Two older postings that appeared on AdvancingTime in recent years have grown in importance as the markets have exploded upward. One of the articles focused on the dark-side of stock buybacks and how for years they were illegal. The other asked readers to consider, no matter how remote, the possibility we could at some point witness a flash crash so devastating that we see markets fall like they are on steroids. If such an event occurred the damage might be so severe that trading would be halted and traders trapped. These subjects intersect with other factors and events taking place over the years that have thwarted true price discovery. The widening disconnect between the financial sector and the real economy increases the risk of a major economic setback in the future.

An example of price manipulation is how over the years the BOJ's buying of ETFs has bolstered the Japanese stock market. This could be viewed as a path to nationalizing Japan's debt. In some ways, the actions of Japan's central bank could be considered nothing more than a new model of "stealth nationalization." Two enormous problems flow from such a policy, the first is while giving the appearance of economic growth, the higher valuations are not based on any real quality and the second even bigger issue is that under this policy eventually the central bank will control or pretty much own everything at a distorted value they determine best suits their narrative or purpose. With Japan's stock market now making new all-time highs this is of course no longer considered an issue or moral hazard. Still, it stands as a monument to the massive manipulation used to convince investors all is well.

The subject of growing market fragility and manipulation was recently addressed in a piece put out by "Thoughtful Money." It commented on how algorithms, often trading overnight, give the big boys

an unfair advantage. It then dove into how stock buybacks are playing into equities and skewing valuations. This centered on how many corporations

are starting to enter the blackout period preventing them from buying

back their stock until they've released their quarterly earnings and how

this temporarily removes a huge amount of important buying support for

shares. While the video rolls on for well over an hour, the first 26 minutes hit the hammer on the nail in how stock buybacks mainly benefit those at the top and destroy true price discovery.

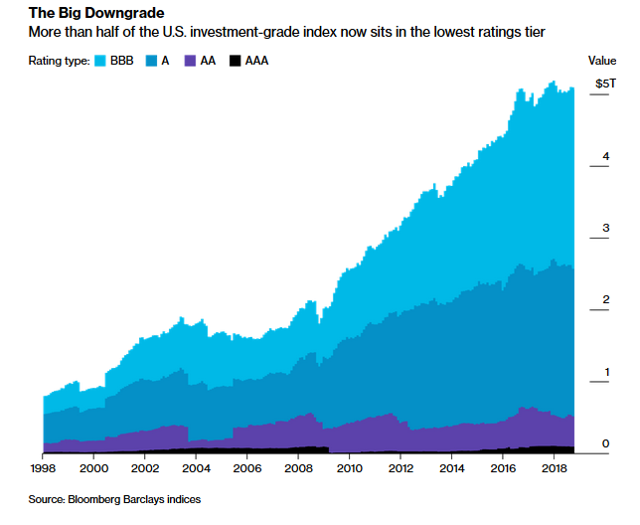

During the Trump era, the tax law that lowered corporate taxes also encouraged the repatriation of cash that had been stored overseas. This fed fuel into the share buyback frenzy. It is important to remember that much of the buyback craze taking place prior to Trump’s tax changes was financed from debt raised by selling corporate bonds with interest rates at historic lows. Another kick came from the Fed's massive injections of money due to Covid-19.

This

is where I remind you it is major investors that sit on the board or

hold executive positions and the same CEOs and other top managers that have received much of their compensation over the years in stock

options reap the largest benefits of stock buyback programs. Also, these

insiders have the advantage of being able to create a well-constructed exit

strategy allowing them to get out of or hedge their positions before

reality sets in and prices fall back to earth.

|

| Stock Buybacks - Financial Engineering |

It should be noted that corporations tend to retreat from buybacks at times of market uncertainty. Share buybacks proliferate when the market is rising but evaporates when the market collapses. In many ways, the decision way back in 1982 to again allow stock buybacks may highlight the true meaning of the phrase. "Been there, done that, learned nothing." The problem with this is many leveraged companies will not have the money to keep their stock flying if markets fall and stocks get hammered.

Footnote; Part two of this article which focuses on the possibility of a flash crash has now been published. https://brucewilds.blogspot.com/2024/04/stock-buyback-and-flash-crash-risk-part2.html

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

No comments:

Post a Comment