|

| A Clear Sign Of Lower Prices Ahead |

For a long

time, I have had a problem with those pointing to the

auto industry as proof that the American economy is on

the mend. The auto market is facing oversupply and this means lower prices. This has been predicted by many of us for some time, however, it has been postponed by a wave of subprime auto loans that have allowed a buyer to purchase a car even when it makes no sense financially. Years of rising auto sales driven by artificially low

interest rates have driven sales and leases. While we hear claims that

the auto market is

hitting on all cylinders we also hear of far too many unemployed

students buying new cars. Failure to focus on where the sales are coming

from or originating is a mistake and a clear sign this industry is creating its own problems in future years. Recently, we have

heard about sales, not about soaring profits. Record levels of channel

stuffing will often produce sales gains,

but no profits.

The lower prices have taken longer to arrive than many of us have anticipated, however, the facts behind what has held up prices and pushed this market forward are very disturbing. More of all new auto loans have been going to subprime borrowers. Subprime currently makes up about a third of overall car loans. The easiest way to become a subprime borrower is by defaulting on previous debt obligations. Auto loan delinquencies have been surging, this means subprime loan delinquencies now stand at 18%. Pretending to sell automobiles to people either dependent on money from the government or no means to pay for that automobile is not a good business idea. When you have huge financial lenders and the rest of the Wall Street banking consortium doling out 7 year 0% loans and subprime loans as if it were candy it’s easy to move inventory. Sadly, while this has temporary boosted the GDP the issuing of what is destined to become more bad debt always comes back to haunt us in the long run.

The lower prices have taken longer to arrive than many of us have anticipated, however, the facts behind what has held up prices and pushed this market forward are very disturbing. More of all new auto loans have been going to subprime borrowers. Subprime currently makes up about a third of overall car loans. The easiest way to become a subprime borrower is by defaulting on previous debt obligations. Auto loan delinquencies have been surging, this means subprime loan delinquencies now stand at 18%. Pretending to sell automobiles to people either dependent on money from the government or no means to pay for that automobile is not a good business idea. When you have huge financial lenders and the rest of the Wall Street banking consortium doling out 7 year 0% loans and subprime loans as if it were candy it’s easy to move inventory. Sadly, while this has temporary boosted the GDP the issuing of what is destined to become more bad debt always comes back to haunt us in the long run.

|

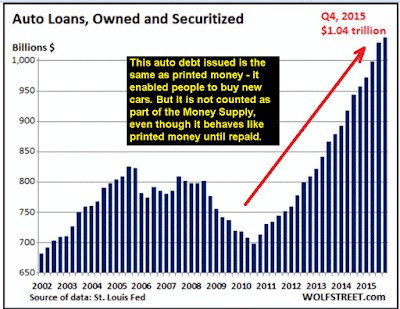

| Auto Debt Is Now over 1.1 Trillion And Rising |

The Federal Reserve has been pumping in trillions of dollars of liquidity into the economy and much of it has resulted in pulling future consumption forward. These policies will soon become a headwind to both future sales and growth. This is more proof of just what an infusion of money from the Fed can produce and how it adds to the great distortion. The American people have been binge-buying cars and with the total stock of outstanding car loans jumping to $1.1trillion, Harry Dent, a financial commentator was recently forced to ask: “Could cars be the death of us this time round?” Auto loan debt has continued to ratchet higher every month since 2010 when the Fed, Wall Street, and the political class in Washington decided they needed new debt bubbles in auto loans and student loans to jump start our moribund economy. Recent figures showed that there are 65 million auto loans outstanding, and the average debt now stands at $17,352. Currently, over 30% of auto “sales” are actually leases. The rest are financed over an average of 65 months. This means that virtually all new car sales are nothing more than 3 to 7-year rentals.

Issuing billions of debt to subprime borrowers for housing proved to be a disaster and going forward we should expect the same trend to reveal itself in autos forcing a slowdown in American factories and a dampening effect on growth. New-vehicle sales in the U.S. were up 13% in 2012 and up another 7.6% in 2013, since then it has been up, up, and away. The problem is that now more used cars are about to enter the market. Manheim Auto Auctions expects millions of off-lease cars to hit the market this year and says that will continue to rise in coming years. This is good news for used-car shoppers but does not bode well for the automakers. When used car prices are strong consumers are more inclined to consider and buy a new car that cost only a little more. Because many people have chosen to lease cars in recent years we are now positioned that millions of used cars will soon be thrust onto the market as leases expire. This flood of used cars is expected to put massive pressure on the prices of used cars as well as reduce the need for many people to buy a new vehicle because of a secondary market that offered only limited choice and selection.

Going forward all this will dampen new car sales in several ways. First car shoppers can expect their trade-ins have less value meaning they will face both larger loans and bigger payments or forgo the purchase. This will carry over and make leasing more expensive because automakers base lease rates on predicted resale or "residual values," which is an estimate of what the new car will be worth at the end of its lease. Another factor we should not underestimate is that many of the used cars entering the market will be attractive top of the line models with all the bells and whistles. These lower used-car prices are a delayed response to the new-car market's revival from the recession: From a bottom at 10.4 million in 2009. John Rosevear who has been writing about the auto business and investing for over 20 years, and for The Motley Fool since 2007 has suggested that if you want a nice car you might want to wait a little longer.

|

| Millions Of Cars Coming Off Lease Now Flooding Market |

Much like the airline industry, the auto sector has always had a history of being a "glamour" industry, this means it tends to attract individuals who enjoy both risk and attention. It also means it is full of stories marking past failures and littered with names that no longer exist. A chief reason the automobile industry took a beating during the 2008 downturn was because the world was mired in overcapacity. When this occurs companies are forced to cut prices and are faced with reduced profit margins. It is important to note that as competition sharpens it will most likely result in the demise of many of the weakest players in coming years. Any slowdown auto sales or the economy will only hasten this event and put the stock prices of auto companies under a lot of pressure, do not be surprised if the issue of bailouts or downsizing again becomes necessary. Most at risk are the smaller players that will have difficulty raising capital in this industry that constantly demands a company invest huge sums of money to stay competitive.

Footnote; It is surprising how it often take a long time for problems to become apparent. Many people claim that those in control of the economy have a better handle on how things unfold but I think not. More on why many of us see a strong similarity between what is happening today and prior financial meltdowns that have resulted in crisis can be found below.

http://brucewilds.blogspot.com/2016/12/thoughts-on-this-time-is-different.html

No comments:

Post a Comment