Advancing Time

Wednesday, April 24, 2024

Advancing Time: The Ugly Future Of Social Security, Huge Shortfall...

The Ugly Future Of Social Security, Huge Shortfalls Ahead

Oh, what a tangled web we weave when the government gets involved. Even if I did not get that saying right, my takeoff on it has merit. A great example of a government program on its way to ruin is Social Security. What is called the unfunded "surplus reserve" is set to run out in 2033. Remember, promises can be broken or altered, and they will. Fixing this system many people refer to as a Ponzi scheme will not be easy.

The most obvious answers include removing the cap for high earners forcing them to pay more into the system. Raising the retirement age and cutting benefits. Another is to not pay what is promised to those who have saved and sacrificed over the years saying they "really don't need it." In other words, making people with savings ineligible, this is sometimes referred to as means testing.

In truth, inflation is already attacking the incomes of retirees based on how the CPI is figured, and adjustments in payouts already fall short of the real cost of living. Months ago when inflation was near its high, the website ShadowStats claimed real inflation was closer to 17.15% rather than the 8.5% that the media, the Biden administration, and the Federal Reserve claimed. This results in smaller raises and payouts for those on Social Security saving the system billions.

Having just seen the cost of caring for an aging parent, it is easy to join those saying the system to designed so that anyone with a long life is unlikely to pass much wealth along to their children. If you have money in old age, the system is geared to rip it from you. This is a brew of wealth transfer endorsed by society in the name of "the greater good."

Comments below an eight-minute video ( https://www.youtube.com/watch?v=j1Bfxxhdn6g ) detailing the most basic facts about the wall Social Security is running into indicate most viewers get it. We understand the problem that haunts the Social Security system, Still, "getting it" changes nothing, the problem still exists. Boomers are draining the system. The comments below the video note;

- As a 37-year-old with 20 years of SS taxes behind me and another 20 years ahead of me... This video makes my skin crawl.

- The SS that you contribute is actually going to the current/next generations of retirees it’s not saving for you. Yours comes from the next generation contributing.

- We're living longer, the younger generations are having fewer children, housing is less affordable, income is not increasing, and the working class is unable to build wealth. Essentially, more people will need it and less will be paying for it.

As noted above, the unfunded Social Security "surplus reserve" is set to run out in 2033, a mere nine years from now. For such a widely used program, it’s a bit surprising that people in the US have put their heads in the sand and ignored the reality that this is no small problem. Also, most people know little about how it works. This remains the case even though most of the news around this program over the past decade has been predicting it’s doomed.

In Recent Years This Part Of The Budget Has Exploded

This is why millennials and younger workers often see the money being taken from

their paychecks with the feeling they’ll never see it again. Sadly, the compact between generations to take care of each other has come under pressure for a number of reasons. The biggest two are difficult to overcome. Demographics and the idea individuals deserve a higher standard of living than necessary are coming into conflict.

Of course, the concern over where all this is headed spans all of society. The truth is ugliness awaits most boomers nearing retirement, not only have they been lied to, but they also have to deal with rigged markets, corruption, and incompetent advisors. Anyway, you look at it, many people will not retire happy. As far as Washington and our politicians sorting out this mess, when all is said and done, this will most likely become another case of, "Thank God for the last minute or nothing would ever get done."

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Monday, April 8, 2024

Advancing Time: A bad debt is a bad debt is a bad debt

A bad debt is a bad debt is a bad debt

In short, this is its core meanings:

- "You cannot get blood from a turnip" refers to the impossibility of extracting something from a source where it is not available.

- It advises someone against wasting time and energy on an unfruitful endeavor.

- It highlights the unfeasibility of obtaining funds or resources from someone who doesn't have them.

A fool willing to make a loan to an idiot or someone who most likely will be unable to pay it back is trying to pick up pennies in front of a steamroller. Years of easy money and low-interest rates are coming back to haunt the greedy souls and concerns that chose to discount the potential risks and drawbacks of making such loans. Charging a high-interest rate doesn't guarantee great returns.

