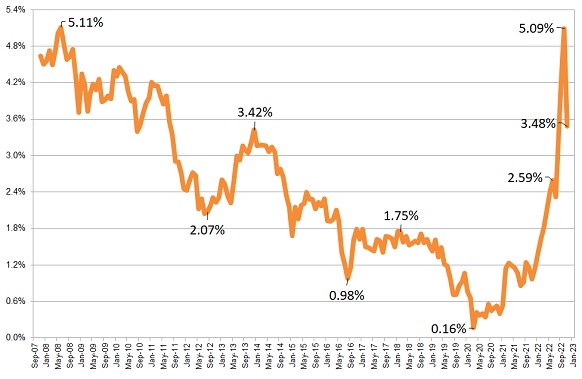

Speculation on what the Fed will do may be overdone considering things are more complicated than what to do about interest rates. While Fed policy is important, it is not everything. The reason I claim this is because other factors and world events tend to feed into the mix we know as our financial future. The general thinking appears to be that as long as the Fed keeps on moving rates higher and inflation keeps falling, it will eventually cause a larger Fed pivot. This has put pressure on long-term yields.

A glaring example of this occurred when the gilt market in the UK hit the wall in September. The spike it caused in yields has cast a spotlight on the problem of sovereign debt. When it becomes apparent that the current unsustainable sovereign debt situation is crumbling beneath our feet the world will face a tsunami of defaults and currency devaluations.

|

This means the Fed is now forced to differentiate the distinct way policy for economic cycle reasons affects economic stability. The issue of liquidity in the economic stability area is being moved to the forefront, this will translate into it being far more difficult for the Fed to reduce its balance sheet.

Sometimes you can't win and when it comes to crashing the sovereign debt market or bringing down inflation, restructuring sovereign debt will take precedence. This distraction to fighting inflation is what we know as a "biggy." Working around destabilizing the global economy while reducing central bank balance sheets while fighting inflation is no easy task. The point is, governments have spent like drunken sailors and the piper will sooner or later demand to be paid in some form or another.

Adding to the difficulty we face is that populations in most developed nations are aging and as this group gains political size it will vote upon itself more freebies. Currently many people accept the idea fiscal austerity is the kiss of death rather than the cure for an ailing economy. Both these factors make it difficult for most countries to reduce spending.

In

the next five to ten years demographics are expected to blow government

spending through the roof. In truth, this has already begun. The

argument older people don't spend money is greatly offset by the fact

governments have to spend tax dollars on their behalf. This is something many economists can't get through their thick heads.

