Wednesday, August 30, 2023

Advancing Time: Colonel Macgregor's View Of Ukrainian War Is Pure ...

Colonel Macgregor's View Of Ukrainian War Is Pure Ugly

If you believe Colonel Douglas Macgregor the Ukraine war is a shitfest. If you want to call a spade a spade this term is appropriate. Macgregor was recently interviewed by Tucker Carlson and his view and opinion, which few Americans have heard, has merit. Whether you think this war is about turning back Russian aggression, or simply about power and money, Macgregor presents a case few Americans have considered or faced.

We live in a time and in a world where it is difficult to gain traction when speaking out against the message and propaganda being spewed out by the mainstream media. This has resulted in Macgregor and his views being sidelined. Macgregor paints the war as a meat grinder in which the Ukrainians are being decimated. This means the war is all but over, unless we allow the warmongers to ratchet thing higher.

The warmongers are moving us towards destruction and their motivation must be questioned. Are they stupid, blinded by propaganda, greedy, or what? History shows what has become known as "proxy wars" create profits for

companies manufacturing weapons. The cost, of course, is then pawned off

on taxpayers and a public preoccupied with personal concerns. The problem we face today is that this may escalate as it becomes clear Ukraine is not winning the war.

This is big, by this, I refer to the situation in Ukraine and what we, as Americans are fomenting. Again, much of it is about power and money. Sadly, this is not the first time we have seen this, and this is not the first war we have entered into that has not made the world better or ended in victory. Still, this conflict is different in that Ukraine has a greater potential to escalate into becoming World War III.

Pursuing a national policy that profits the few at the detriment of the many does not generate good outcomes. Twenty-four minutes into the interview the topic turns to the financial cost of this conflict and America's national debt. Macgregor brings out the ugly numbers of waste flowing out of Washington and what Biden and are leaders are doing to America.

As the Colonel points out many of the problems our country faces he points out there is little difference between the two political parties. He highlights this by calling the Democrats and the Republicans the Unaparty. Like many Americans he sees the swamp getting richer while the vast part of America gets poorer. Adding to his downcast appraisal of the situation he does not see a white knight coming to save us from the group currently running for president. As far as viewing this war as a shitfest, the Urban Dictionary defines shitfest as:- 1) An extremely undesirable or unpleasant situation.

- 2) An occasion or situation where only bad things are expected to happen, or a situation that is expected to become progressively worse.

- 3) A monumental clusterf##k.

Forty-seven minutes into the interview things go totally disgusting when Tucker Carlson plays a tape of the kind of propaganda being broadcast to the masses in Ukraine. Long-time readers of the AdvancingTime blog know it has taken the stand time and time again against the whole Ukrainian thing from the get go. Ukraine has a history of corruption and its current leader who ran as an anti-war candidate is no different.

Biden's war is a shitfest and train-wreck that few Americans seem willing to confront for what it is. This goes all the way back to President Obama, in April of 2014 an Advancing Time article titled: "War In Ukraine A Bad Idea!" warned against such an endeavor. It noted the now infamous phone comment, "F— the E.U.," by U.S. Assistant Secretary of State, Victoria Nuland, which underlines who was pushing an agenda of confrontation.

While some people hold the former President Obama in high esteem, the world has paid dearly for his sins, Remember it was Obama that reassured and almost encouraged the people of Syria to rise up and overthrow their brutal leader. Obama started a series of events that took countless lives and destroyed millions of others. Flowing from Obama's actions are the development of ISIS, the flow of millions of refugees into Europe, and the bombing and destruction of cities and innocent civilians.

As this war drags on Biden continues playing a deadly game and the people of Ukraine are his pawns. Whether Macgregor is right or wrong, the one thing many Americans would agree upon is the money we have spent we havespent in Ukraine could have been put to good use here at home. As of today that figure totals roughly five hundred dollars per man, woman, and child in America.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Sunday, August 27, 2023

Advancing Time: The Hidden Tax Of This And That

The Hidden Tax Of This And That

Life is full of hidden taxes. Governments, banks, and businesses all benefit from taking advantage of us by shifting costs and then nibbling away at us. This often occurs when we are distracted by a larger attack on us coming from another direction. All this should be considered part of a larger ruse, or ploy to mask how we are being weakened by a thousand cuts. Such schemes promote the idea these "little" penalties and taxes upon us are minor tolls that must be paid for society to function rather than a theft fostered upon us.

Of course, this is

becoming much easier as we move towards a cashless society where

systems allow people to pay bills without even looking at them. In

general, most people have come to accept a little pilfering here and

there as normal. Fighting such incursions into our lives usually fails

and many people deem the effort more trouble than it is worth.

