|

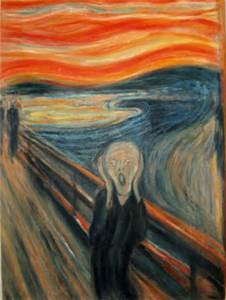

| Contagion Is A Reason To Scream |

When you study the derivatives market it become clear the main goal of QE may have been to hold up the underlying value of assets that feed into and support the massive derivative market more than help the economy. QE has up to now stopped an implosion of derivatives and the resulting contagion and shock that would have spread throughout the financial system. Everyone paying attention knows that the size of the derivatives market is about 20 times larger than the global economy. About 95% of the $230 trillion in US derivative exposure is held by four US financial institutions. It is hard not to see this as a reason for concern.

If you look close you will see the currency markets are beginning to reflect diminished confidence in the system central banks have created. As the currency games continue to ratchet ever higher it is becoming more apparent that we are standing on shifting sand. This was emphasized when the Swiss National Bank surprised markets and eliminated its exchange-rate cap a key source of support for the euro. The schemes bankers have used for years to hide and transfer debt are coming under attack, if they crumble under the assault it will culminate in a reset of the economic system across the globe.

Even as the Euro-zone contemplates its self destruction the death of the Yen that makes up only 3.2% of worldwide reserve holdings compared to the Euros nearly 26% sits near a new multi-year low. This is a harbinger of what is to come, the myth that advanced Democratic countries are immune to hyperinflation might soon be destroyed as the value of the Yen spirals downward. Soon after that people will realize that the Euro, Pound, and even the Dollar are not safe from what happens when a currency falls from grace. These four currencies make up about 95% of the Central Bank reserves backing other currencies. Faith in paper money in general stands ready to be shattered and the question is whether the euro or yen will be the first domino to fall.

Ben Bernanke made a statement recently that I thought should have received a lot of attention. The former Fed Chairman said Presidents should have the power to declare economic emergencies along the lines to declare war. The reason I think this should have received far more attention is that it screams massive risk still exist. After seven years the "System Is Not Ready!" and cannot adjust to what lies ahead. It is incredibly naive and pure folly to think that during a crisis a band-aid applied from Washington by any President is the solution or even a makeshift stopgap to economic carnage.

Contagion is a problem in a world where we are all interconnected. Some people have been calling for a "world currency" for years. the saying "one should never let a good crisis go to waste" means a meltdown with high levels of fear would present a perfect opportunity and catalyst to advance this agenda down the field. Remember many people with agendas have a lot to gain when a major shift in the currency markets takes place. Even with some countries not participating in such a currency it could dislodge the American dollar as the world reserve currency and this would represent a major shift. Expect calls for a new world currency may grow over the coming years, if the world stumbles into an economic hell the noise could become deafening because people and their leaders tend to look for easy answers.

While those in charge work frantically to limit the impact of a default by Greece we should remember this is only one of many financial problems that plague us, but it might be enough to cause or start the dominoes to fall. I for one have little faith when I see the massive growth in crony capitalism and corruption in Washington that allows those in control to "change the rules" and positioning themselves to benefit at every turn. Neither Martial Law, bank holidays, or instituting a price freeze can quell or halt a panic and the damage resulting from a major collapse of the economic system. If we get put in a corner the option of a new world currency would represent to many a new lease on life and a way to avoid and lessen the consequences of past actions.The blessing of this political smoke screen has "inflation" written all over it in the kind of ink only visible with a special light.

No comments:

Post a Comment