|

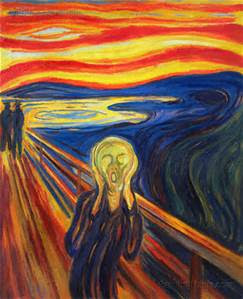

| Edvard Munch, The Scream |

We are but pawns in the giant game known as the global economy. Please excuse the tone of this article, it is rooted in the idea that on occasion it is good to vent or say what is on our mind. Sometimes we have to simply concede things are what they are and find solace in the thought that things could be far worse. You can expect promises to be rewritten and broken. Rules will change as we go through the wash. Most people will see their assets rinsed away as society is put through the wringer. For example, expect the cost of living adjustment on social security to be modified reducing payments to the elderly. Adding to the woes of retirees is that many pensions will be forced to reduce payouts and break promises as the returns on their investment fail to meet expectations. Many of the guarantees and paper promises granted over the past decades will prove to be less valuable than the paper they are printed on.

Recent revelations showing the Fed has been in collusion with Goldman Sachs and complicit in allowing them to do damn well as they please garnered little attention. The scheme to transfer wealth to the large banks is intact and most Americans know something is wrong but are too busy with their day to day existence to react. Eyebrows should be raised over the revolving door between large financial institutions and government that allows former employees with connections and strong ties to policies to flow freely back and forth between the two and the conflict it raises. It is not illogical to consider this growing wave of crony capitalism will soon sweep us off our feet. This is something that has inflicted pain upon people throughout history and closely related to what we know as government corruption.

With big business increasingly exerting its power over small enterprises it is not surprising that many people feel trapped in a world where their options are rapidly vanishing. In many ways, those in control have paved over economic reality masking and covering a multitude of sins against the laws of supply and demand. It is impossible to deny this has also taken its toll on "true price discovery" that allows our economic system to adjust and properly function. As pawns in this game, we can either choose to sacrifice ourselves or fight. In this case fighting means to undertake a strategy that protects what we can of the life we have created within the power we have been granted. The fact you are reading and thinking about this subject puts you in a far better position than the masses who see before them blue skies and unicorns grazing upon a hill.

As the global economy moves forward it is difficult to ignore that it is constructed on a weak foundation of imbalances, lies, and excesses. We only need to look towards China with its ghost cities and the fact its massive factories continue to crank out far more steel than is needed. Across the world debt has exploded as wages stagnate. Countries have borrowed against the future by running up huge deficits. Good jobs based on creating and doing a real task that can be economically justified are in short supply. The situation has become dire and the numbers do not work, borrowing money to merely pay the interest on past debt and NIRP is not a prescription that leads to economic nirvana and bliss.

Make no mistake, we cannot and should not look for a white knight to come riding in to save the day, no such leader exists to lead us out of the economy hell we have created. Predictions of "lost decades" are not uncommon as we recover and struggle to find a path forward. Here in America, we have seen a field of over twenty presidential hopefuls weened down to three, and soon it will be two. Ironically, the system we have created now ask a majority of voters to cast their ballot for the candidate they "hate the least" or in more politically correct terms the "least of two evils". Adding to our woes is the constant reminder that even if we garner up the enthusiasm to go to the polls rather than disengaging from the process the poorly crafted electoral college will soon strip us of any illusion that all votes are created equal. In the end, a few voters in some "battleground" state will make the final decision as to our fate.

Footnote; Again I would like to apologize for the tone of this post. If it seems out of sorts my only defense is after a long hard week sometimes we find we have had more than enough. Seriously, when transgender restrooms become a major issue in our political discourse we are reaching the outer-limits or twilight zone of reasonable concerns and substance.

Footnote #2; Some people have been calling for a "world currency" for years. the saying "one should never let a good crisis go to waste" means that a meltdown with high levels of fear would present a perfect opportunity and catalyst to advance this agenda down the field. Remember many people have a lot to gain when a major shift in the currency markets takes place. More on this subject in the article below.

http://brucewilds.blogspot.com/2014/02/contagion-may-lead-to-new-world-currency.html

Footnote#3; I would like to share the following picture forwarded to me of young love showing a couple standing in front of the carriage about to take them to the prom. Love is a beautiful thing, however, no amount of planning can prevent reality from casting a dark shadow upon any event.

|

| Jake And The Lovely Haley |

|

| Please note, Jake and Haley's horse |

Wow. The horse...LOL.

ReplyDeleteI was thinking the hand, LOL.....but I am a butt man so more power to you Jake!

DeleteIn this case fighting means to undertake a strategy that protects what we can of the life we have created within the power we have been granted. The fact you are reading and thinking about this subject puts you in a far better position than the masses who see before them blue skies and unicorns grazing upon a hill.

ReplyDeleteThe masses continue going about their day because everyone that's sounding the alarm is only doing just that.

What are the solutions ?

Dan, thanks for the comment and my apologies for the slow response. When it comes to protecting yourself and what you have created many strategies exist. It is always a good idea is to hone your skills and work towards being as self reliant as possible. Since it is difficult to know when or how "bad things" may unfold and also because the amount of wealth we are talking about can vary a great deal the next part of my advice I often withhold. A few ideas that must be customized to your situation are given below.

DeleteWhen it comes to storing your wealth avoid investing in paper promises, this includes even futures contracts thinking you will take possession at the first real sign things are headed south, hard assets need to be in your possession and hidden away. Stay away from debt where any type of recourse exist and that you cannot clearly walk away from or renegotiate lower. Hats off to Jim who commented below, he has a good idea that will work for many people, besides silver any valuable commodity that you have a good place to store becomes interesting.

Being a contractor I like paid for real estate in good areas when it can be bought at the right price. NOTE, (the longer I hold clear title, the more comfortable I feel). Replacement values have gone through the roof in many places and are unlikely to drop much. Several problems exist with this, it should be where you can keep a close eye on it and not in an area where prices are high leaving a large amount of downside, also carrying cost can be high if the property is empty and you have a lot of carrying cost. You must know what you are doing to properly execute this strategy and the leaning curve as well as the commitment is very long.

I'm hedging pure silver (9999 maples) against the inflationary forces. The volatility of the stock market combined with increasing swings of currency valuations in the face of perpetrated devaluations is worry-sum! Overall debt-derivatives are leveraged against unrealistic probabilities and eventually will either collapse or be marked to fantasy. Not the hedge I would recommend. If your locked into a 401k or some other pension plan offering little control you should double-down and start hedging on the cheaply priced pure silver! Time is not your friend this time around, so to say.

ReplyDelete