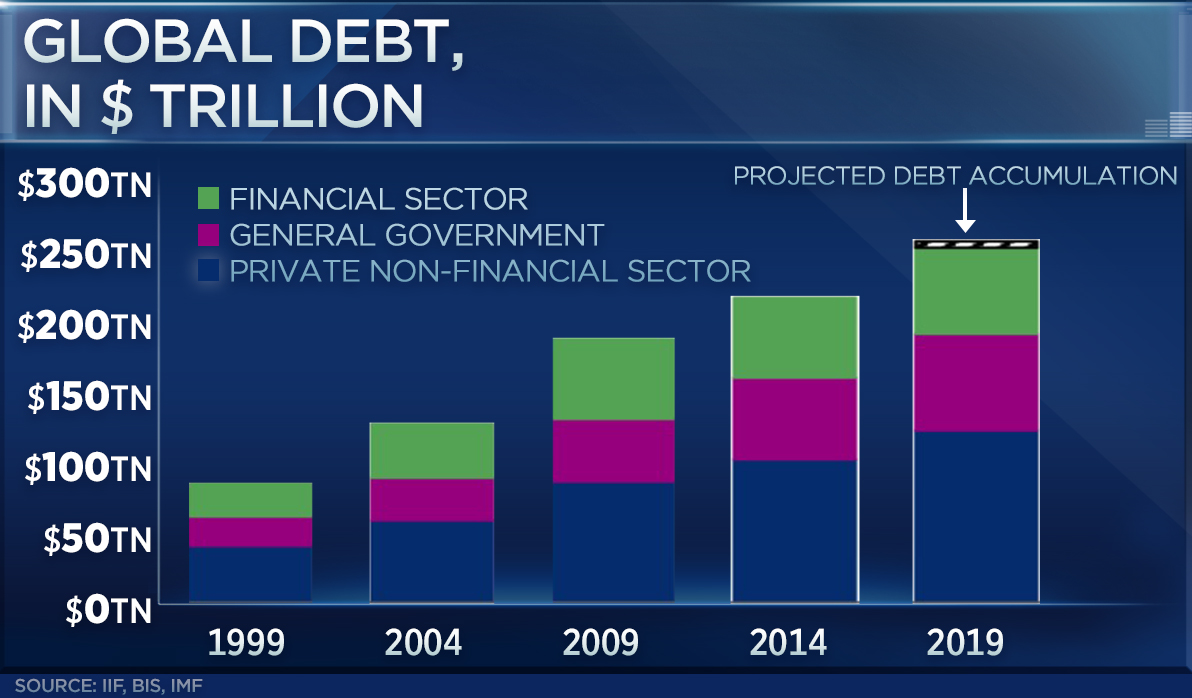

The Federal Reserve has responded to runaway inflation by hiking interest rates during a time when many Americans are drowning in historic levels of personal debt. This debt is a dead weight on economic growth in that it tends to crowd out productive investment. The fact is we need liquidity to allow people to refinance as debt comes due, without it, everything comes to a halt. Today

there is 350 trillion dollars of debt in the global economy. Roughly 70

trillion dollars of this debt needs to be rolled over on average each year.

Today There Is 350 Trillion Outstanding

New credit is needed each year to service the refinance of debt or you have a refinancing crisis which of course fits under the same heading as a "liquidity crisis." If liquidity is not available the financial system locks up and falls into crisis. Financial pundits and economists can speculate and opine all they want but how events actually unfold will determine the course forward.

With this in mind, two central banks, the Fed and PBOC are likely those really shaping policy going forward. We should not be surprised if the wild card in all this becomes a PBOC that stimulates China's economy to mask all the problems China faces. (This is the subject of my next post) Such an expansion of credit in China would temporarily spark global growth but create multiple problems in doing so.

Some of these issues are addressed or at least talked about by Michael Howell, Founder & Managing Director of CrossBorder Capital in a recent video. This video can be found at, https://www.youtube.com/watch?v=v2G0PAoRGbg Howell's views on cross-border flows and Central Bank behavior across some 80 countries merit our attention. The Fed put, negative yielding debt soaring into trillions of dollars, and massive never-ending expansion of credit underlines just how insane things have grown.

How the majority of people in developed economies with stagnant or declining wages in real terms respond to what we are experiencing matters. Most are not keen on witnessing another obscene upward transfer of wealth to the small group of capitalists responsible for causing this mess. The looming problem is that in the midst of a crisis bailing out these thieves and clowns is often deemed the easiest solution by their friends in power. Considering these "birds of a feather flock together," we should lower our expectations for a good outcome.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

The global house of cards will eventually collapse and it should have back in 2008 but the global economy was given a "get out of jail card".

ReplyDeleteA 5th grader using simple math could tell anyone that increasing debt levels for decades will eventually lead to an implosion and here we are as the world becomes Cyrus and Lehman Bros all rolled into one.

If the Fed thinks raising rates will fight inflation, they have another thing coming because it will most likely cause the opposite effect.

Rod, thanks for the comment. It caused me to glance back over the article and what stood out was the word "trillions." When I saw it all I could think is the "piper always demands to get paid."

DeleteEgon Von Greyerz who founded Matterhorn Asset Mgmt in Switzerland says the world is actually on the hook for $2.5 Quadrillion when you factor in the global derivatives market.

DeleteIt is becoming increasingly obvious why those pulling the strings want and need war and why Der Klaus Schwab is itching for a full blown global reset.