caught within the system into political pawns.

|

| America's Immigration System Is Broken |

The debate over immigration, processing new arrivals, and addressing

millions of undocumented immigrants, receives plenty of press but most of our immigration problems lurk below the radar. The point is that we should be careful what we wish for. In our complicated world, there are often pros and cons for every issue. The

ongoing migrant crisis is unprecedented and is hitting countries across

the world. Here in America, it is impacting not only the border states

but is reaching deep within the country.

Even small businesses in my

state, far from the border, are required to confirm a worker is legal to

work. This is a bit ridiculous for small firms with only a few workers,

all from their own family and people they have known since

birth, but that's the law. The comment section of the CNBC video is full of opinions on how opening the border is impacting

America. Since these people are flooding to cities, that is where most

problems are apparent. Several of the themes revolve around things like,

"As a Chicagoan, my city is being ruined." People from New York and Denver are also echoing the same message and crying about what Texas has dealt with

100 times over.

|

| Trump's Politically Divisive Border Wall |

Washington has been playing games and politics with America's immigration policy for years it has been a political football. The immigration system is badly broken and fixing it is easier said than done. A huge part of the problem stems from the fact most people can not agree on exactly what kind of immigration system we should have. To many Americans, the key issue is how open the borders should be and who should be allowed to enter. Now Washington's inaction is coming back to haunt us.

Tens of billions of dollars are wasted each year on this costly inefficient system according to an article published by the American Action Forum way back in April of 2015. The article explored the cost of a broken immigration system on American business. The fact is that when the American Action Forum (AAF) analyzed the total costs of the immigration system, they found close to $30 billion in annual regulatory compliance costs. It hardly takes a rocket scientist to determine that reducing the number of people "illegally" entering the country would save billions of dollars and allow the system to function better even in its current poorly crafted form.

A lot more of our political attention should be focused on the broken bureaucratic apparatus that comprises our current immigration system. While we spend hundreds of billions of dollars on this and that in overall cost the wall Trump proposed now seems a rather puny amount. This is confirmed by figures that show merely doing away with making and handling the penny America would save enough to pay for a border wall. Of course, none of this is a solution to the Deferred Action For Childhood Arrivals (DACA) situation. Loading millions of people on buses and deporting them will never happen. At the same time, those wanting more open borders should realize the current situation does not work either.

Washington should step away from the "emotional" aspects of immigration such as flowery debates about the rights of people and what they "deserve" and focus on the key issues of restoring a functioning government and getting on with real immigration reform. In the overall scheme of things considering America's multi-trillion dollar budget, the 5.7 billion dollars requested for the wall is peanuts. In truth, it is easy to see how America will get a good economic return on money spent on a barrier that works 24/7 year after year. Most taxpayers, if asked, would see this as a far better investment than paying government workers to stay home, as we did during the last government shutdown.

Footnote; The article above contains several links due to the fact parts of this issue have been the focus of prior AdvancingTime posts. It is important to understand that immigration policies determine the future of a country and its "way of life."

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)