Sunday, April 30, 2023

Advancing Time: The Left Has No Intention Of Going Quietly Into Th...

The Left Has No Intention Of Going Quietly Into The Night

Adding to this is the reality that we live in a world that has made a mockery of hard work and savings, this is a major disservice to those carrying the load. Many people fail to take into account that the socialist agenda of the far left is in many ways anti-social. As we look around it is easy to see that much of the workforce has gone full "John Galt" and decided not to participate in the job market. Much of this is driven by the notion that hard work does not pay big dividends and we might as well dump our problems off onto those stupid enough to accept them.

Society and politicians are rapidly dismantling the rights of ownership. This transfer of rights constitutes a transfer of wealth whether we wish to call it by that name or not. This is the main reason so many of the most capable contributors to our economy are now moving toward the sidelines. Capable and smart people do not have to work hard to make ends meet and are proving this by going out and enjoying life rather than working to support those that won't. When people decide to remove themselves from a game they see as rigged in favor of those far less deserving it is an indication of greater problems ahead.

Still, make no mistake, the left claiming it is "progressive" has no intention of melting quietly into the night. I fear those both in the middle and on the right that think things will turn around are overly optimistic. Those on the right often point to California as a failed state. They use as an example drug-infested San Fransisco. At the end of 2021, it was estimated that of the city’s roughly 8,124 people that were at the time "unhoused," a full 73 percent were “unsheltered.” This means they sleep out of doors, in tents, and under highway overpasses.

|

| Catch-22 Is A Real Thing |

While much of the country views high taxes, rampant drug use, and crime as the reason many major retailers are closing stores in the state, its Governor is being touted as a candidate for the Presidency in 2024. The bad news is that if you think it can't get any worse, you are wrong. Sadly, society has turned onto a fast path to ruin downward. A slew of lightweight JV thinkers have taken us down the rabbit hole when it comes to creating a better future.

|

| We Need A Hero, But None Is In Sight |

It could be argued that those on the far left have been joined by, or are being

egged on and encouraged by those wishing to weaken the United States

from the inside. Russia and China are generally painted as the villains

in such a scenario. The real problem we face is that true leadership tends not to exist in a vacuum. The fact is that we need a hero and they are in short supply. It has been said, the "pioneers took all the arrows," meaning it is much safer to travel west today. It also means people of real value will most likely be destroyed if they attempt to move to the front.

A feeling of hopelessness recently descended upon me when I became a victim of vandalism. How do you protect what can not be protected? The catch-22 here is that you have a very difficult time insuring an empty building but how do you rent it when it is constantly being ripped apart by vandals? While not the economic disaster that will end me, such events are "mentally" troubling. It is also why so many people shy away from owning hard assets, this applies to gold, real estate, and more. Readers of AdvancingTime know not owning "real things" is an investment strategy I consider problematic.

The efforts of those in power to paint vandalism of private property as mischief is the reason so many Americans when given the chance, op to live in gated communities. In truth, we cannot "gate off" everything. This reflects society's inability to make people behave. The failure of people to take responsibility for their actions signals greater problems ahead.

It does not help that we are facing a toxic mix when it comes to protecting our freedom. Big companies are predatory and big governments are stupid. The thing they have in common is they both want more control and power. In truth, we are the underdog in this ongoing struggle for control of our lives and progressives are promoting policies that empower those that want to control us. Throw in the likelihood of an economic reset or hard landing and you might say, if you think it can't get any worse, you are wrong. Lowering your expectations may be in order.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Thursday, April 27, 2023

Advancing Time: Living With An Older Parent Suffering From Dementia

Wednesday, April 26, 2023

Advancing Time: Ugliness Awaits Many Boomers Nearing Retirement

Advancing Time: As We Sell Off Our Strategic Oil Reserves, Ponder ...

Advancing Time: China Is Staying Afloat by Flooding Its Market Wi...

Monday, April 24, 2023

Advancing Time: Central Banks Use Of Credit Swaps To Stabilize Mar...

