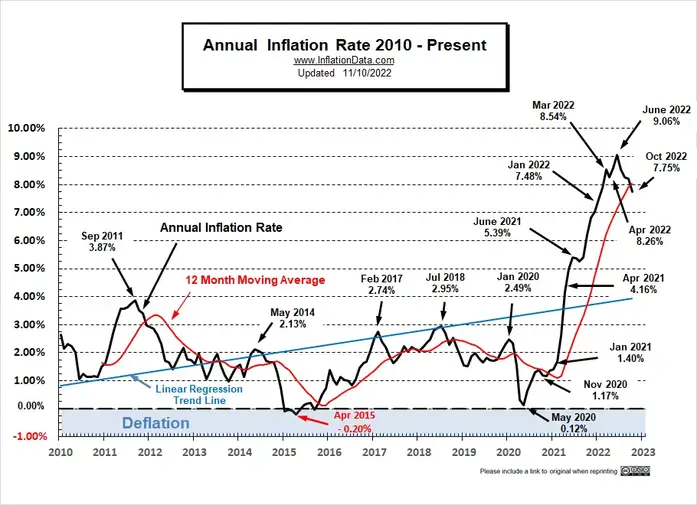

The view that inflation will be around for some time is growing. Many people in the inflation camp see at least 5% inflation will stay with us for most of the next ten years. This is something we should consider and note because the ramifications would be huge. It is a prediction that is likely and lives in the area between runaway hyperinflation and deflation.

The whole inflation regime dictates how everything is valued. It is important to remember inflation affects everything but not equally. My premise is that wealth will flow out of paper promises and fiat currencies and into tangible assets. Such a shift in where money is invested is a game changer. If I'm correct, this will result in a fundamental change in the economy.

The recent CPI numbers have come in hotter than expected. Headline CPI month over month was double expectations with core numbers rising 6.6% year over year. These numbers are the highest since August 1982. Going forward it is likely we will see inflation in services and "fees" continue to rise as the prices of goods begin to slow. Adding to our pain as consumers is the fact the CPI routinely understates inflation by using a formula based on the concept of a “constant level of satisfaction.” This was concocted by politicians and their advisers to reduce the cost of living adjustments for government payments to Social Security recipients, etc.

|

| Services Inflation Continues To Rise As Prices Of Goods Slow |

Source: Bloomberg

The argument for deflation is very clear, we have too much debt and when

defaults occur it will trap us in a deflationary vortex. Most

deflationists think by the time you factor in demographics we will find

ourselves trapped in a long and painful deflationary cycle. The

general consensus is that as people age they buy less and spend less.

This leads people to see an aging population, such as we have in

America, will add to the forces favoring deflation.

The flaw

in their thinking may lay in the fact that a lot of money will be spent

by the government to maintain both their health and support those

retiring with little or no savings. Also, when people retire most no

longer contribute to the supply side of the economy but move completely

to the demand side. How can we say older people consume less when

they generate huge medical bills and have other special needs? Even if

the cost is shifted to the government it still shows up as consumption.

Some people are predicting inflation will soon drop based on the idea

much of the data reflecting inflation flows from past numbers that

reflect what is already behind us meaning we are looking in the

rear-view mirror and retail prices are about to drop due to high

inventories. Still,

some problems refuse to fit into the narrative that inflation has peaked. How do

you pull forward rent, health insurance, energy, etc?

Sure some

deflationary numbers may be coming out on the retail side of things due

to heavy inventories but this may not be enough to offset prices rising on the

things we need. The problem is, inflation does not always cure itself. You can't tamp

down inflation by merely talking about how high prices destroy demand. Many things driving inflation, such as rent

increases are not all behind us. As leases expire each month renters are brought up to the current pricing. The same thing can be said about utility bills

and other needed services. Do not expect the

cost of shelter to fall. Too many of the costs feeding into this sector

are still moving higher.

Unfortunately, those seeing

deflation ahead base it on a horrible

economy, falling liquidity, and the destruction of demand rather than

improving supplies. We have to recognize the difference between

supply-side and demand-side inflation. With this in mind, you could say,

a broken supply chain also feeds into the inflation picture and could

make a case that the supply chain is the economy.

Recent

"hotter than expected" PPI data indicates inflation will be with us for some time. It

seems to have deeper roots and may prove stickier than originally

thought. The idea we may see both a weak economy and stagflation

dovetails with a recent piece put out by David Stockman. Of course, this

debate is far from settled. There is a lot going on and few pundits or

economists agree on where this is headed.

Below is a sampling of a

few financial headlines from last month that indicate economy watchers are

all over the place as to where the economy is headed.

Fed’s Williams sees steep decline in inflation ahead

Oct. 3, 2022, at 3:27 p.m. ET by Greg Robb

The 4% retirement spending rule may be too high. Could you get by on 1.9%?

Oct. 3, 2022 at 10:59 a.m. ET by Mark Hulbert

Europe’s red-hot inflation numbers may be ready to cool off, says Morgan Stanley

Oct. 3, 2022, at 10:40 a.m. ET by Barbara Kollmeyer

The elephant in the room remains that restrictive monetary policy means that liquidity

is vanishing and the risk-reward for loaning money on a promise is

breaking. When credit fails to grow the economy rapidly falls into a

recession or depression. When credit is a problem, how do we move the

economy forward? The big question is whether destroying the wealth effect in certain sectors of our economy will offset the redeployment of wealth in others enough to halt inflation.

The massive mindless "exchange-traded-funds"

trade where all ETFs own the same ten stocks has supported this market

over the years. Unfortunately, this sector seems greatly out of wack and

hugely overvalued. If money starts to flow out of the ETFs and this

sector breaks markets may go into a free fall. This would be an

indication the markets may be underpricing the duration of high-interest rates.

Footnote; The following AdvancingTime article details how the CPI understates inflation by using a formula based on the concept of a “constant level of satisfaction” that evolved during the first half of the 20th century in academia. Politicians touting the benefits of this system created it as a way to reduce the cost of living adjustments for government payments to Social Security recipients, etc.

https://brucewilds.blogspot.com/2019/08/the-cpi-understates-inflation-skewing.html

(Republishing this article is permitted with reference to Bruce Wilds/AdvancingTime Blog)