No matter how much we rile at the failure of our institutions and governments, the biggest problem we face is things will most likely get far worse. Many of the trends that are developing indicate that society is having a very difficult time adjusting to the rapid rate of change taking place. This can be seen in the large number of people that are being left behind.

While many people have been lifted out of poverty we have also witnessed a growing percentage of the population with both physical and mental ailments. These "disabilities." often take the form of things such as addiction, alcoholism, and eating disorders. The demographic picture unfolding across the world combined with huge government deficits does not bode well for future growth. When you mix these dysfunctional people into the demographic soup it becomes downright ugly.

| It Also Allows Him to Avoid Customers |

Too much of the world, too much of what we see, too much of what we are told is a lie and that is a fact. The small hidden taxes on this and that almost guarantee that further declines in both society and the financial system are likely. We are constantly bombarded with charts showing where things are going based on historical references but a question we must ask is just how relevant today's comparisons are with prior economic cycles. Changes in how the economy is structured do not take place overnight. This does not mean it will be worse, just different.

|

| Low Productivity, Cones But No Workers |

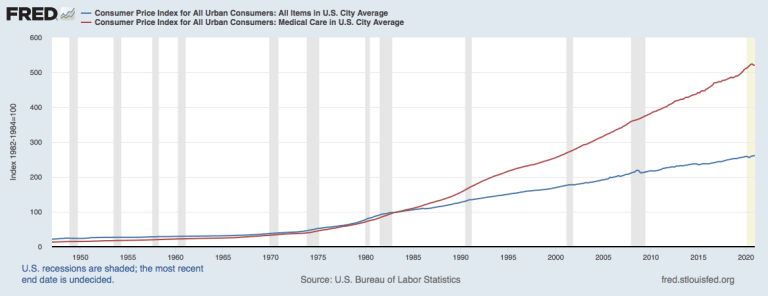

The term trueflation merits a great deal more attention than it gets, how the government arrives at these numbers matter. Inflation is viewed on a year-over-year basis, which means as the higher months drop away the numbers tend to give the impression we have it on the run. This should not be seen as prices now going back to "normal" but rather that they are not moving up as fast. Unfortunately, this method of computing inflation creates a "base effect" on inflation rates setting them up for another wave higher. Inflation is not gone and this means long-term investment in government bonds remains problematic.

It is important to note that a fundamental change has occurred in the economy related to productivity. The hidden tax resulting from the acceptance of continued incompetence is no longer an exception, it is the rule. AI and all the newfangled improvements be damned, many things no-longer work and productivity is falling. Government regulation is monkey-hammering businesses, especially small businesses. High wages kill small businesses that can't afford to automate. Many small businesses are being forced to cut hours and staffing until they simply go out of existence. If you want you can declare this the plan of a government seeking to control everything and everyone.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Monday, August 21, 2023

Advancing Time: Volatility Ahead, Deflation, Then Inflation, Equal...

Volatility Ahead, Deflation, Then Inflation, Equals Inflation

The CPI is a poor indicator of true inflation, it is rigged to give the impression everything is still in control. Decades ago, politicians and those concocting this system created it as a way to reduce

the cost of living adjustments for government

payments to Social Security recipients, etc. By moving

to a substitution-based index and weakening other

constant-standard-of-living ties those reporting inflation have muddied the water lessening the impression of just how

much our cost of living is impacted by inflation.

Then we have the GDP. It is created by junk numbers, which makes it a "more out of nothing at all" thing. For example, utility bills are up everywhere, and guess what? For most consumers and businesses this acts as a "not good" driver of the GDP. Another driver is government spending which tends to be a negative growth multiplier that pulls money away from the private sector. In short, the case could be may that the GDP is a big fat hoax.

Today we are looking at an America that is running a wartime deficit at a

time of peace. Considering how the GDP numbers are figured this is heavily weighted to give the impression all is well. When we think about the definition of a

recession, two consecutive quarters of negative GDP, government spending

makes it almost impossible to get there. Still, other factors are at work that signal trouble ahead.

A fair number of economic forecasters foresee a hard downward move in the value of assets followed by a massive rise due to inflation. It has been my experience that it is not as easy to move in and out of hard assets such as real estate or even precious metals. The bars to entry are often high with a lot of fees, many of these markets are also illiquid. This is the main reason many investors turn to stocks.

|

| Are You Ready To Get Jerked Around? |

This all means we should focus on several points. Often the most important ingredient when it comes to wealth preservation is not putting yourself in a position where you get squeezed out of your asset. The squeeze usually is the result of debt and over-leverage. This is especially true in volatile markets where liquidity has dried up. It is also important to remember in a world of global markets many markets are still local. The collapse of a market in one area does not mean it will drop in another or guarantee it will stay down when due to narrow short-term circumstances.

