When markets move to extremes they can become very dangerous. Traders and investors need to ask if the market is factoring in some really aggressive Fed moves or merely recognizing that the economy is rapidly slowing. The markets and how it is priced often centers on how the Fed controls monetary policy. Until now we have seen no real action from the Fed but only jawboning and promises.

Generally, the Fed controls monetary policy in two ways, through the money supply and short-term interest rates. For decades, promoting the "wealth effect" has been a key part of Fed policy. This centers on keeping asset prices high and the notion when consumers feel better about the economy because their wealth is increasing, they go out and spend. Nothing lasts forever and the delicate balance between the "wealth effect" and inflation is currently under massive pressure.

_120.png?itok=YKniKTgj) |

| Leveraged Much? |

Until this time, the current pullback in markets has been rather orderly. Still, the volatility we have seen has left many investors whipsawed out of their money and the worst is probably yet to come. I see this as an indication we may be closer to the end of this euphoric bull market than many investors think. The buy the dippers should remember that markets climb a wall of worry but when they crash, it can come fast and furiously.

It would be wise to remember that the terms overbought and oversold are often "overused." While many systems have been designed to track demand, much of what is considered demand can often surface or vanish in the blink of an eye. Whether it comes from bears running for cover or bulls taking profits, any big player can start a big move in one direction or another. Add to this the fact that with many investors using leverage and taking on more risk than they think, margin calls can generate huge pain and force them to liquidate positions.

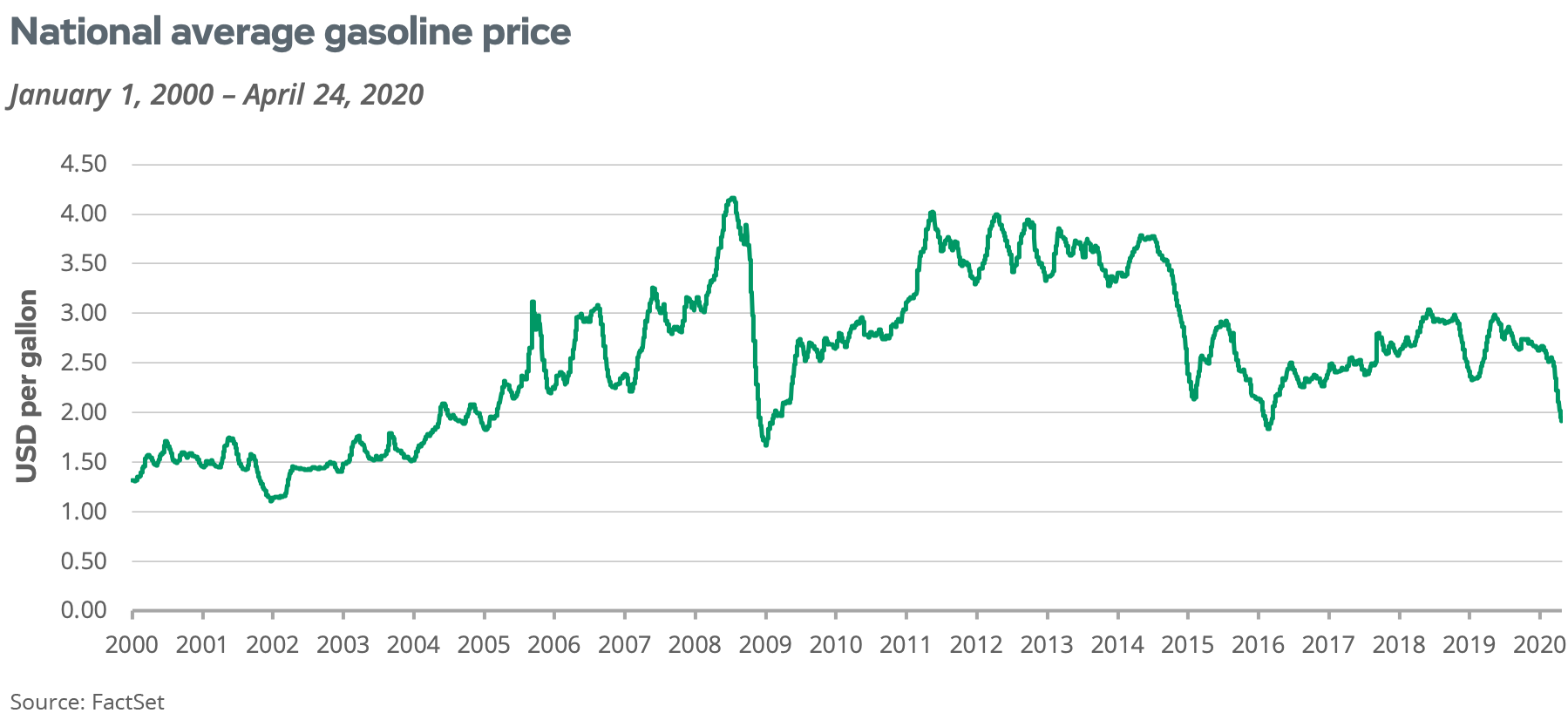

Markets can take huge swings that defy logic. The word, contango, is so poorly recognized my computer spell check could not deal with it. An excellent example of this type of event is the great oil contango of 2020. It was caused at the time by the raging Corona pandemic that inflicted economic repercussions on the gastronomy and hotel business, retailers, automobile producers, and airlines. Commodities traders were also affected, especially those with dealing in the price of crude oil.

|

| Most People Have Forgotten the Great Oil Contango Of 2020 |

Not immediately halting oil output combined with a lack of storage capacities left traders and speculators faced with rapidly falling prices for crude. This forced many desperate traders to offload expensive crude oil contracts before settlement to avoid taking physical delivery. The result was a super contango in the oil market. On April 20, 2020, for the first time in the history of crude oil futures, it caused the oil price for West Texas Intermediate (WTI) to drop to -37.63 dollars per barrel for May contracts. This was partly caused by a technical effect that took many market participants completely by surprise.

There is always a group of traders that fall into a category akin to flippers, these people often think they are smarter than you, whether they are or not is questionable. When things are good, they can be very good, when things are bad, they can be very bad. The media and financial companies pushing the economy forward are well entrenched in the art of doublespeak and finding a silver lining in every cloud and it is upon these clouds such traders ride.

These self-promoting market cheerleaders love to use the terms overbought and oversold as justification for any market move. More important is the issue of strong capitulation and how in a realizing market markets are not overbought or oversold but attempting to reach true price discovery. In such instances, strong capitulation is avoided and replaced with those on the wrong side of a trade simply continuing to deny anything has changed until all their money is gone. Sadly, this can occur faster than most investors realize. With all the financial Ponzi schemes that make up and influence our markets, such as stock buybacks, a very long fall is possible before we reach true price discovery.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

/confused-confusion-571b8bf35f9b58857db47336.jpg)