|

| A Valuation Spike Is Common During A Bubble |

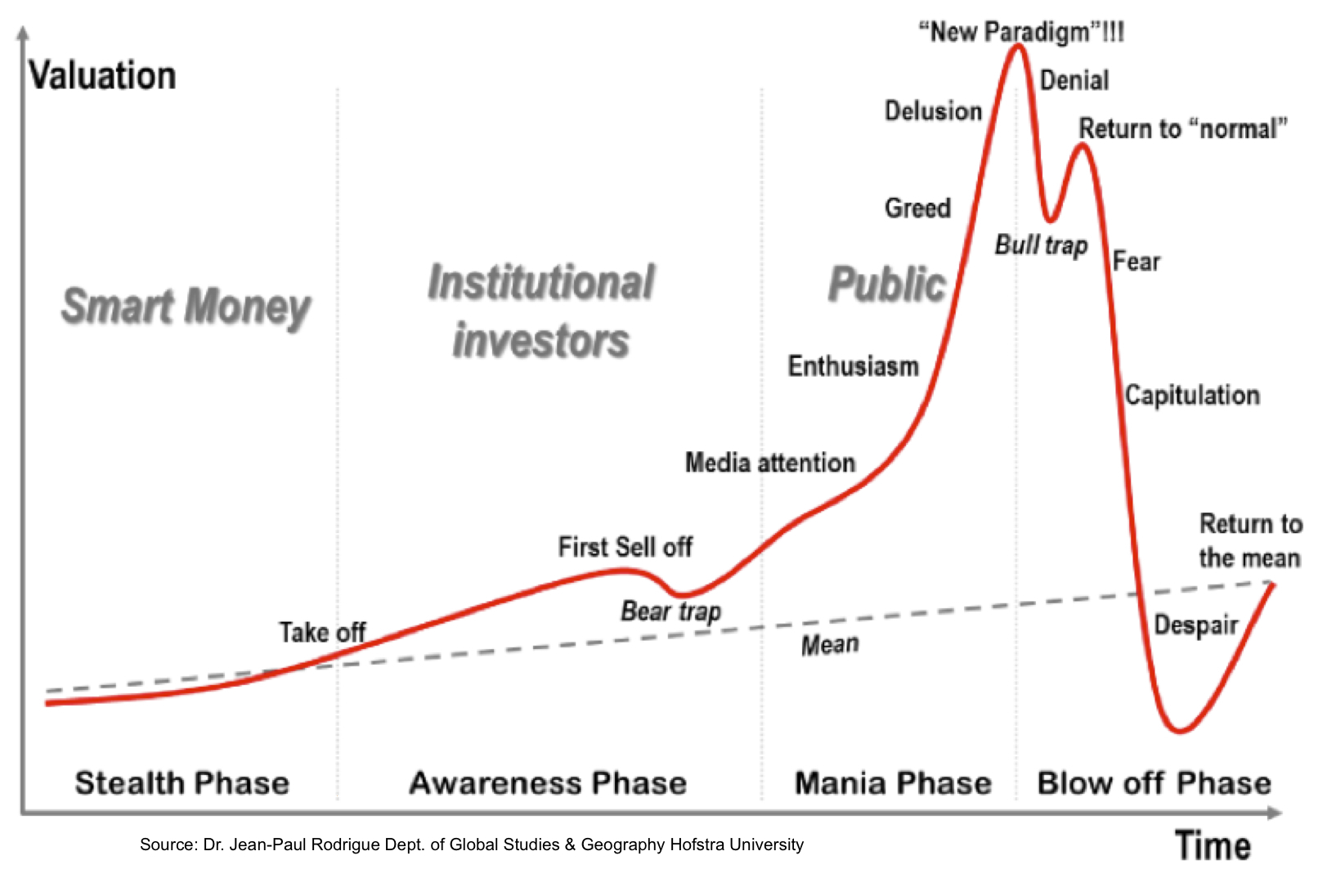

The growth of debt moves us down the path towards a Minsky moment or what might be viewed as a "liquidity trap," a term that can be baffling and difficult to understand. This term has been used by Allen Greenspan and a few others, it represents a huge problem for the economy. It can take on several forms but sooner or later most of them tend to lead us into one of several possible self-feeding loops that disrupt the flow of credit and impacts the real economy. We should remember that in all honesty the economy is lubricated by faith. this means that when faith erodes in the ability of our institutions to govern at some point the return on loaning our wealth, in the form of money, to banks, governments, and others is simply not worth the risk!