It seems this "stupid lending"has not only been going on for a long time but we may be reaching the place where it becomes apparent how much this activity has been going on. This is because more and more of those owing this money are defaulting on their obligations. the depth of this problem may have been papered over due to all the helicopter money that big government showered down upon the masses in recent years.

It could even be argued this unprecedented growth in free and easy money acted as a fertilizer fostering a whole slew of bad loans. The idea and moral hazard of "too big to fail" added fuel to the flame and did little to deter this. So I ask, who are the parties making such loans? The answer is, more people, institutions, and governments than we would like to admit. We see them in student loans, credit cards, and more. Sadly when all is said and done some of the cost for these bad loans will be passed on to society in general.

|

| Debt Is On The Rise And Much Of It Will Never Be Repaid |

Years ago I wrote a piece titled, "Where Bad Debts Go To Die." Also, another posting that spills over into this area is one warning of the danger of dealing with "bad people" and how they will muck up your life. As for the motivation for this post, it flowed from a pop-up ad from a fella promoting a seminar that was "coming to a town near you." It promised he would show you how to make an oversized return on your money by investing or buying tax sale liens. This could be called a loan to the local government with the property as collateral. This is another area of high risk for the inexperienced or unsophisticated investor.

Companies and businesses in general play by a set of rules that can boggle the mind. Other than not meeting their payroll a situation that is immediately noticed, they can bob and weave in a series of moves to hide their true financial situation. Bringing in a new investor, or shafting a current supplier after a big order can extend the life of a dying business. Such a business can claim it is still solvent and reorganizing will set everything straight. If done legally, the top management can collect paychecks the entire time this unfolds.

The current risks of debt defaults are being massively discounted. A great deal of our economic system is about debt. It is important to remember not all debt is created equal. The current risks of debt defaults are being massively discounted. It is important to remember all debts and obligations do not come due at the same time and when a bill is not paid or defaults it often starts a long and drawn-out legal battle. This so-called collection process may extend for years without harsh consequences.

Companies and businesses in general play by a set of rules that can boggle the mind. Other than not meeting their payroll a situation that is immediately noticed, they can bob and weave in a series of moves to hide their true situation. Bringing in a new investor, shafting a current supplier after a big order are just a few ways to extend the life of a dying business. By stalling on paying bills a business can claim it is still solvent and reorganizing will set everything straight. If done legally, the top management can collect paychecks the entire time this unfolds.

Gone are the debtor prisons and much of the shame associated will not paying your bills. Still, debts unpaid are more than a transfer of wealth it is theft. This is the reality of modern life and the bottom line is that you never want to find yourself in the position of having to decide whether to most throw good money after bad by taking legal action against a debtor in the hope of recovering even part of what you are owed.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Monday, April 1, 2024

Advancing Time: Stock Buyback And Flash Crash Risk (Part 2)

Stock Buyback And Flash Crash Risk (Part 2)

|

| Equities Could Fall And Not Come Back! |

A question lingering on the minds of thoughtful individuals is how "do we get there from here?" The fact is that events happen and generally not in a controlled way. Recency bias or our tendency to overemphasize the importance of recent experiences when estimating future events. Recency bias often misleads us to believe that recent events are an indication of how the future will unfold. An interesting mental exercise is to imagine what some of us might consider the unimaginable, a market "flash crash" from which the market does not recover.

The fact is most investors believe that even if the stock market drops they will be smart enough to get out after taking only a minor hit or simply ride it out. Others simply think no way exists for these markets to fall sighting a lack of investment alternatives and what they see as the "Fed put" having their back. Don't forget, the reason we talk about the "too big to fail" is that they did fail.

