|

| Japan's Government Debt To GDP (click to enlarge) |

As for taking the temperature of the Japanese economy, it appears things are not about to get better going forward. The Health, Labor and Welfare Ministry asked for a record 31.90 trillion yen as the costs of caring for the country's graying population through spending on pensions and medical care continues to soar and the Defense Ministry has asked for 5.30 trillion yen, another "all-time high," part of this money will be used to purchase a missile defense system from the United States to act as a shield against potential North Korean attacks. The Land, Infrastructure, Transport, and Tourism Ministry looking towards public works that bolster response to natural disasters such as the massive flooding in western Japan in July and Hokkaido earthquake also needs more money and has requested 7.07 trillion yen.

This is happening as Prime Minister Shinzo Abe's administration attempts to balance surging social security costs and increased defense spending with fiscal consolidation. To complicate matters the Prime Minister has also promised a stimulus package to offset the negative impact of a planned increase in the nationwide consumption tax set to take place in October 2019. This makes it highly unlikely that Japan will shed its status as having the worst fiscal health among advanced economies anytime soon.

|

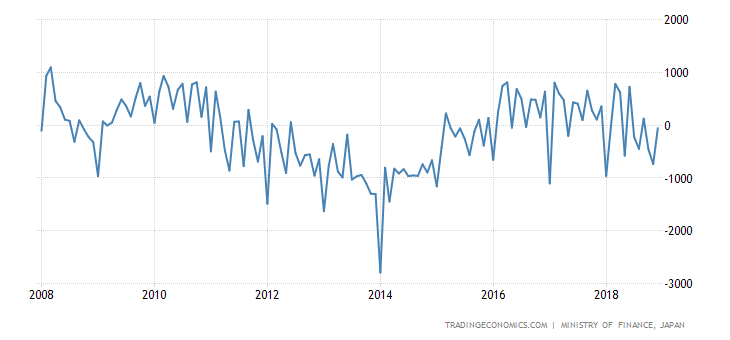

| Japan's Trade Balance Is In Deficit Territory |

For some Japan watchers, a bigger concern may be that Japan's trade balance has again swung into deficit territory in August. Trade is very important to Japan and its trade balance has been all over the place hitting a high of 1608.67 JPY billion in September of 2007 and a record low of -2795 JPY billion in January of 2014. The possibility of escalating trade friction cloud the outlook for Japan's export-reliant economy which until now has been able to sidestepped problems and not become a major target of President Donald Trump concerning trade. Still, another area they are vulnerable is that if China's economy takes a hit they will absorb a bit of the pain.

While many people are unaware of it, Japan has strong economic ties to China, that formed over decades as direct Japanese investments flowed into China. Japanese technology has played a critical role in the development and competitiveness of China’s global supply chains. China, as usual, exploited this relationship to learn the advanced industrial skills and production techniques of its neighbor. This is apparent at call centers in China where young workers speaking flawless Japanese answer customer service calls for a Japanese insurance company in western Japan. Another example is a new commercial Chinatown that grew in Kobe City's rebuilt port area but instead of the gaudy restaurants of old Chinatown, the new area contains nondescript office buildings that are leased to Chinese companies focusing on everything including biotechnology.

In part, it has been this increased trade with China that has bolstered the Japanese economy at the same time cheap imports from China have driven prices significantly lower for Japan's long-suffering consumers. Ironically, this has also played into creating the deflation that has plagued Japan since the late 1990s following a property bubble that burst earlier in the decade. This tight relationship can be seen each time trouble surfaces in China's economy, when this happens the yen rises in value as wealth exits China often through business back-channels. This should not be misinterpreted as the yen strengthening, but rather a temporary bump before the wealth moves on to an even safer place.

A matter that has not garnered enough attention is how the economic problems that continue to develop in China will most likely spill over and affect Japan. The Japanese economy is very vulnerable to a negative economic feedback loop flowing from China. As stated earlier, over the decades the two countries have joined together in an effort to maximize profiting from exporting to America and as a result of this their economic interdependence has intensified. China and Japan have become major trading partners and the links they share may come back to haunt Japan if a trade war between America and China escalates. The bottom-line is that if Japan did not have enough problems of its own for now it seems bad news flowing out of China is about to further undermine Japan's hopes for growth.

No comments:

Post a Comment