|

| The Fed Has Allowed This To Happen |

To be perfectly blunt, none of the rapid expansion of debt and credit during the last decade could have occurred without the Fed being totally complicit and in agreement. It has been the Fed that decided to allow the dollar to be used as a global prop. This exploded following the 2008 financial crisis when then-Fed Chairman Ben Bernanke adopted policies of massive quantitative easing (QE) to stimulate the economy when standard monetary policy began to become ineffective. Today this policy has become the lifeblood of a sick financial system rather than the jolt needed to restore its health.

Across the world, central banks jumped in and allowed governments to abdicate their role in creating an environment where sustainable economies can exist. This could not have been done without the collusion of America's Federal Reserve. As central banks literally "took turns" stepping up to the plate and announcing round after round of easing and lower interest rates the Fed stood idly by. Following each announcement stocks and asset prices across the world soared. In many ways, the growing popularity of cryptocurrency is rooted in central banks decision to go down this destructive path. This is especially true today when wealth is able to rapidly move across borders. The inflow or outflow of capital is a big deal.

|

| Stock Buybacks Drive Markets Higher (click to enlarge) |

Circling back to the dollar, the Fed, as the dollar's protector had the power to halted this global creation of stimulus and credit by raising interest rates in America. Instead, it chose to join in and seemed to almost encourage the trend to continue. This central bank experiment calls into question the use of currencies as an economic tool going forward. It has also increased the risk that more currencies will fail as their capability to safely store wealth, is examined. As currencies morph into a tool of government they are being weaponized which takes them further away from their original role as a medium of exchange in commerce.

A recent Semiannual Report to Congress, published by the Treasury cited research by the International Monetary Fund which pointed out that the 4.5% dollar appreciation over 2018 is concerning and noted that sustained dollar strength is likely to exacerbate persistent trade and current account imbalances. According to the IMF, the dollar is overvalued by 8-16%. Still, this is not necessarily out of line with fundamentals since the US is growing faster than many other countries. Also, in these times of heightened uncertainty, the dollar is underpinned by safe-haven flows.

|

| Click Here To Enlarge |

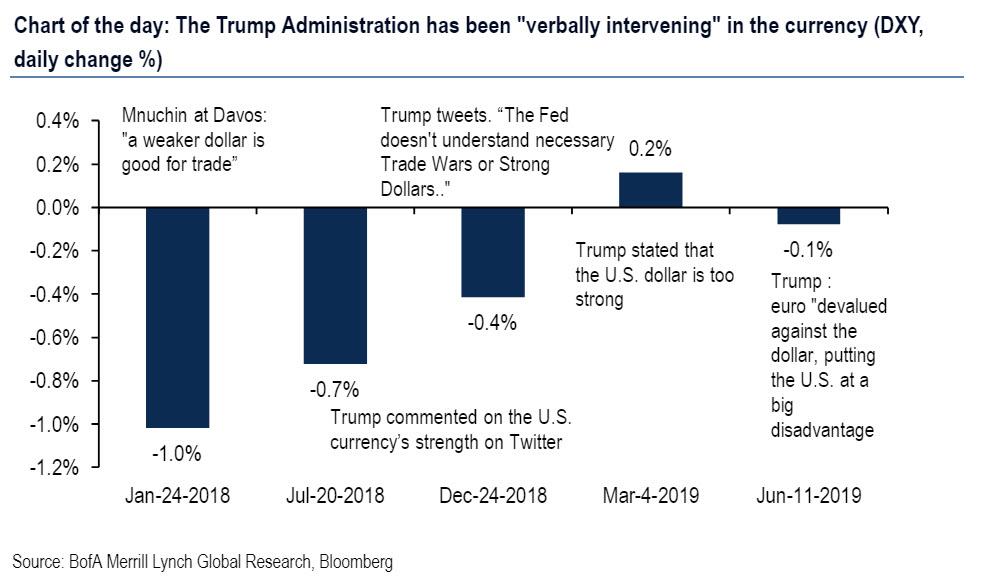

The G20 countries have agreed not to target exchange rates for the purpose of competitive devaluation but does allow for temporary intervention for the purpose of stabilizing a currency. If risk-off conditions would cause a disorderly rise in USD a paper BofA recently stated, "the probability of intervention by the Trump Administration increases significantly." The history of currency intervention shows it is a useful tool for emerging market countries which need to stabilize exchange rates but little evidence exists that it is effective for advanced economies wishing to target long-term FX competitiveness.

The US Treasury also plays a huge role in international financial policy. This is because it is responsible for managing the USD. Simply put it could intervene and guide the NY Fed's market desk to weaken the dollar by selling dollars and buying other currencies. The currencies that are used for intervention come from the Fed's holdings and the Exchange Stabilization Fund of the Treasury it is comprised mainly of the euro and Japanese yen. The two types of interventions are possible, sterilized and unsterilized. In a sterilized intervention the NY Fed will buy or sell other securities (e.g. sovereign bonds) through open market operations which prevents the intervention from changing the monetary base and interfering with monetary policy. In an unsterilized intervention, it has the ability to influence the money supply and also can impact interest rates.

Again it must be stated, the dollar's role as a reserve currency gives it oversized importance in world markets. It is indeed the benchmark by which other currencies and commodities can be valued. When all things are considered, fiat currencies are in general a rather weak lot. This means it is best not to look too closely or the system glued together by faith and a prayer could come crashing down. Overall the dollar remains a far better currency to hold than its weak sisters, the euro and the yen. It should be noted that currency manipulation is a slippery slope bringing into question the real value of a currency further distorting true price discovery. In our current global financial environment, this would be a very dangerous path to start down.

No comments:

Post a Comment