When it comes to the issue of failing banks, backstop, ring-fence, and a slew of other words are used to describe the tactics being used to halt the growing risk the financial system could collapse. A lot of these words are being pitched out there by people that want to avoid using the term bailout. Most banks are illiquid but solvent, thus assuring their depositors their money is safe, should not be considered a bailout.

This is where it is important to understand small community banks are not in the same business as the big boys with their trading desks and such. These banks are far more rooted in the economy of Main Street. The challenge for the Fed is how to reassure depositors and support the banking system while continuing its battle against inflation. In many ways, the current liquidity issue is a situation the Fed created. This is especially true when it comes to the smaller banks.

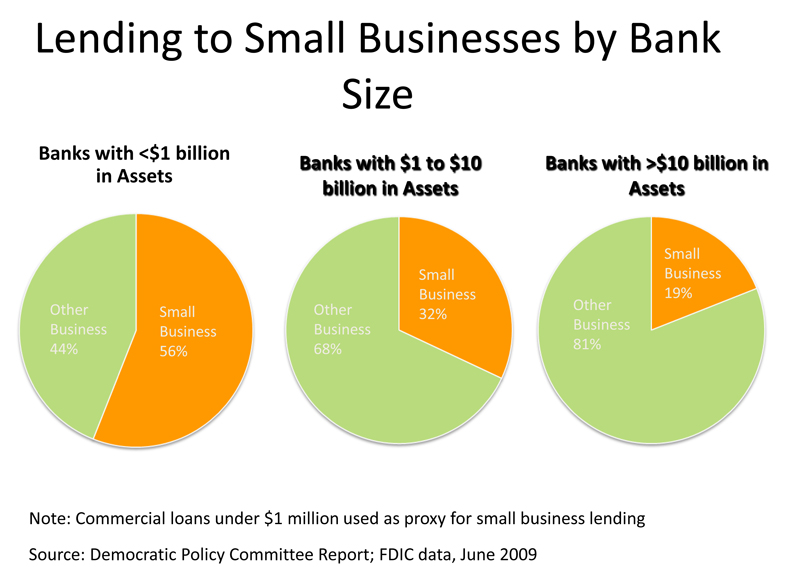

|

| Smaller Banks Tend To Work More With Local Businesses |

Silicon Valley Bank was by no means a small community bank. Before its collapse, it was America’s 16th largest commercial bank. With operations in Canada, China, Denmark, Germany, Ireland, Israel, Sweden, and the United Kingdom, it provided banking services to roughly half of all US venture-backed technology companies. Fueled by ultra-low borrowing costs and the pandemic-induced boom in demand for digital services, SVB benefited from the tech sector’s explosive growth.

This article is more about the huge number of smaller banks scattered across America that many people and businesses deal with on a day-to-day basis. In reaction to the new scrutiny environment smaller banks face expect them to rapidly pull in their horns when it comes to loaning money. They will be more risk-averse and not inclined to make loans. This will result in a massive reduction in liquidity add drag the economy lower.

While some people focus on the huge amount of money the Fed will have to put out there to assure depositors that they can pull their savings out of banks at any time, this will not expand the money supply. That is because it is just sitting there, it is not flowing through the economy.

All in all, the latest bank scare here in America is being handled. While a great deal of the recent attention is centered on America's banks, it should be noted that in other countries the banks may be far weaker. Powell has by the way he has handled this situation put some space between the banking sector in America and other countries. This "decoupling" may prove very important if economies come under a lot of pressure over the next few months.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Thanks for pointing out that what the Fed and Treasury have done lately with respect to insuring deposits is not a bank bailout. It is obvious that the FDIC and even the entire govt. don't have enough money to insure every single bank deposit in the country, but the intent is to prevent bank runs. If millions of people suddenly believe that their deposits aren't safe and they all rush to the banks to pull their money out then we will have a monumental crisis and subsequent depression similar to what happened in the 1930s. Of course, if this happened today, the Fed would be forced to print trillions to keep the banks capitalized and then withdrawals would be restricted, but this would only make things worse and ultimately exacerbate price inflation in the long run.

ReplyDeleteI only hope that the boards, executives, and shareholders of the banks that fail due to gross mismanagement and recklessness are held accountable, and I don't even fault most of the shareholders as they rely on the boards and executives to properly manage the banks. The Fed and other govt. agencies clearly dropped the ball on SVB, Signature, and First Republic as they were supposed to be regulating those banks and should have noticed the problems. It just goes to show that regulation doesn't always work like it's supposed to. We need a Glass-Steagall 2.0 act that separates commercial and investment banking to help keep ordinary deposits safe. The fools in charge at SVB were more concerned with ESG and DEI, plus making themselves rich, instead of being good stewards of their clients deposits. I hope they are punished.