The idea that Chinese savers are flush with cash and will roll out in mass following the lockdown may be flawed. If they do, most of the spending will be contained within China and still not be enough to offset other factors. Some people seem to be forgetting that much of Chinese household wealth is invested in China's falling housing market. It is unlikely those losing money on their housing investments will feel like rushing to spend.

The largest financial issue China must face is that its real estate market which made up north of 25% of its economy has imploded. The far-reaching impact of a housing crash in China has just started and may take years to play out. The Chinese people have up until now had three-quarters of their wealth and savings stashed away in housing. With prices falling they are feeling a full-blown reverse wealth effect flow over the economy.

In the middle of January China's central bank pumped a record amount of short-term cash into the banking system as demand rose ahead of the Chinese New Year holidays. The People’s Bank of China (PBOC) added a record-high net 1.97 trillion yuan (S$384 billion) via open market operations according to Bloomberg. To clarify, the Chinese Yuan (CNY) and Renminbi (RMB) are interchangeable terms for China's currency.

The trade in goods between the US and China climbed to a record in 2022. This kept the world’s two biggest economies deeply connected despite their efforts to forge separate paths. It is now projected that imports from China are likely to come under pressure due to consumer spending and business investment growth moderating. American companies are also making efforts to find substitute suppliers or shorten supply chains and bring jobs home.

|

| This data, not adjusted for inflation, may prove to be the high mark for many years. |

