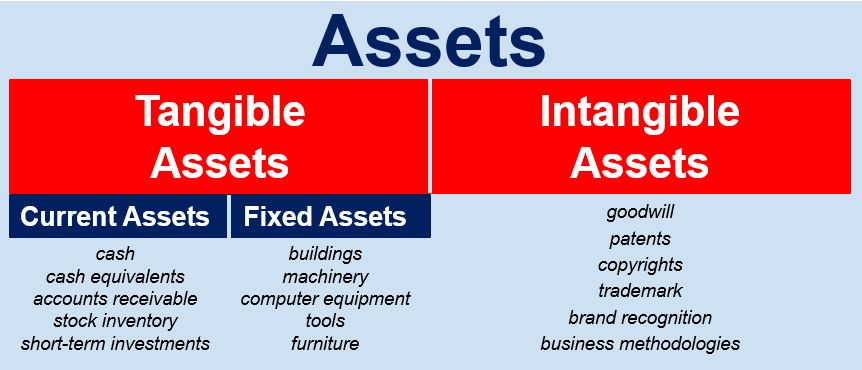

This is key to not only inflation but our future. The Fed should be ecstatic that so many people are willing to invest in intangible assets. By not buying tangible and real items they help to minimize inflation. An intangible asset is a useful resource that lacks physical substance. Examples are patents, copyrights, trademarks, and goodwill. Such assets produce economic benefits but you can’t touch them and their value can be very difficult to determine. These intangible assets are often in sharp contrast to physical assets like machinery, vehicles, and buildings.

|

| This Does Not Tell The Whole Story |

Some things fall into the middle ground between tangible and intangible assets. An example of quasi-intangibles is stock, when you buy stock what do you

really have? You no longer get a certificate as in days of old, this

should send the fear of God into those that worry about hackers. What

you get is a glorified memo in a computer base somewhere, good luck

proving what you have if things go bad. Most likely even getting a

government official to listen will be a huge task. If you do get action

most likely it would be years before you get any of your money back.

|

| This Chart Screams Much Of what We See Is "Bullshit"! |

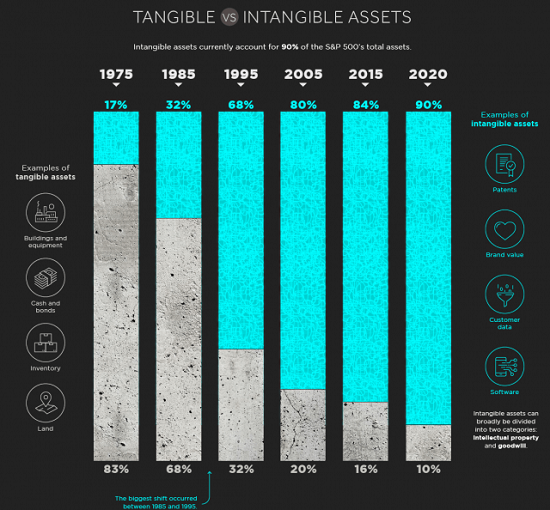

For a long time, I have taken the view that many "financial assets" have slipped into the intangible class. Assets such as stocks, pensions, and annuities harbor many of the qualities of "soft assets." These are things we can not touch and often live in the land of future promises. Today many are recorded on a computer somewhere and paper records of them are having a difficult time remaining current and in good order. Simply put, many people are not even sure where they have stored their wealth.

The theory that investments in intangible assets minimize inflation may be a chief reason government savings and wealth-building programs are centered on driving money into such assets. Over time, this has the potential to result in the collapse of the financial system. In our complex interdependent world, this would most likely hit the economy extremely hard, and the contagion from such an event could easily spill over and tear apart society.

To divert criticism of the fact no bona fide program exists which allows people to truly protect their wealth or preserve their purchasing power from inflation the U.S. government issues a type of Treasury security known as TIPS. This stands for, Treasury inflation-protected securities, these are indexed to inflation in order to protect investors from a decline in the purchasing power of their money. Sadly, even TIPS fail to hold up under scrutiny in that they are tied to the CPI which understates the true rate of inflation.

To be clear, I view the

dollar as the best of the four major fiat currencies,

however, I expect all of them to come under attack in the near future.

Circling back to the growing danger resulting in policies encouraging

people to invest in intangibles to lessen inflation. When money is

created or printed it has to go somewhere, this has been fueling the

"everything bubble." This is not the key driver of inflation. The

main reason this newly created money has not resulted in massive

inflation is rooted in the fact it is being diverted from goods everyone

needs to live and into the intangible assets described above.

When you consider the amount of interest in cryptocurrencies and other inflation hedges it is easy to argue many investors are losing faith in the central banks and fiat currencies. A monetary crisis and the chaos that comes with it may very likely be coming down the road. The fact that over the decades, growth in intangible assets and the money supply has vastly exceeded the growth in real and tangible assets is problematic.

There has been little resistance to moving investors into intangible

or quasi-intangible assets because it is easier to own intangibles than

deal with taking care of "real things." This could account for part of the

mismatch in growth between these two kinds of assets. Currently, the

gap

is so large that even if you allow for a great deal of the wealth

stored in intangible assets to be washed away there will still be enough

cash and credit available to create inflation. Ironically a huge

washout in the value of this type of asset could become a driver of

inflation by igniting a shift into hard assets.

All this can be a difficult concept to grasp. When looking at soaring house prices, we should view the cause as more driven by inflation than because of a falling dollar. The important point is that everything is relevant and values and prices change. With this in mind, the one thing we as individuals should try to avoid is putting our wealth into something intangible that could vanish during the night.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

No comments:

Post a Comment