Central Banks Use Of Credit Swaps To Stabilize Markets

The dollar has been swept into the

debate of failing fiat currencies. At

some point, these clowns will realize all this doom porn about the dollar

crashing is not helping them. Talk of killing the dollar, often referred to as the "cleanest dirty shirt in the closet," is not a panacea for other currencies. Remember the whole system is based on

faith and the idea it is all downhill for the dollar creates a doom

loop for all fiat currencies.

It is important to point out that the ECB President, Lagarde, is one of "them." By this, I mean, her background solidly plants her in the "globalist camp." Her time as head of the IMF may enhance her credibility with some people but it also stains her as a liar with an agenda that cannot be trusted. There is little doubt that Lagarde is committed to propping up the current system while pushing to be a key player in its replacement. All this feeds into why the ECB views completing the European capital markets union as pivotal in determining whether the euro retains its place as the second global currency.

Information collected before April 10, indicates we are seeing a tightened of lending standards. This is worsening a credit crunch that is likely to spark a hard economic landing in the coming months. This was confirmed in the latest Federal Reserve's Beige Book. The reality is that without these credit swaps, the global financial system might spin out of control. Major shifts in the value of currencies could easily set off a crisis in the massive highly leveraged derivatives market.

The ICE U.S. Dollar Index which measures the dollar's strength against a basket of rivals recently logged its fifth straight weekly decline according to data from FactSet. This puts the U.S. dollar on the path to its longest losing streak in nearly three years. That may soon end. Recently the weekly data released by the Commodity Futures Trading Commission indicated for the first time since January 2022 that speculators are now using futures and options to bet that the dollar will appreciate against a broad group of currencies. These include the British pound, the euro, the yen, the Canadian dollar, and more.

In the past, independent central banks could

focus on stabilizing inflation by steering demand without having to pay

too much attention to supply-side disruptions. That period of relative

stability is over. We have entered a more multipolar world. Lower

growth, higher costs, and

trade tensions all signal the possibility of repeated supply shocks. This is bad news for both the economy and financial markets.

It has been over a month since signs of banking stress first appeared in America's regional banks. What many Americans fail to see is the stress growing across the globe. Now everyone is busy looking for the next "credit event" to surface or waiting for the next shoe to drop. Michael Every of Rabobank has pointed out that Fed-speak underlined the US economy is ‘doing just fine’ with rates at 5% is the usual "small picture" stuff of most market commentary rather than something of substance.

Positive market commentary does not offset the reality that credit availability in certain sectors of the economy is contracting at a highly alarming pace. As conditions in the broad finance sector deteriorate lending volumes and loan demand is declining. This is a problem, especially for Main Street considering small to medium-sized banks with less than $250bn in assets account for roughly 50% of US commercial and industrial lending. They also are responsible for around 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.

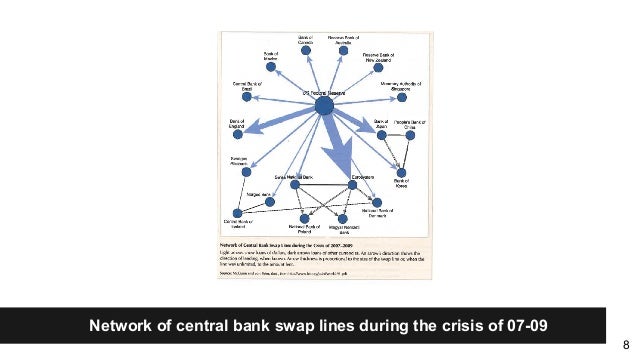

Keynes noted that central banks have been allowed to act like the conductor of an international orchestra. This is because after the USD became the global reserve currency, and the euro rose to second place their power was enhanced. Some of this has now waned due to China's growing influence. The People's Bank of China has gone about setting up over 30 bilateral swap lines with other central banks to compensate for the lack of liquid financial markets in the renminbi.To be clear, as the world drifts farther into competing geopolitical blocs, governments increase their spending, and deficits grow, it is difficult to envision any fiat currency as a safe store of wealth. Inflation is structurally built into the system. The FX architecture of swap lines may temporarily ease pressure giving the system time to adjust but will not hold back the tide of reality for long. Even some major fiat currencies will lose value faster than others. The yen is proof of this.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Tuesday, April 18, 2023

Advancing Time: Is It Wise For Those In Power To Push EV Demand?

