Since the outbreak of the pandemic, Chinese authorities have issued 4.75 trillion yuan ($683 billion) in local and national debt with most of that earmarked for infrastructure projects to boost construction. China is far from transparent and making it difficult to know what exactly is happening. This is also true when it comes to imports which are sometimes stored away rather than used. Speculation and projections of future use all play into this. Whether we are talking about grain prices, oil, or metal, China is a bigger user of commodities and the demand flowing from China affects prices. Factor into this the notion that China is big in projecting a positive narrative of economic growth and the spillover becomes clear.

An example of this can be seen as iron ore prices hit a six and a half year high on Thursday as the Chinese construction and manufacturing sector claims to be experienced levels of activity not seen for almost a decade. Fastmarkets MB reported that benchmark 62% Fe fines imported into Northern China were changing hands for $129.92 a tonne on Tuesday, up 2.1% on the day. That would be the highest level for the steel-making raw material since mid-January 2014 and put gains for 2020 to over 40%. China is responsible for more than half the world’s steel output and 70% of seaborne iron ore imports. This makes such numbers a key gauge of economic activity in the country.

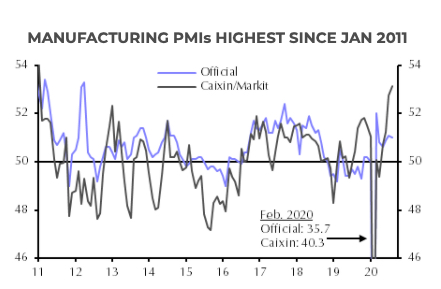

|

| Source: Capital Economics (click to enlarge) |

If accurate, the numbers released this week indicate a rapid expansion of China's manufacturing and construction sector in August. The question remains as to whether this is a dead cat bounce from the diabolical covid-19 pandemic or a recovery with real legs. The chart on the right shows the Caixin manufacturing PMI index rose from 52.8 in July to 53.1 in August, well above analysts’ expectations. The official PMIs released by the Chinese government showed a slight drop in activity but the Caixin index is often seen as a more reliable gauge of activity.

The export orders component of the manufacturing PMI rose above 50 for the first time this year on the back of recovering foreign demand. This could indicate that foreign demand is now beginning to again increase. It could be argued that China’s factories are again humming at the same time spending on infrastructure is soaring, however, as a China skeptic, I view much of this a temporary. It could be many stores across the world now simply need to refill their shelves after months of economies being locked-down. If this is true prices and demand may soon begin to fade.

|

| Click On Image To Enlarge |

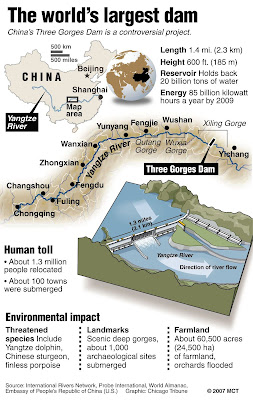

As mentioned earlier in this article, China is suffering from massive flooding. It has been estimated the loss so far exceeds 50 billion dollars and is adding to supply chain disruptions across the world. Currently, the weather in China merits our attention because months ago word began leaking out that China's massive Three Gorges Dam was in peril. Reports coming out of the area indicate the situation remains dire.

While this is the largest dam in the world, most people know little about it or the implications if it fails. About 400 million people live downstream of the dam and its failure would have catastrophic consequences. It is said the flooding might kill as many as half a million people. Ironically, if the dam does fail the province's capital Wuhan the epicenter of China's coronavirus outbreak would be hard hit.

For more about the Three Gorges Dam see the link below. If this dam does break it will become a major news story.

https://brucewilds.blogspot.com/2020/07/chinas-massive-three-gorges-dam-is-in.html

No comments:

Post a Comment