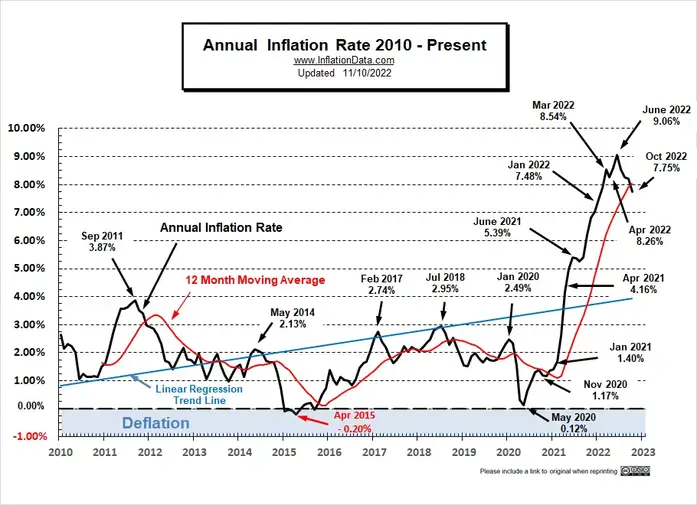

America’s inflation is now the highest since 1981. The number slightly above 17% is based on calculating inflation the same way economists and politicians did in the 1980s. Yes. inflation is a problem and indicators such as the inverted yield curve in the bond market are screaming that we should expect a recession. Considering what we are seeing and the fact Fed Chairman Jerome Powell has warned of pain ahead, there is good reason to think he is telling the truth.

The crux of this issue is that there is a huge difference between these two views of inflation and accepting the wrong number as fact could greatly impact your future. This rapidly becomes apparent in retirement for those older Americans fortunate to have accumulated some savings. The problem is that unless their investments perform at least as well as inflation they face seeing their wealth vanish into the deep dark hole of inflation.

|

| This Chart Indicates The CPI Inflation Number Is A Lie |

Decades ago, politicians and those concocting this system created it as a way to reduce

the cost of living adjustments for government

payments to Social Security recipients, etc. By moving

to a substitution-based index and weakening other

constant-standard-of-living ties those reporting inflation have muddied the water lessening the impression of just how

much our cost of living is being impacted by inflation. The general argument used to promote this change was that changing relative costs

of goods results in consumers could easily substitute less-expensive goods

for more expensive goods, the reality is that this assumption is often false.

|

| Basing Decisions On A False Inflation Premise Is Problematic |

Of course, if you concede the real rate of inflation is higher than the CPI indicates, charts such as the one above become invalid. Higher inflation than reported also feeds into the Fed being forced to raise the interest rate to destroy and slow demand. Expect a hard landing, wild rallies in the markets in my view are more a reflection of investors taking short positions using tight stops. This means those shorting this market often paint a target on their back and become sitting ducks for the algorithms generated by computer trading. These rallies are not a sign of a strengthening economy. All this translates into volatility and a somewhat unstable investment landscape.

The ugly reality of inflation is apparent during a shopping trip to a grocery store or stores such as Walmart. Sadly, what we see is the type of inflation that directly impacts many of the consumers that can least afford it. Recently product manufacturers like Coca-Cola, Pepsi, and Procter & Gamble all started raising prices across the board, which means that "something has to give." Retailers can only absorb so much of these increases before being forced to pass them on to consumers. Walmart values low prices and it is a key part of its marketing strategy but higher wages, transportation costs, and e-commerce investments have all pressured Walmart to bump many prices higher.

Years ago when America was experiencing what the late economist Allen Meltzer described as "The Great Inflation" his take was that inflation generally was not considered a major problem until it rose into the double-digit area. Still, I maintain the view the manipulation of data to artificially lower the official rate of inflation is very harmful in that it feeds into the illusion of economic stability. This helps both politicians and central banks sell the idea that inflation is not and will not become an issue.

If we accept Shadowstats version of 1980 based inflation then consumer prices over the last 20yrs or so would have almost quadrupled... (using an av. inflation rate of 7%. )

ReplyDeleteI have not really seen that, in regards to what I spend my money on ...to live.

What do u think Bruce ?

In the '80's I bought Big Mac meal for about $2.75 including tax and today i buy same meal for $10.42. This is about 4 times more than the '80's

DeleteI agree with all this. My question is, how can I as a saver/investor avoid losing money, and at least keep pace with inflation? Hard assets, or stock I'm assuming. Any thoughts as to the best hedges against this? I've heard you can get 3 month CD @ 4%. I'm considering those as a short term thing.

ReplyDeleteI agree, t-bills are also a good "short-term" move. More on this in the article I posted yesterday. I also like paid-for real estate that can generate a cash flow if you are able to care for it and buy it at a bargain price. Just as important is where not to put your money.

DeleteA fella that lives in Western Pa. on about 100 Acres of Land, Gives his take on inflation and its toll on our purchasing power. His thoughts on this subject is inline with what many of us think. The link to his video can be found below.

ReplyDeletehttps://www.youtube.com/watch?v=ZXyf0UxTbaI