Having assets that hold their value is important. Also, not putting all your eggs in one basket is something we should remember. When the so-called experts are busy downplaying the risk of jumping in and out of various markets a red flag appears in front of my eyes. What is in it for them, do they have an agenda? "They" don't care about you. The goal is to whipsaw investors and savers out of their money. There is a reason caveat emptor, a term that means "buyer beware," remains in our vocabulary. Buyer beware is still a relevant term.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Tuesday, August 15, 2023

Advancing Time: China Busy Hiding Reports Of Flood Damage And Death

China Busy Hiding Reports Of Flood Damage And Death

Devastating reports of flood damage and death are trickling out of China. The country has just been hit with the largest flood it has seen in 140 years. This means the Chinese Communist Party (CCP) has cranked up its propaganda machine to downplay the destruction and bury the devastating reports of damage and death. This includes fabricating stories of rescues and rapidly arriving to help the victims of the disaster.

In some ways, this could be viewed as a "Hurricane Katrina moment" for China's leader Xi Jinping. It certainly represents an embarrassing failure of the Chinese government to protect its people. Hundreds of thousands of China's citizens have lost everything and had their lives destroyed. Still, the government is more interested in quelling the protests of victims than providing help. For the leadership this is about saving face. It is also proof that when a government "makes the news," it controls the news. This leaves the question of how bad the flooding has become.

It also highlights the fact that China's system of dams has not tamed its rivers. In a video, Chris Chappell of China Uncensored reported that China's northeast got some biblical-level flooding this month. Streets were turned into rivers, and rivers were turned into lakes. This unfolded so fast that most people had little or no warning. The capital was woefully unprepared for such a deluge. But what really has people angry is how the CCP handled it. China's flood waters are washing up some nasty truths. The government has put itself and saving certain cities it values above the lives of the people in other less favored areas.

This includes creating levee breaks and discharging water to flood farmland and lesser cities to defend what the government values. China Insights claims that On

August 10, the upper reaches of the Qing River in northern China's

Hebei Province had a dam break while flood levels downstream Tianjin were dropping. This

has brought about speculation the authorities discharged

flood water to Hebei in order to protect Tianjin. These officials led

police teams and personally directed them to block the flood water

exits to make sure the water stays in the farmland.

As far as Western media being able to get this story out, we get a big fail. An example of this is a Newsweek article focusing on dogs. It reports that according to Humane Society International (HSI), hundreds of dogs and several cats were saved by animal activists during the devastating floods. The article did, to its credit, mention that dozens of people have been killed in the floods and several more are still missing. It also took the focus off the disaster in China by pointing out Typhoon Doksuri sparked heavy rainfall in parts of the Philippines, Taiwan, China, and Vietnam, causing extensive damage to homes, crops, livestock, and infrastructure in those areas as well.

|

| China Controls Its News And What Is Seen |

One CNBC story focused on what this might do to the price of rice. It states global rice markets could come under further pressure as the world's leading producer China grapples with heavy rain and flooding. It noted that China is the world's largest producer of rice, and flooding hit three provinces that account for 23% of the country's rice output. Unfortunately, the article fell short of telling the extent of the true devastation suffered in much of the area. This is not simply about lower rice yields.

On the other hand, UPI told the story the CCP propaganda machine dished out. It told of how 21 people are dead and another six are missing after heavy rain caused flooding and mudslides in China's northwestern Shaanxi Province. And followed with tales of how more than 180 people have been evacuated from mountainside villages according to China's state news agency Xinhua. It expanded on this telling how fourteen rescue teams with 980 rescuers were rapidly dispatched to lead the evacuation effort and repair infrastructure. It also reported that three heavily damaged sections of National Highway 210 have been repaired and power has been restored to more than 850 homes, the Global Times reports.

|

| The Situation Is Worse Than Reported |

It appears the loss of life may well be in the thousands but we will never know. Under the CCP's rule, the authorities prioritized protecting Beijing and Xiong'an, sacrificing the lives and well-being of the people of Hebei Zhuozhou. The efforts of many families spanning decades or even generations have been washed away in these floods. Sadly, many of these people know that even when the CCP states that money has been shifted to provide aid, corrupt officials have a way of stealing most of it before it reaches its destination.

Footnote; The article below delves into how does a society that has been castrated behaves when betrayed by its government? In China the people bend under the

weight

of an

oppressive government that has used propaganda to destroy free thought.