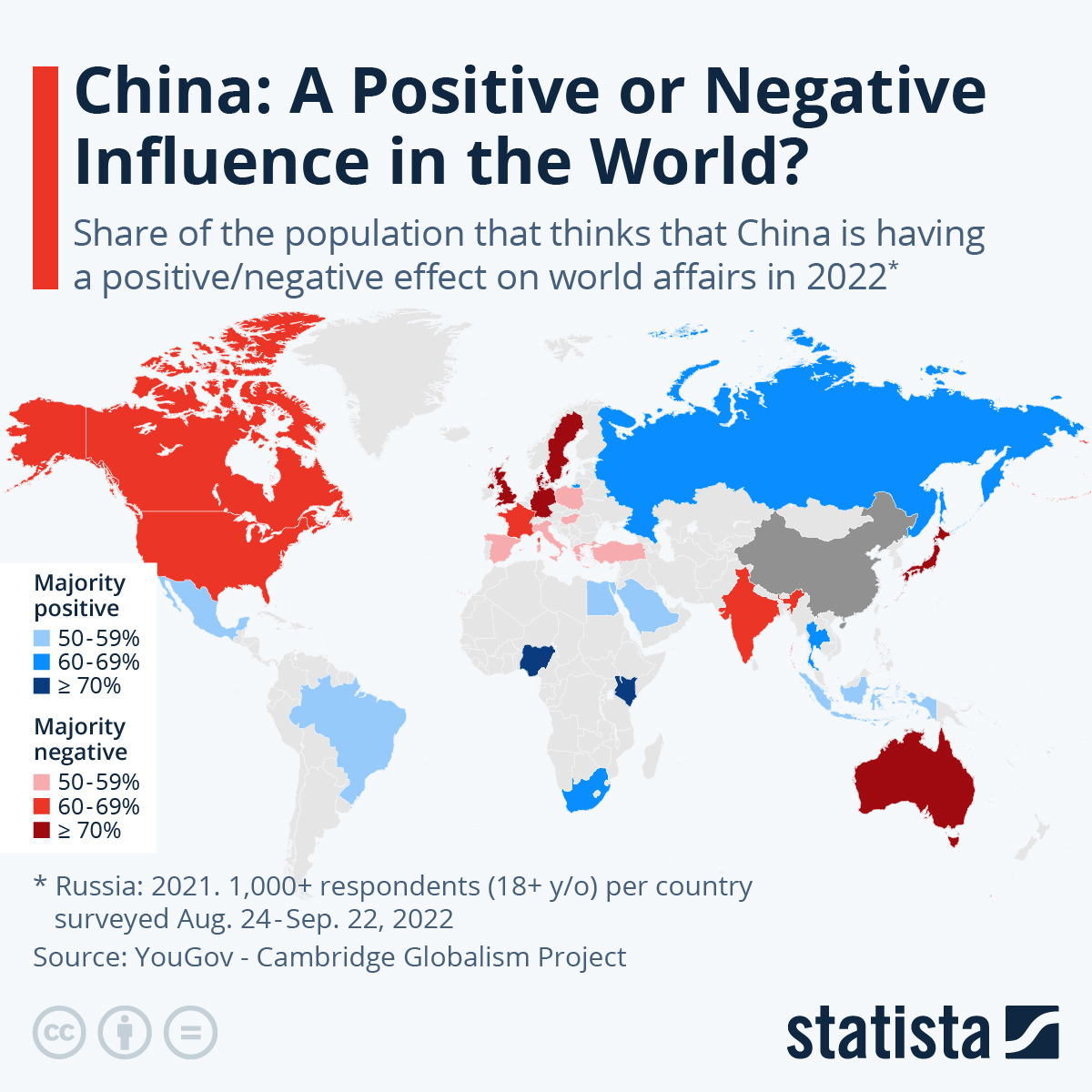

With China now having put its One Belt One Road initiative into full motion, the world is busy trying to understand whether China deserves to be looked upon as a favorable force. Statista's Katharina Buchholz reports that out of 26 countries surveyed, negative views of China prevailed in 16. The number of countries looking unfavorably at China has increased since the poll started in 2019.

The countries with the most respondents favoring China were Nigeria, Kenya, Thailand, Russia, Egypt, and Saudi Arabia. Still, views of China are broadly negative across most of the advanced economies. Roughly three-quarters of respondents in Japan, Sweden, Australia, Denmark, the United Kingdom, and Germany had a negative view of China.

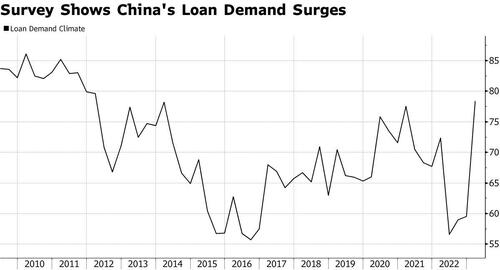

Returning to the issue of China influencing world markets by flooding the financial system with cash, this signals that China has a problem. Unlike in America where the US banking turmoil and the economic damage from an inevitable tightening in lending may only be starting, in China, the opposite seems to be happening. In an effort to reboot the economy the Communist Party is currently easing and loan demand is surging.

|

| The Reason For Surging Loan Demand Matter! |

A recent PBOC quarterly survey of bankers released Monday showed loan demand surged to its highest level in more than a decade. While there is a deleveraging in the household sector amid housing turmoil, the actual bank lending data indicates long-term corporate loans are shooting through the roof. It could be that this suggests a resurgence of business confidence as entrepreneurs expand factories or invest in new businesses. Still, more likely at least part of the demand for corporate debt may be companies borrowing new money to refinance existing debt.

Michael Every, a Global Strategist at Rabobank, and based out of Singapore appeared on Wealthion the other day. Around 28 minutes into the video, https://www.youtube.com/watch?v=00QS52Y40rQ he takes the stand what is now happening in China is not about to pull the global economy forward. Linked to this topic are matters relating to why someone would rush to dump dollars and view the yaun as a competitor for replacing the dollar. I contend that China has seen its best days, is overrated by many people in the West, and has seen its best days.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

In the past, I have made the case much of the money flowing south due to America's trade deficit with Mexico flows to China via Mexico's trade deficit with China. This New York Time video points out that China may now be getting hollowed out by its companies shifting to Mexico. https://www.youtube.com/watch?v=eUs1m_wDHIQ&t=880s

ReplyDelete