In short, this is its core meanings:

- "You cannot get blood from a turnip" refers to the impossibility of extracting something from a source where it is not available.

- It advises someone against wasting time and energy on an unfruitful endeavor.

- It highlights the unfeasibility of obtaining funds or resources from someone who doesn't have them.

A fool willing to make a loan to an idiot or someone who most likely will be unable to pay it back is trying to pick up pennies in front of a steamroller. Years of easy money and low-interest rates are coming back to haunt the greedy souls and concerns that chose to discount the potential risks and drawbacks of making such loans. Charging a high-interest rate doesn't guarantee great returns.

It seems this "stupid lending"has not only been going on for a long time but we may be reaching the place where it becomes apparent how much this activity has been going on. This is because more and more of those owing this money are defaulting on their obligations. the depth of this problem may have been papered over due to all the helicopter money that big government showered down upon the masses in recent years.

It could even be argued this unprecedented growth in free and easy money acted as a fertilizer fostering a whole slew of bad loans. The idea and moral hazard of "too big to fail" added fuel to the flame and did little to deter this. So I ask, who are the parties making such loans? The answer is, more people, institutions, and governments than we would like to admit. We see them in student loans, credit cards, and more. Sadly when all is said and done some of the cost for these bad loans will be passed on to society in general.

|

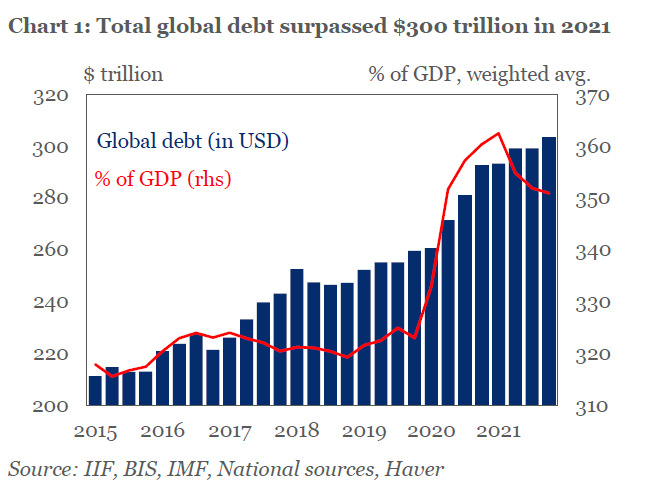

| Debt Is On The Rise And Much Of It Will Never Be Repaid |

Years ago I wrote a piece titled, "Where Bad Debts Go To Die." Also, another posting that spills over into this area is one warning of the danger of dealing with "bad people" and how they will muck up your life. As for the motivation for this post, it flowed from a pop-up ad from a fella promoting a seminar that was "coming to a town near you." It promised he would show you how to make an oversized return on your money by investing or buying tax sale liens. This could be called a loan to the local government with the property as collateral. This is another area of high risk for the inexperienced or unsophisticated investor.

Companies and businesses in general play by a set of rules that can boggle the mind. Other than not meeting their payroll a situation that is immediately noticed, they can bob and weave in a series of moves to hide their true financial situation. Bringing in a new investor, or shafting a current supplier after a big order can extend the life of a dying business. Such a business can claim it is still solvent and reorganizing will set everything straight. If done legally, the top management can collect paychecks the entire time this unfolds.

The current risks of debt defaults are being massively discounted. A great deal of our economic system is about debt. It is important to remember not all debt is created equal. The current risks of debt defaults are being massively discounted. It is important to remember all debts and obligations do not come due at the same time and when a bill is not paid or defaults it often starts a long and drawn-out legal battle. This so-called collection process may extend for years without harsh consequences.

Companies and businesses in general play by a set of rules that can boggle the mind. Other than not meeting their payroll a situation that is immediately noticed, they can bob and weave in a series of moves to hide their true situation. Bringing in a new investor, shafting a current supplier after a big order are just a few ways to extend the life of a dying business. By stalling on paying bills a business can claim it is still solvent and reorganizing will set everything straight. If done legally, the top management can collect paychecks the entire time this unfolds.

Gone are the debtor prisons and much of the shame associated will not paying your bills. Still, debts unpaid are more than a transfer of wealth it is theft. This is the reality of modern life and the bottom line is that you never want to find yourself in the position of having to decide whether to most throw good money after bad by taking legal action against a debtor in the hope of recovering even part of what you are owed.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

No comments:

Post a Comment