Is It Wise For Those In Power To Push EV Demand?

If this were not the case the world might be a much better place to live. It is not uncommon for those with an agenda to shape our future. Today this is evident in the area of electric vehicles (EVs) and how they are being touted as the answer to our environmental woes. While there is an argument that EVs do have a role in certain areas of our transportation infrastructure, the idea they will solve our problems is ludicrous.

It seems the decision to move rapidly towards EVs is being chosen for us and those in power are determining EV demand. This is being done by the carrot and stick method. This is a technique that achieves the desired actions from others by offering a reward (carrot) and a negative consequence by smacking them with a stick. Pain and negative sanctions can be strong motivators.

In this case, the stick is the new rules proposed by the EPA and White House to tighten carbon emissions. These aggressive tailpipe emissions standards will impact car

model years 2027 through 2032. While the White House touts the changes will result

in carbon emission reductions of nearly 10 billion tons by 2055 as well as save consumers an average of $12,000

Sunday, April 16, 2023

Advancing Time: China Is Staying Afloat by Flooding Its Market Wi...

China Is Staying Afloat by Flooding Its Market With Cash

The idea that Chinese savers are flush with cash and will roll out in mass following the lockdown may be flawed. If they do, most of the spending will be contained within China and still not be enough to offset other factors. Some people seem to be forgetting that much of Chinese household wealth is invested in China's falling housing market. It is unlikely those losing money on their housing investments will feel like rushing to spend.

The largest financial issue China must face is that its real estate market which made up north of 25% of its economy has imploded. The far-reaching impact of a housing crash in China has just started and may take years to play out. The Chinese people have up until now had three-quarters of their wealth and savings stashed away in housing. With prices falling they are feeling a full-blown reverse wealth effect flow over the economy.

In the middle of January China's central bank pumped a record amount of short-term cash into the banking system as demand rose ahead of the Chinese New Year holidays. The People’s Bank of China (PBOC) added a record-high net 1.97 trillion yuan (S$384 billion) via open market operations according to Bloomberg. To clarify, the Chinese Yuan (CNY) and Renminbi (RMB) are interchangeable terms for China's currency.

The trade in goods between the US and China climbed to a record in 2022. This kept the world’s two biggest economies deeply connected despite their efforts to forge separate paths. It is now projected that imports from China are likely to come under pressure due to consumer spending and business investment growth moderating. American companies are also making efforts to find substitute suppliers or shorten supply chains and bring jobs home.

|

| This data, not adjusted for inflation, may prove to be the high mark for many years. |

