In short, nothing has been fixed or repaired, we have not created a sustainable economy. Printing and creating new money is not fixing the problem, instead, it has created an economy addicted to printing and creating even more new money. We here in America need to focus on the American economy, if that is strong it will help galvanize the country's future.

An example of our failure is seen in how China got a big boost with the passing of Biden's 1.9 trillion dollar relief package and the American taxpayer is the big loser. Buying junk from China will do little good when it comes to creating jobs in America. When looking at the policies flowing out of Washington it is clear many politicians seem to have no idea that all consumer spending and purchases are not created equal.

Damn near every economist and analyst seem oblivious to the point that what and where consumers buy matters a great deal. An article that delves into spending and its impact on the economy claims, "Where

money flows and who it enriches is a key component of economics. The

failure to consider this is a blind spot many people have." Much of what

has been registered as growth over the last few decades does not necessarily transfer into economic

strength.

This point is something that has been covered time and time

again on this blog in articles such

as, Healthcare Spending Wrongly Feeds Our GDP, and Economic Growth Does Not Equal Economic Strength. Many of our economic problems stem from consumers making poor decisions. The least responsible

consumers tend not to fulfill

obligations but to take on new debt and squander every penny they

can lay their hands on. Online shopping and companies such as Amazon are

like heroin to an addict when it comes to promoting spending that

destroys real economic strength.

Another huge issue is that inflation is not just prevalent in manufactured consumer goods but inflation also occurs in the area of fees, tolls, and taxes. People tend to forget just how much of government spending is done on the local and state levels where simply printing more money is not an option for eliminating revenue shortfalls. This translates into a slew of revenue-driven schemes that come back around to become a huge driver of inflation.

When we look at where inflation has occurred during the last decade or so we find it centered in areas where the government has expanded its influence. Two that rapidly come to mind are in the areas of healthcare and education. The skyrocketing cost of even basic health tests and medicine, as well as tuition at universities, screams inflation. This dovetails with claims by politicians that leveraging local dollars to match federal and state resources is not always a win for the residents.

Many people fail to grasp just how much government has expanded over the years. Much of this growth has been masked by "outsourcing" a great deal of the work done by government workers. Another place this sneaks under the radar is in the huge growth of "quasi-government " entities such as airport authorities and downtown improvement districts which are able to levy special taxes. Utility companies, often monopolies carrying out government mandates under government supervision, also can be placed in this category.

The theory that a lot of future inflation will flow from governments is tied to local governments' need for revenue. Local and state governments have hidden and masked the size of its growth and financial promises from the public. Since state and local governments lack the federal government's ability to print money and buy back its debt they must pay higher interest based on their credit rating.

It is a fact that businesses and landlords eventually must pass on to consumers the added cost forced on to them often through higher prices. Another way to do this is by transferring responsibilities, limiting warranties, or reducing goods and services that had been previously provided. A city forced to cut costs or increase revenues often chooses to plow snow only when three or more inches fall, reduce the number of times it picks up leaves, or increase fines for such things as parking violations or ticketing drivers for violations caught on camera.

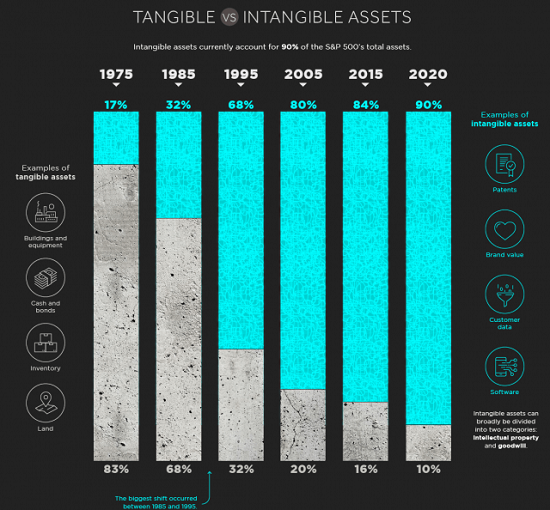

An unnoticed but very important part of the inflation puzzle is that so many people are willing to invest in intangible assets. The Fed should be ecstatic about this, in not increasing demand for tangible and real items they help to minimize inflation. Intangible assets are often "useful resources" that lack physical substance. Examples are patents, copyrights, trademarks, and goodwill. Such assets produce economic benefits but you can’t touch them and their value can be very difficult to determine.

Another example of quasi-intangibles are stocks, when you buy a share of stock what do you really have? For a long time, I have taken the view that many "financial assets" have slipped into the intangible class. Assets such as stocks, pensions, and annuities all harbor many of these qualities. These are things we can not touch and often live in the land of future promises. Over the years the growth in such assets has exploded. Intangible assets stand in sharp contrast to physical assets like machinery, vehicles, and buildings.

|

| This Chart Could Be Considered Very "Troubling"! |

The growing danger resulting in policies encouraging

people to invest in intangibles does lessen inflation. When money is

created or printed it has to go somewhere, and this has been fueling the

"everything bubble." Yes, the wealth effect creates more spending but it is not the key driver of inflation. The

main reason all the newly created money has not resulted in even more inflation is rooted in the fact it is being diverted from goods most people need to live and into intangible assets. The theory that investments in intangible assets minimize inflation may

be a chief reason government savings and wealth-building programs are

centered on driving money into such assets.

Many people and even economists have real misconceptions as to how the economy works. Where money flows and who it enriches is a key component of economics. The failure to consider this is a blind spot many people have. Fans of Keynesian economics that encourage government spending to stabilize the economy tend to discount the importance that savings plays in a balanced economy, or that small local businesses are the heart and soul of the economy. Where and how money is spent matters a great deal. In the end, we will all be forced to pay the price of this "cost-shifting" by suffering a lower standard of living.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

No comments:

Post a Comment