|

| The Money Supply Has Exploded |

The term helicopter money refers to unconventional methods used to get money into the hands of people that will rapidly put it to use. Whether to buy products or pay bills it is often seen as a way to kick start a stalled economy in need of a boost. This is seen as an alternative to quantitative easing and is considered by some a faster way to add liquidity into the economy. It could be argued that over the years such policies have proven to be inefficient and poorly targeted. While helicopter money may accomplish a certain goal such as supporting a market, it is poorly targeted and seldom addresses the root problems in a financial system or economy.

The failure of central banks across the world to use their power to push governments to undertake reforms is coming home to haunt us. Rather than assuming the role of enforcer and protector of our fiat currency system central banks across the world have joined with governments in what I call the "Financial-Political Complex." This is comprised of the organizations, comprised of authorities, politicians, and bureaucrats that want increased power and influence. These people benefit a great deal by unleashing huge sums of fiat currency upon the masses and ignoring the long-term ramifications of their actions upon the financial system. It should not bring comfort to the average man that these unholy forces have joined together in such a union.

A huge problem with simply sending out big checks to a population with little experience handling large sums of money is that they don't know how to handle it. While some big income earners and politicians in Washington may not think so, for a family of three with an annual income of $30,000 two checks from the government totaling $6,000 is an incredibly big deal. It is equal to 20% of their income and in truth, the windfall most likely doesn't end there. Often other goodies are thrown their way such as rental assistance and a slew of other programs aimed at paying their bills.

An important factor we should consider is that such programs weaken in the minds of these people the relationship between the value of currency and reality. This translates into much of this money being poorly spent and flowing into areas where it does little to move the American economy forward. An example of this is when the money is not used towards old bills, mortgage payments, or rent, but used to buy flat-screen televisions imported from China. In such a situation the unpaid debts tend to fester and become a problem for the economy going forward. Buying junk produced in China generally does little good when it comes to creating jobs in America.

What consumers buy matters a great deal. When looking at the

policies flowing out of Washington it is clear many politicians seem to

have no idea that all consumer spending and purchases are not created

equal. Senator Rand Paul has good reason to be bouncing off the wall with criticism of the 1.9 trillion dollar relief bill just passed. Sadly, not enough politicians and voters are anywhere near as outraged. This may have to do with the fact this is such a huge amount of money that few people can get their head around it. In fact, most Americans are oblivious to the fact less than 25% of the 1.9 trillion dollars in this bill is being given to the people in the way of direct checks but again the majority of it is pork and a gift to special interest.

| Helicopter Money Not Focused On Cause |

The important issue when it comes to the latest rounds of stimulus, relief, and Fed easing is they fail to address the underlying cause of our economic problems. Rather than trying to correct the imbalances in our system, they are an attempt to paper over them. This means under the surface things are getting much, much worse. The massive overspending in the just passed bill is why Republicans in Congress did not support the bill. Senator Paul said, "There's $10 million to study Native American languages, there's $750 million to build Native American housing, there is $300 billion in there to bail out New York, California, and Illinois." Paul believes those blue states spent money recklessly and in essence, are being rewarded for overspending in the American Rescue Plan. Wasting our resources is not the way to get the economy back on track.

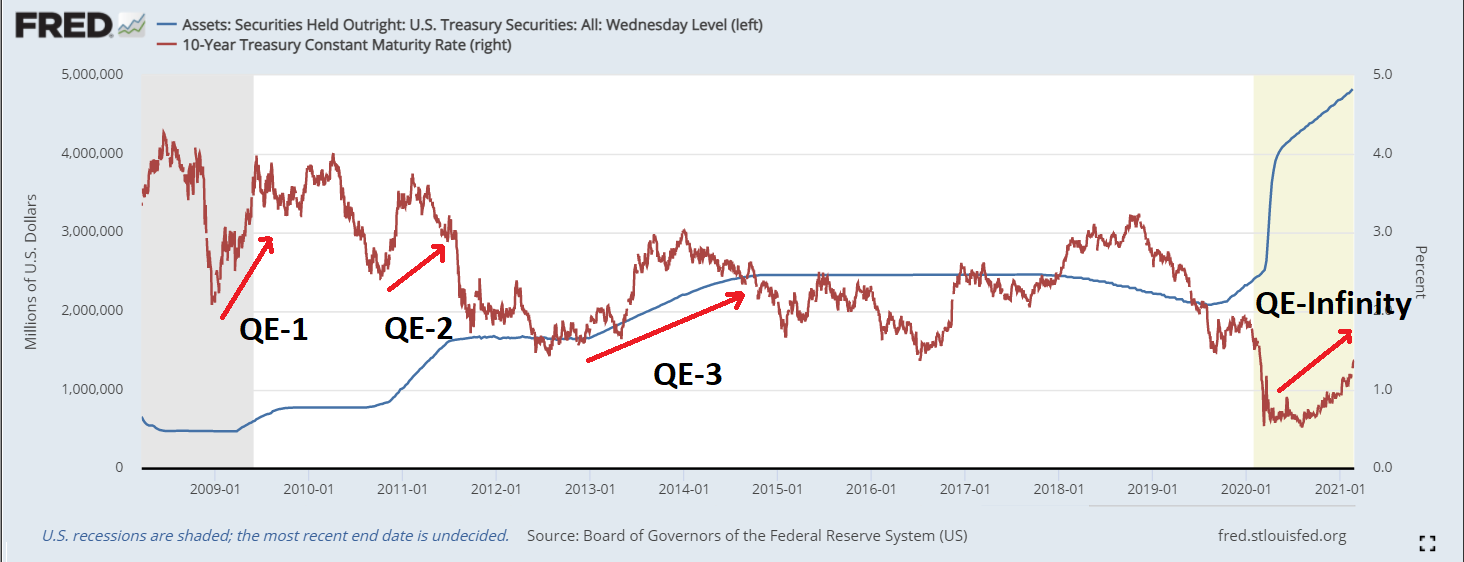

The chart below shows how over the years each infusion of money into the economy has been greeted with diminishing returns. In the past, other countries embarking on similar policies have had similar results. With this in mind, it is difficult to make a case such spending spurs real economic growth.

|

| QE Followed By More QE Has Failed To Produce The Desired Growth |

It seems those in power see the way to a stronger economy will come from banks loaning more and for us to borrow more and spend more. However, at some

point, we reach a place where too much money or currency makes it a

worthless commodity and inflation takes root. Many investors are beginning to worry that time is rapidly approaching. When it does arrive it will bring about a financial crisis, that is when those saying that we only need to print more money to move forward will find they are on the wrong side of history.

No comments:

Post a Comment