In short, the people moan and then accept the transgression. https://brucewilds.blogspot.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Saturday, August 12, 2023

Advancing Time: A "Global Inflationary Depression" Is Very Possible

A "Global Inflationary Depression" Is Very Possible

Global inflationary depression is not a mix of words we normally see placed together. To those finding this notion unacceptable, we could reframe this as a stagflation era of reversion. Moving us towards the depression part of this scenario is the fact many economic watchers are predicting outright deflation pointing to a huge slowing of the economy. Currently, the biggest source of demand comes from governments. Demand from working people and private sector growth is on the wane. If you remove all the money being spent on Covid-19 vaccinations, tests, and a slew of inefficient spending that has created little long-term benefits to the economy the GDP would fall like a stone.

We seldom have depressions but instead tend

to roll through mild recessions, however, what we face today may be far more

severe. In the past, times of falling economic activity have

generally been deflationary as defaults rise but this time if inflation does not abate the result may be very different. Part of this is rooted in the fact that in the past many events tended to be regional

rather than global. Today, economies have become more

interconnected the

resulting codependency presents an increased possibility of problems

spreading across the world.

The money flowing from the

central banks and governments has created the so-called "pent-up demand"

we have been hearing about and the constant predictions of solid GDP growth. In truth, capacity utilization and productivity are down even while trillions

of new dollars pour into the system. This is the logic behind saying a

depression may be in the wings. The methods governments use to use to determine GDP have also become so skewed that they lack real value. Paying someone to dig a hole and then fill it back in adds to the GDP but does nothing to increase productivity. Government spending can increase the GDP while at the same time reducing productivity.

| China's Economy Is Hitting A Wall |

Growing concern over the debasement of the fiat currencies issued by nations and central banks is adding to expectations inflation is waiting in the wings. Policies such as we see today would have been impossible when money was tied to gold. As investors shift into assets that do well during times of inflation, it is possible they will set in motion a self-feeding loop or cycle. When fiat money that has quietly sat in paper promises begins to be exchanged for tangible assets and inflation hedges it has the potential to reverse the long-falling velocity of money. Money sitting in the hands of wealthy people that sat in one place for years may start to move.

This dovetails with the fact that inflation brings with it higher interest rates that impact most sectors of the economy. This tends to put a spotlight on the difference between liquidity and solvency. As interest rates rise construction tends to grind to a halt. Higher interest rates also result in people having a difficult time paying for or financing big-ticket items such as automobiles. In short, it puts a great deal of stress on most parts of the economy including government deficits which have exploded since the 2008 financial crisis.

Two often-overlooked factors support the idea we are headed down a path of inflation even if the economy drastically slows. The first is many laws have been set in place to raise the minimum wage. The recent agreement workers made with UPS screams wage inflation. The second is the fact that so many Americans work for the government. These are mostly full time and workers seldom get laid off without pay. Figures from the National Debt Clock show just under 150 million workers are in the workforce and nearly 24 million of them are employed by the government. That is almost one in six. The government's oversized role in today's economy which is much larger than it was during the Great Depression has put a net under the ability of prices to fall.

Across the world, sophisticated lenders, but not the general public, understand the history of how governments’ monetary policies destroy the purchasing power of currencies. To avoid the issue of currency debasement risk, regardless of the yield we have seen the power of being the world's reserve currency on display in loan documents. The BIS reports this is up from 40% a decade ago. One reason the dollar will most likely fare better than the euro or yen when fiat currencies come under assault is the huge percentage of the world’s $30 trillion-plus in cross-border loans are priced in US dollars.

|

| Inflation Hits In An Uneven Manner |

Inflation is a form of thief that moves wealth from the people and into governments' coffers. While many investors are

focused on yield curves, bitcoin, and surging market valuations, the

foundation of central bankers' argument that QE is possible without

inflation may be crumbling. We are now seeing that large sectors of the economy are broken. Inflation

expectations are continuing to grow and the law of diminishing returns

is raging havoc with the efforts of central banks to control the

economy. Expect more investors to move into assets that do

well in an inflationary environment while the masses wither in pain.

This all folds into the story of how for decades the monetary illusion created by central banks collaborating with governments has delayed an inevitable crisis by not dealing with reality. This means when the forces pent-up over the years finally break free events will most likely occur faster with far deeper ramifications than many people expect. When imbalances are ignored, bad things occur. When things finally blow up in the faces of those creating and promoting MMT we can expect to hear them claim it was not their fault and it was because of a general misunderstanding of the role of money and credit in the economy.

Such a shift will have profound consequences for inflation-sensitive assets around the world. The one thing we can count on is that when things crumble, we will hear the old, "we should have done more" or the "it would have been far worse" lines flow forth. Those in charge often find great comfort in spouting such nonsense. We have been lulled into complacency and have given central banks too much credit for being able to control the economy and stop financial crises. The first global inflationary depression may not start today or tomorrow but it is coming and when it arrives most people will have never seen it coming.

Republishing this article is permitted with reference to Bruce Wilds/AdvancingTime Blog