A Minsky moment is a sudden major collapse of asset values which is part of the credit

cycle or business cycle. Such moments occur because long periods of prosperity and

increasing value of investments lead to increasing speculation using borrowed money.

The policy of rapid credit expansion while often viewed as the answer to moving forward a slowing economy brings with it negative consequences such as diminishing returns on investment with the extra GDP growth generated by each infusion of money dropping as the economy reaches economic exhaustion and overcapacity from continually priming the pump. At the point when the debt snowball continues getting bigger and bigger, without contributing to real activity, we are on the verge of a "Minsky Moment" where the debt pyramid collapses under its own weight. The problem is why does anyone want to loan money if most likely you will never be repaid or repaid with something that is totally worthless?

When this happens the only safe place to store wealth will be in "tangible assets" and the only lenders will be those who print the money that nobody wants. History shows that at some point when inflation begins to exceed the rate of interest paid people start altering their buying habits which can create a self-driving feedback loop. The collapse of credit poses major problems such as what we saw when many sellers were forced to demand payment up front before shipping goods in 2008. When this happens many of our economic policy options will vanish and we are at the end game or poised for a complete economic reset.

|

| Bonds Are IOUs - Debt Has Surged Globally |

Unfortunately at some point, we reach the place where debt comes due, however, the collection of a debt can be similar to a mirage that keeps moving away each time you approach it and the small print that governs most contracts often tells us rules can be changed causing many people and companies to become instantly insolvent. The bottom-line is that we have abused the large amount of wiggle room in our economic system and our ability to put off the day of reckoning. Modern society has become very good at kicking the can down the road and delaying the consequences of bad policy.

When the debt pyramid does collapse actually writing off bad debt will be a painful process for the person, business, or institution that holds the paper. It is important to consider how this will all play out or shakedown, this is yet to be determined but the ramifications remain powerful. Obviously not all IOU's are deemed as trustworthy, and as trust drains from this over-indebted system the value of subprime debt and that of "shaky" issuers will plummet in value fastest. Junk debt is thus a Hindenburg in search of a spark. Often unpaid debt shifts the pain or obligation to another party and acts as a wealth transfer, usually, this is not a voluntary act unless the note is being forgiven by the holder. The fact is some way or form the piper must be paid and we will be reminded that there is no such thing as a free lunch.

Debt defaults will result in pensions being cut, inflation edging higher, or simply lowering our overall standard of living. Part of this will play out in the world of bankruptcy and unpaid debt which has become a complicated place where protection for one party can leave another totally exposed. We have seen things like "clawbacks" or the government making an exception and changing the rules as in the case of shafting the bondholders of General Motors during the bailout. Yes, writing off debt can be a slippery slope. The debt that is written off takes something with it when it leaves this world and that is the wealth of someone else! It is important you make sure you are not that someone else.

Footnote; This is the first of a three-part series exploring the massive debt pyramid that has formed during the last decade as a result of central banks lowering interest rates and allowing credit to expand and what will happen when we are forced to finally deal with this unsustainable debt load. Below is the link to the next part of this series.

https://The Ramifications Of A Massive Debt Collapse.html

Thanks for the interesting article. Japan for some reason is the advanced model for this experiment. The have govt debt 3x GDP. So far so good. This makes no sense to me but for some reason they plow ahead. If we use Japan as the model for irresponsible central bank and govt largess/debt we have a long way to go. We are currently at 1xGDP in govt debt. How this ends is anyones guess.

ReplyDeleteWell, consider that the Yen has been allowed to keep it's strength by the cooperation of all the other Central Banks, otherwise what it has been doing would have not lasted as long as it has. It's not likely the US dollar or Chinese Yuan will have the same grace period. In fact it appears we are approaching the end game when we see the FED pump massive liquidity into the banking system. Although admittedly I thought this would end years ago and have been wrong to date.

ReplyDelete