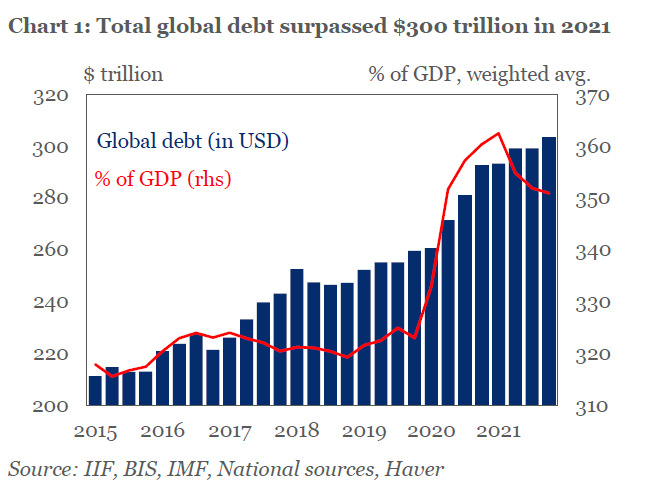

As we look at a bull market long in the tooth, a global economy that is rapidly slowing, and debt exploding across

the world, it seems any opportunity to panic the bears is not going unexploited. It is against this backdrop

that one allows optimist fellas to think, this time is different. The

thing many investors are not taking into consideration is that if the

market falls like a flash crash on steroids they could be trapped. Investors have been assured that can't happen because circuit breakers have been

put in place to arrest panic-style moves, however, imagine a market that

falls, trade is halted, and the market simply does not reopen for days

or even weeks. As remote as this might seem remember Japan's stock

market has only just recently taken out the high it made decades ago. See the 1980 to 2015 chart below.

|

| It Has Taken Decades For Japan's Nikkei 225 To Take Out The 1980 High |

Also,

please take a moment to consider the possibility and the far-reaching

ramifications of stocks falling from grace. Not only would active stock

market investors get hammered but pensions, 401 plans, and most other

investment programs would be devastated unleashing a wave of contagion.

While you are imagining

this scenario remember that America's stock market is the gold standard

and consider how less stable global markets would react in countries

like China and Brazil.

I continue to contend that we have never recovered from the Great Recession or corrected the many problems that haunt our financial systems such as derivatives and collateralized debt obligations. By printing money, imploding interest rates, and exploding the Federal Government's deficit we have only delayed the "big one." These two quotes on macroeconomic stabilization and crisis speak volumes. First, from Macresilience;

"As Minsky has documented, the history of macroeconomic interventions post-WW2 has been the history of prevention of even the smallest snapbacks that are inherent to the process of creative destruction. The result is our current financial system which is as taut as it can be, in a state of fragility where any snap-back will be catastrophic."

And next from Nassim Taleb (author of The Black Swan);

"Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. In fact, they tend to be too calm and exhibit minimal variability as silent risks accumulate beneath the surface. Although the stated intention of political leaders and economic policymakers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite."

These quotes suggest an analogy with ideas about forest management when natural fires are suppressed. If random fires do not periodically clear away forest underbrush, we see a build-up of flammable material sufficient to power a massive conflagration. I certainly think an equivalent truth applies to financial markets. The longer it has been since a painful collapse, the greater the willingness to pile on leverage and complexity, such that the next crisis becomes unmanageable. The "Too Big To Fail" and other policies implemented since 2008 have distorted markets across the globe and laid the groundwork for "The Big One", or what we will someday look back on as the mother of all sell-offs.

Over the years not only have we witnessed many cases of government overreach and many rule changes to protect the system at the expense of the people. What happened in Cyprus years ago should serve as a warning to anyone who thinks money in the bank is safe. A bad haircut, in this case, means you have been robbed. That may be the case if the government reaches in over a long weekend and steals money from your bank account. This is a horrible precedent to set, and the worst part may be how many people accept it saying it is OK as long as it is only on the larger accounts and only impacts the savings of someone else!

By not taking steps to correct many of the ills lurking in our financial system we have made things worse. Absent are actual structural changes necessary for our economy to become sustainable. Instead, we have put band-aid upon band-aid, upon band-aid while what was necessary was the amputation of a diseased limb. After all the threats that this market has avoided, and sidestepped, some investors have come to think of it as invincible. This market has overcome a struggling euro, the financial cliff, the end of Greece as we knew it, a trade war, and a global pandemic.