|

| Fed's Action Obliterates True Price Discovery |

Until now, the size and pace of Fed balance sheet expansion have put a floor under global equity markets and driven equities higher. Yet Powell is going out of his way to signal that more economic support is on the way. The problem with market manipulation is that once it starts, where does it end? This is an area of moral hazard that once breached is difficult to turn back. Another issue is that the Fed is not alone in playing this game, the Trump administration also has invested a great deal in keeping markets moving higher. In recent years we have witnessed more central banks and government intervention in markets. This supports the argument that true price discovery has been massively distorted.

|

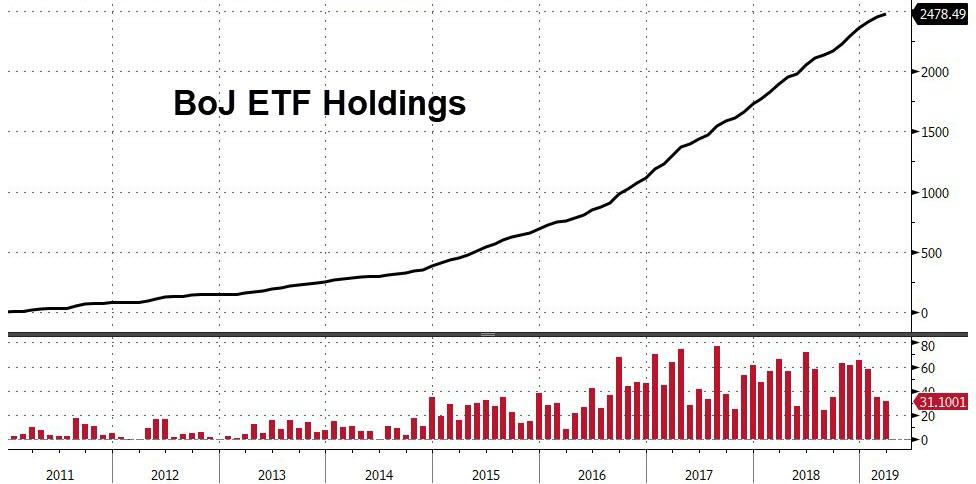

| The BOJ Buying ETFs Is Distorting Markets |

The Federal Reserve was intended to act as the “lender of last resort" but as Nomi Prins says, "As if the Fed hasn’t done enough to destroy honest markets, now it plans to start buying individual corporate bonds. It’s just another step closer to the Fed deciding the winners and losers in the market." This has forced even the most bearish of us to finally concede that, for whatever reason you want to claim, the Fed under the leadership of its Chairman J. Powell has crossed the Rubicon and the point of no return.

Crossing the Rubicon means the point of no return. This high-level idiom comes from an event in ancient Roman history. In 49 BC Julius Caesar's army crossed the Rubicon River, this was forbidden. It was an event from which he knew there is no way back. When Julius Caesar crossed the Rubicon, he started a five-year Roman civil war. At the war's end, Julius Caesar was declared dictator for life. Putting the Fed's recent actions into context and what it means for investors, the miserable policies adopted by the Fed, which has allowed other central banks to do the same, has created a new environment redefining risk and value. This highlights the fact there is nothing normal about what is happening, this is far from normal.

Savers, investors, and a new wave of speculators as a result of Central banks expanding balance sheets while reducing interest rates are now embracing any investment that promises yield. This combined with rising government spending has disaster written all over it, not just in America but across the globe. This and a slew of other horrible moves have created a bubble in bond and equities. Only the claim that no inflation exists and this is the only way to halt deflation allows this reckless policy to continue, however, when people realize the fallacy of this assertion it will be to late too stop the economic and financial carnage it will create.

|

| The Shrinking Private Sector (click to enlarge) |

The idea we are about to experience a “V-shaped recovery” is rubbish. Many people are afraid to fly, travel, or eat out at a restaurant. The government's solution to give the masses just enough to silence their outrage is a bizarre extension of crony capitalism. It feeds large businesses with access to cheap capital are the winners and the big losers are the middle-class, small businesses, and social mobility. All those people that want a higher minimum wage can forget that ever happening as tens of millions remain out of work. It is difficult to argue true price discovery exists and risk is not being discounted when prices fail to reflect unemployment at around 20% and ignore news of a sharp escalation in Korean tensions or the deadly clashes between Indian and Chinese border troops.

Bubbles always pop, this time is not different. Exacerbating the current situation is that many investors in these "paper promises" have become over-leveraged. This puts them at great risk if a sudden decline in the value of these assets occurs. The disconnect that has taken place between Wall Street and the economy is not logical. We are in uncharted waters and should consider the possibility the destruction of true price discovery will only add to the demise of fiat currencies across the world. I contend this will fuel the desire of people to once again hold tangible assets rather than trusting the promises now being made. To say things are messed up is an understatement.

Couldn't have said it better myself.

ReplyDeleteWe have already passed the point where the problem of servicing the national debt can be solved without violating the principles of a free economy. That is to say for example, through a non-debilitating level of taxation rather than a confiscatory capital levee. Our economy will be forced into an increasingly totalitarian mold, and the freedoms which we are presumably arming to defend will be lost.

ReplyDeleteIt is 100% likely default in the West won't happen. Instead financial repression and inflation will lead to the same result. However this will sustain asset prices...yet the key element of inflation people forget is that your cost of living goes up faster than your assets go up. It is very hard to believe today that food, rent, Insurance could one day go up faster than your income. Well that's Inflation. Both income and prices go up , alot! But you'll always be behind.

ReplyDelete