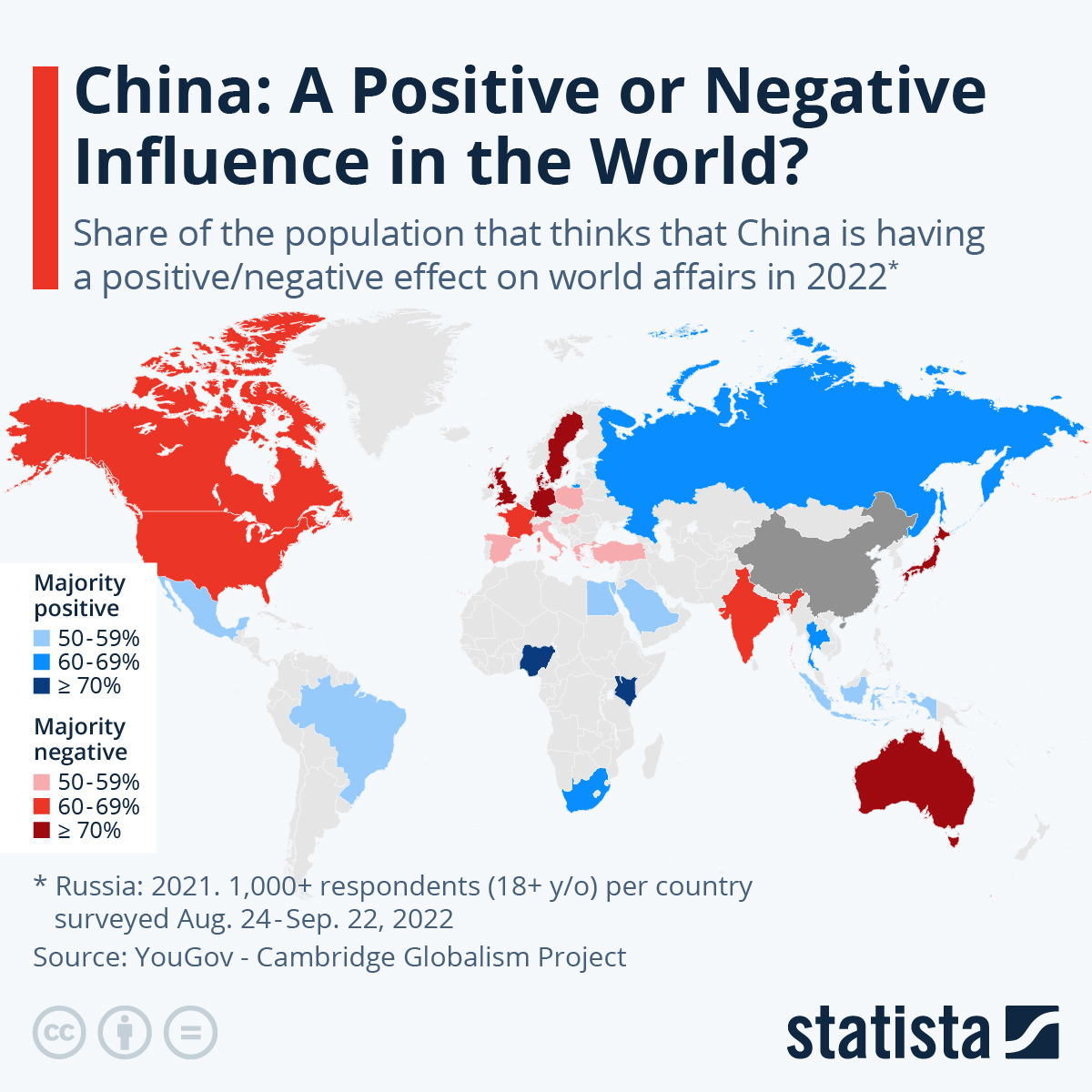

With China now having put its One Belt One Road initiative into full motion, the world is busy trying to understand whether China deserves to be looked upon as a favorable force. Statista's Katharina Buchholz reports that out of 26 countries surveyed, negative views of China prevailed in 16. The number of countries looking unfavorably at China has increased since the poll started in 2019.

The countries with the most respondents favoring China were Nigeria, Kenya, Thailand, Russia, Egypt, and Saudi Arabia. Still, views of China are broadly negative across most of the advanced economies. Roughly three-quarters of respondents in Japan, Sweden, Australia, Denmark, the United Kingdom, and Germany had a negative view of China.

