|

Japan's goal to make ensure that commercial development of AI would not be hampered has now turned more cautious. With the policy shift, Japan is now hoping it can play a more dynamic role in crafting international rules on what have been called lethal autonomous weapons systems, or LAWS. At the conference of the U.N.'s Convention on Certain Conventional Weapons, it appears Japan will submit documents summarizing its views on LAWS and call for the establishment of a panel of technical experts in the field of AI. Let it be clear, killer robot-drones are no longer the stuff of science fiction. The technology to make such weapons exist today and research is rapidly being pushed forward.

Up until, now it has been some African, European, and Latin American countries have been the most active in seeking a prohibition of AI-equipped weapons while the United States, Russia, and other countries said to be developing them are reluctant. It is only logical that the countries most opposed would be those that know that since they are low on the technology totem-pole have no way of defending themselves and will most likely be the victims of future attacks. This brings together several topics that I have written about in the past including how many large mega-companies have grown to where they have more power than most nations.

The companies dealing with the internet, cloud storage, and such are particularly worrisome for democracy in that they have placed themselves in the position where they control the communication networks collecting and storing data on all of us. This puts them in a position to manipulate us in every way in a world where fake-news and propaganda are out of control. This train of thought brings front and center the question of whether mega-global companies are working in the direction of taking over the world and even dominating governments and countries. This could in many ways be considered an extension of the New World Order theme with CEOs pulling the strings.

Not only does it intersect with the question of whether globalism is in our best interest but helps explain how and why governments are becoming more authoritarian. This can be seen in a slew of new programs being unleashed to watch over us and even grade our actions in an effort to make us conform to what has been declared "the greater good." The idea that a world controlled by mega companies would be benevolent and kind ignores the greed and ambitions of those who control them and how little regard they can have for those ranked below them. One article even explored the possibility that China's OROB initiative into Africa might eventually lead to mass killings and genocide if Africa's population growth explodes as predicted.

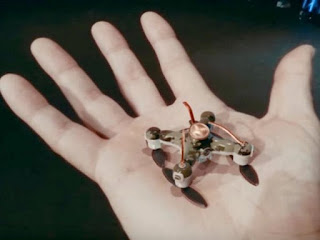

Circling back to the topic of killer robots, this is a subject I last wrote about in November 2015 when I echoed the concern being raised by many people who feel giving a non-human technology the ability to decide if a human lives or dies is simply morally reprehensible. It puts these weapons on the same level as chemical and nuclear weapons which ironically could be replaced as the most dangerous threat to armies and civilians by AI-directed killing machines. Of course, advocates say the weapon could become a crucial tool for saving lives by claiming they would be able to go into an area and eliminate "hostile forces" with less collateral damage.

|

| "Slaughterbots" Death In A Small Package (click to play) |

Again a big problem with a killer robot or any tool of death and destruction is who or what controls these machines. If we look at mega-companies an added bonus for these behemoths is they can hide behind the governments they control sucking profits from them but remain aloof and shielded from the evil they inflict. Whether robots function under artificial intelligence, governments, or are directed by people like Jeff Bezos who have been empowered by their position, to such forces the rest of us may rate low on the food chain. This should be a major concern to all of us as the killing ability of these machines continues to be ramped up and also expands into the fear that one day in the future Orwellian governments may deploy robots to keep their people under control.

Many of the people viewed as leaders in the field of artificial intelligence (AI) continue to warn of the potential of creating a system that can go awry even when placed in good hands. A recent article in, The Cut, tells how a clever AI computer hid data from its creator to cheat at its appointed task. Depending on how paranoid you are, this research from Stanford and Google will be either terrifying or fascinating. It confirms, that computers do exactly what they are asked, if not explicitly prevented from doing so, meaning you have to be very specific in what you ask them.

Killer robots that are autonomous may be even worse than those under the control of power-hungry or stupid men. Either scenario moves us in the direction of producing more killing fields across the globe. Hoping such events will occur far away and not affect you or your loved ones is not a practical defense for avoiding the carnage. I noted that at the end of 2016, a matter that merited far more of our attention but has become merely a footnote lost in the noise of daily news is the total destruction of once great cities such as Mosul and Aleppo and how they had been reduced to rubble. It cannot be overstated how photos graphically showing the total devastation and death modern warfare wrecks upon those caught in its path are being ignored.

Footnote; Your comments are welcome and encouraged. If you have time check out the archives for other posts that may be of interest to you. Three other articles about robots can be found below,

http://brucewilds.blogspot.com/2013/09/thats-my-robot.html

http://brucewilds.blogspot.com/2013/04/robot-factories-mean-less-jobs.html

http://brucewilds.blogspot.com/2015/10/sex-bots-could-make-spouse-obsolete.html