This is why AdvancingTime has pounded away at the idea that where and what we buy has a major impact on the future of both communities and countries. I just finished watching "Thoughtful Money (with Adam Taggart) Good news!" The Zero Hedge team put this special Thoughtful Money's debate on the fate of the US dollar on the YouTube channel. This was a deep-dive discussion of over three hours.

This important video did nothing to change my mind about where the world is going. In short, I liked Brent Johnson's line, "certainty is death." He claims he is not certain about anything. The footnote under the discussion title makes it clear that Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves risk of loss. Loss of principal is possible. Also, some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic, and currency risks and differences in accounting methods. In short, it underlines Johnson's uncertainty.

|

| The Financial System Is Built Like This |

More than one economist, big wig CEO, and Fed watcher have admitted the problems haunting the financial system have very deep roots. These people often contend governments and central banks have not fully rectified the problems causing the great financial crisis of 2008. Instead, they have merely papered over our failures by printing money and flooding the system with liquidity.

In truth, the financial system is a rickety cobbled-together mess of poorly fitted pieces. Overall, the financial system is not a well designed machine. Instead, it is glued together in a haphazard way to get the job done. To make matters worse, this system is greased by the greed of those who benefit from stealing a little from here and there.

In the real world,

things are usually not intentionally designed to be complicated but the

reality is that they just are. Part of getting a clear picture of where we are headed stems from the reality this is not all about economics but politics plays a major part in our future. Recessions have always had the effect of cleansing the economy of weak noncompetitive companies to clear the way for new stronger companies. The efforts of those in charge of such things to remove recessions from the economic cycle has created a new hazard.

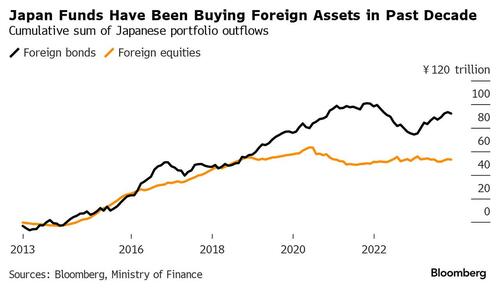

An excellent example of "hidden plumbing" is the Japanese carry trade. An article by Bloomberg reporter Masaki Kondo that appeared on Zerohedge on February 1st titled, "Aozora Delivers Grim Reminder Of Japan Carry-Trade Risk" details some of these issues. It details how Japanese investors as a whole have boosted their overseas investment since the BOJ expanded monetary easing in 2013. This includes Japanese banks. This puts them at risk if the cost of borrowing in yen should rise. He point out this could trigger an unwinding of Japan's massive carry trade.

While many people have focused on the losses US banks have incurred on long-term US bonds and American Banks' exposure to commercial real estate, little attention has been paid to Japan's exposure to these items. Not only could Japanese banks take a hit on both these investments but Japan's exposure to the downturn and losses in China is another area for concern. Yes, it is possible that China's economic problems will spill over and negatively impact Japan. Still, this is an area many financial gurus claim is an opportunity for Japan to expand into and exploit, in short, they claim economic chaos in China is a plus.

We should be aware that clogs in the system could create liquidity issues and even a change in the velocity at which money moves through the financial system could cause problems. The "slowing in the velocity of money" is rooted in where it is being placed. The speed at which money flows through the economy in some ways is tied to the speculation about the future of inflation.

Behind the scenes, a lot of things are occurring that we don't recognize as important until they are unveiled as being so. Trade deficits, reshoring of manufacturing, changes in how taxes are accessed, man made and natural disasters, and more all flow into this mix. This translates into "nobody really knows what the future holds." The so-called, often self-proclaimed experts, included.

Another thing we should be worried about is "financial one-offs" These are one-time events that may prove unable to propel the financial system forward over the long haul. In a world void of financially nutritious content, an individual has to really go out of their way to become educated in the way to avoid ending up as financial road kill. The less you know may increase your feeling all is well but does little to ensure your financial future.

(Republishing this article is permitted with reference to Bruce Wilds/AdvancingTime Blog)

No comments:

Post a Comment