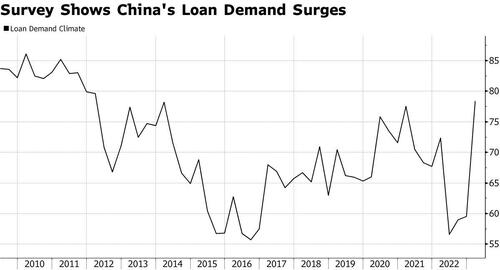

Returning to the issue of China influencing world markets by flooding the financial system with cash, this signals that China has a problem. Unlike in America where the US banking turmoil and the economic damage from an inevitable tightening in lending may only be starting, in China, the opposite seems to be happening. In an effort to reboot the economy the Communist Party is currently easing and loan demand is surging.

|

| The Reason For Surging Loan Demand Matter! |

A recent PBOC quarterly survey of bankers released Monday showed loan demand surged to its highest level in more than a decade. While there is a deleveraging in the household sector amid housing turmoil, the actual bank lending data indicates long-term corporate loans are shooting through the roof. It could be that this suggests a resurgence of business confidence as entrepreneurs expand factories or invest in new businesses. Still, more likely at least part of the demand for corporate debt may be companies borrowing new money to refinance existing debt.

Michael Every, a Global Strategist at Rabobank, and based out of Singapore appeared on Wealthion the other day. Around 28 minutes into the video, https://www.youtube.com/watch?v=00QS52Y40rQ he takes the stand what is now happening in China is not about to pull the global economy forward. Linked to this topic are matters relating to why someone would rush to dump dollars and view the yaun as a competitor for replacing the dollar. I contend that China has seen its best days, is overrated by many people in the West, and has seen its best days.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Tuesday, April 11, 2023

Japan, A Record Trade Deficit In 2022 Added To Its Woes

Japan reported a record annual trade deficit in 2022. It marked Japan's second straight year of red ink and surpassed the 2014 record of 12.8 trillion yen. This is only one of many problems facing the island nation. The deficit came in at 19.97 trillion yen ($155.9 billion) as imports soared and the yen weakened. Some of this was due to higher costs as the price of natural resources spiked following Russia's invasion of Ukraine.

|

| Japan Is Heavily Indebted |

Outgoing Bank of Japan Governor Haruhiko Kuroda became governor in 2013 and led the BOJ into uncharted territory with aggressive buying of government bonds and other assets to support the economy. Kuroda guided the powerful monetary easing experiment that was a key pillar of the "Abenomics" economy-boosting program. This policy under then-Prime Minister Shinzo Abe weakened the yen and boosted stocks while sending the government deeper and deeper into debt.

The utmost priority for Kuroda was to achieve a departure from deflation and attain a 2 % inflation target. Some may argue that just as Kuroda departs as Japan's longest-serving BOJ chief conditions are gradually falling into place for the price hike goal he desired accompanied by wage growth. The problem is that as his tenure ends, Japan's potential growth rate is around zero percent and its gap from the economy's actual output indicates demand remains weaker than supply. With its yen having been weakened, this is a bit of a slap in the face for the Japanese people.

Kuroda's predecessor Masaaki Shirakawa, a skeptic of the 2%

target has called the BOJ's

decade-long monetary policy a "great monetary experiment" and noted

that it has only produced a "modest" impact on growth and reversing

deflation. Part of the problem is that companies making solid profits

have invested in other countries where the potential for growth was

greater. This eroded the economic results the BOJ had hoped for. It also lessened the need to increase wages which would spur forth more consumption.

I contend things would have been even more difficult for Japan over the last few decades had it not tied itself to China's meteoric rise. Its close proximity to China allowed it to develop many profitable relationships that created a tailwind for the Japanese economy. Unfortunately, much of that tailwind is gone and the failure of many Chinese companies may soon have a negative effect on Japan's future earnings.

| If Year After Year Trade Deficits Are In Its Future Japan's Problems Will Escalate |

Looking toward the future, Japan is at a crossroads. Japan's economy is built on exporting finished goods and has prospered from trade. If year-after-year trade deficits are in its future Japan's problems will rapidly escalate. Resource-poor Japan is dependent on creating a positive trade surplus to fund caring for its aging population.

The new head of the BOJ is an academic by the name of Kazuo Ueda. It is difficult to predict what policies he might adopt. Underlining the fact the current bout of inflation is being driven by surging costs rather than strong demand creates a problem he will have to deal with. This reinforces the view that the bank's options are limited and that monetary easing will be in place for a while.

What next? only time will tell. For a good overview of Japan and its economy view this video; https://www.youtube.com/watch?v=YY_ePpT0fLY It should be noted that around 19 min into this video the comparison of China and Japan is both made and difficult to deny.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Sunday, April 9, 2023

China's Auto Price War Is Now Out Of Control

As for the main driver or motivation of these sales, auto sales in China plunged by 35% from a year earlier to 1.65 million

units in January 2023. This was the lowest figure for the month since 2012 data from the China

Association of Automobile Manufacturers (CAAM) showed. It was also an 8.4% drop when compared to sales a month earlier.

As might be expected, the Chinese government will and can make decisions that benefit them and only China. Those of us living in more free market economies tend to forget how skewed things can become when a government injects its desire upon supply and demand. This is done in an effort to influence not only what people buy but more explicitly the type or their preference.

It is no secret that China wants to dominate the Electric Vehicle market come hell or high water, by fair means or foul. The current disruption in the Chinese automobile market feeds into such a scenario. The current Chinese automobile price war is being ignored by most mainstream media or considered a nonevent but has important ramifications. Currently, China is the clear leader in procuring and refining the materials necessary as well as assembling EV battery cells.

Whether EVs are really good for the environment and rushing to make fossil fuel vehicles obsolete is still an issue of great debate. The fact much of the electricity needed to power EVs comes from fossil fuels will remain the reality for years. Feeding into this debate are also issues about materials needed for batteries, heavy EVs rapidly chewing through tires, and the waste created by dooming over 1.4 billion vehicles to an early death.

Below are two important facts;

- By the end of the first quarter of 2022, there were approximately 1.45 billion vehicles in the world, of which about 1.1 billion are passenger cars. That means there is a car for every 7.18 people on the planet.

- China’s demand for coal has surged from 1990 to 2019. China consumes more coal than

the rest of the world combined. As of 2020, coal made up 56.8 percent of China’s energy use.

|

| All Aimed At Hurting "Foreign Competitors"? |

Caught up in the worst price war ever, foreign automobile brands are tasting the bitter fruit of entering joint ventures with the Chinese. A recent report from China Insights ( https://www.youtube.com/watch?v=tBxcJIjlQuA ) details how without these price cuts, it would be far more difficult for Chinese automakers to move cars.

There is also talk China may soon institute new emission rules and regulations that make these cars unsaleable. After the new regulation, it is said even new cars cannot be sold as new but can only be resold once purchased. This means all gas cars are going with discounts up to 50%. As expected, this is also driving the price down for electric cars.

We are talking about

hundreds of thousands of cars by companies such as BMW, VW, Toyota, and

Honda. This is a disaster for the legacy car makers. It means they will

lose billions of dollars. Sales of the legacy brands we in the West know best have hit a wall. These cars are sitting idle in showrooms all over China gathering dust. We are looking at massive losses. The bulk of this pain will hit Europe harder than America and this puts an arrow in the idea stronger ties with China would benefit the EU.

In a video that came out on March 19th ( https://www.youtube.com/watch?v=81H3gZ56_vw )The Electric Viking reported the inventory of these cars has exploded to 70 days, the most in a decade. This increased from 57 days only weeks ago. This is occurring at the same time many manufacturers are throttling back production. Still adding to the confusion are claims of supply bottlenecks and shortages of cars here and there across the world. All this screams that the auto industry will be interesting to watch going forward.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Right now, those that are hellbent on burying the internal combustion engine are cursing my stand. While I say to them, you are being deceived by those conveniently forgetting that most electricity is still generated by fossil fuel. To those that scream about freedom of choice or how climate change is a hoax, my message is self-indulgent, and self-centered, people with the attitude the world is their oyster and the hell with everyone else should consider that how we conduct our lives may have some effect on the climate.

An argument can be made that policies incentivizing electric-car production will lead to the creation of more carbon emissions during coming years than if we were to instead encourage the use of efficient gasoline engines. Electricity demand is still rising across the world, most nuclear plants getting very old, and the most ecologically friendly sources are running full out. This means the slack is being taken up by fossil-fuel-generated plants. Under the idea of, last in first out, this would mean that almost all the juice being pumped into EVs comes from fossil-fuel-generated juice.

To make matters worse, other issues exist. Below are a few comments, or parts of comments, about EVs that have been gathered from different articles. I have not fully researched all these but they do add to my doubts about these vehicles.

*The Greenwashing Industrial Complex is one of the evilest and most fraudulent scams of the 21st century. The pollution and environmental destruction created by the manufacturing and disposal of EV batteries, and also the magnets for power-generating windmills, is 10X worse than pollution created by fossil-fuel vehicles.

*Battery production causes more environmental damage than carbon emissions alone. Consider dust, fumes, wastewater, and other environmental impacts from cobalt mining in the Democratic Republic of the Congo; water shortages and toxic spills from lithium mining in Latin America, which can alter ecosystems and hurt local communities; a heavily polluted river due to nickel mining in Russia; or air pollution in northeastern China, as mentioned above.

*There isn't enough cobalt in the world to replace even half of the current ICE vehicles. Never mind the fact they have kids mining the stuff in the Congo. InsideSources, says, every EV battery contains cobalt, with most of it mined in the Democratic Republic of Congo (DRC). This area has been an ugly mess for years as the Congo government and armed militants duke it out over the control of mines. Much of the DRC cobalt is then hauled to South Africa and shipped to China for processing.

Also flowing into the issue of " less damaging to the environment" is something recently brought to my attention, and that is, EVs tend to rapidly eat through tires. While many people may not think this is a big deal, it is. Since electric car batteries are heavier than petrol engines they need a more robust tire. Also, because of their accelerating faster from a standstill. If you want to take advantage of that without too much wear then you need a more robust tire, these cost more, and it has been said, you are lucky if you get 20,000 miles out of a set of tires. All this is addressed at, https://www.quora.com/Is-it-true-that-electric-cars-wear-out-tires-faster-than-fossil-fuel-cars

Like many people, I had brushed aside the thought something as common as the tire is also an environmental factor. This should have been high on my radar because years ago I was given a building simply because it had been filled with tires. The officials in my city were all over the owner to get rid of them. It cost me a bit of money and a lot of work to have them hauled away and properly recycled. With that in mind, below are a few of the many articles voicing pollution issues concerning tires.

Homeguides.sfgate.com claims; Toxins released from tire decomposition, incineration, or accidental fires can pollute the water, air, and soil. While 42 states regulate tire disposal to some degree, eight states have no restrictions on what you must do with your discarded tires. Even with laws in place, illegal dumping still occurs, presenting negative environmental impacts.

Tiretechnologyinternational.com states; Air pollution from tire wear particles can be 1,000 times worse than what comes out of a car’s exhaust, Emissions Analytics found harmful particle matter from tires is a serious environmental problem. What is even more frightening is that while exhaust emissions have been tightly regulated for many years, tire wear is not. With the increasing growth in sales of heavier SUVs and battery-powered electric cars, non-exhaust emissions are a growing problem.

And, www.politico.eu/article/tires, delves into how driving affects the environment in ways beyond the well-known pollutants spewing from tailpipes and leaking from engines. Tires shed tiny pieces of plastic as they wear down, accounting for about 10 percent of the microscopic pieces of the pollutant found in the sea, according to one estimate. Tire waste was addressed in the European Commission's Plastics Strategy earlier this year. The EU executive is looking into how to cut down on microplastics that may be coming from tires and is considering regulations.

Considering increased regulations, it seems unlikely that combustion vehicles will be able to reclaim much of their lost market share. It must not go unnoticed that the President and those trying to crush the internal combustion vehicles are also playing right into the hands of the Chinese. Currently, China is in the middle of an EV price war gone wild Partly due to its desire to own the global EV market. (https://brucewilds.blogspot.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)