We must understand the housing market in China to fully comprehend how wealth is stored by many people in China. To those looking in from the outside, the housing market in China appears a house of cards ready to collapse at any minute. It is also a market sector that has become greatly oversized that it may now account for 25% or more of China's GDP. Because it has become so ingrained in China's economy we find that the Chinese government has no choice but to shore it up while at the same time trying not to encourage its growth.

| Prices Have Soared In Top Tier Markets |

A clear sign something is wrong is evident in the findings of an analyst for economic research firm Rhodium Group that estimates around 90 million apartments across China are sitting vacant. This indicates a huge oversupply in some areas of the country and unaffordable homes in certain cities. For years, developers have put up large apartment blocks in isolated parts of China. This was done because the land is less expensive in these areas and under the concept "if you build it they will come," but often, they have not.

|

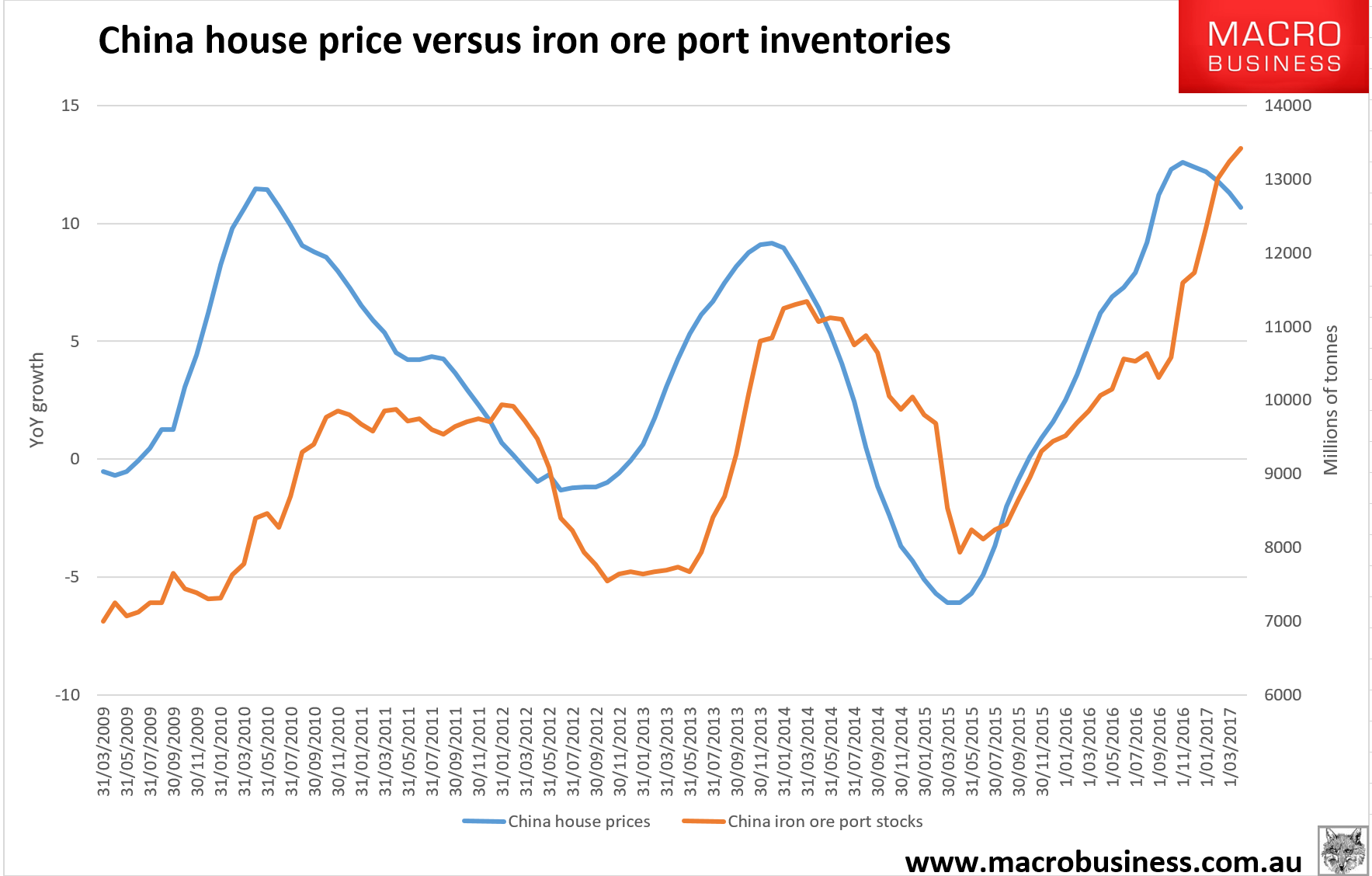

| China's Housing And Iron Ore |

|

| China's Government Pulls The Strings |

The government of China has been concerned over rising house prices for

years. Following the Central

Economic Work Conference in December of 2016, it issued a statement

saying, "Houses are built to be inhabited, not for speculation." Over the years low investment returns

in the real economy and easy credit have triggered excessive growth in

property prices in China and attracted too many financial resources to

the real estate sector. Despite efforts by the government to

cool this market and moderate

property prices, market sentiment has remained robust partly due to a lack of other good investment options.

|

| Typical Upscale Housing Development In China |

As a contractor and being heavily invested in real estate, I was thinking about how "draw systems" work. This has to do with how a certain percentage of the cost of construction is shelled out as each stage of construction is completed. This is done partially to make sure projects are actually completed. Please note, much of the money spent on constructing a housing unit is spent in finishing, many people give this little thought.

Years ago Home Depot was excited

about entering and developing the massive market in China because

apartments are sold by the developer at the "roughed in" stage with no

interior. You might know Home Depot cut and ran after a few years adding

to the list of American companies that failed in China. Home Depot has

blamed their bad experience on not understanding the Chinese culture.

After reading this article you may question both the quality and just how well

many of the housing units in China have been finished. The fact is, many will never get

"finished" or occupied.

In trying to understand the massive housing market that drives much of

China's growth it is important to realize that people in China buy

apartment units that are only roughed in. This means the buyer is

essentially purchasing what we in America would call an "empty shell" or

an unfinished apartment. In most cases, apartments are sold with

internal walls and electrical outlets in place but everything else,

including doors, flooring, and bathroom fixtures will need to be

built out by the owner after purchase. Understandably, this

created a great deal of excitement for a company like Home Depot that

sells the "rest of the package" in a way that can be a one-stop answer

for any home buyer.

A

close look at housing in China and the customs under which deals are

completed will give Americans some real surprises. Getting information

on this subject is not as easy.

It takes a bit of digging and research to better understand the

internal workings of China and how its real estate system functions.

Unlike property and housing ownership in America and other western

countries, all property in China is simply being leased for 70-years. Also, the various procedures and steps

Americans take for granted when purchasing a property such as; due

diligence, housing inspections, and secure escrow accounts simply do not

exist.

The lease is supposed to renew automatically upon expiration, this might unnerve many buyers that know the Chinese government's relatively new Ministry of Housing and Construction retains full "property prerogatives," meaning that leases can be nullified at any time if the government determines that it needs that property for any reason. In addition, the government is also entirely free to decide how much compensation should be offered for that property in the event the land your apartment happens to be located on is reclaimed by the state. Residents now have the right to sue the government if they feel they receive unfair compensation, but they rarely win in court.

|

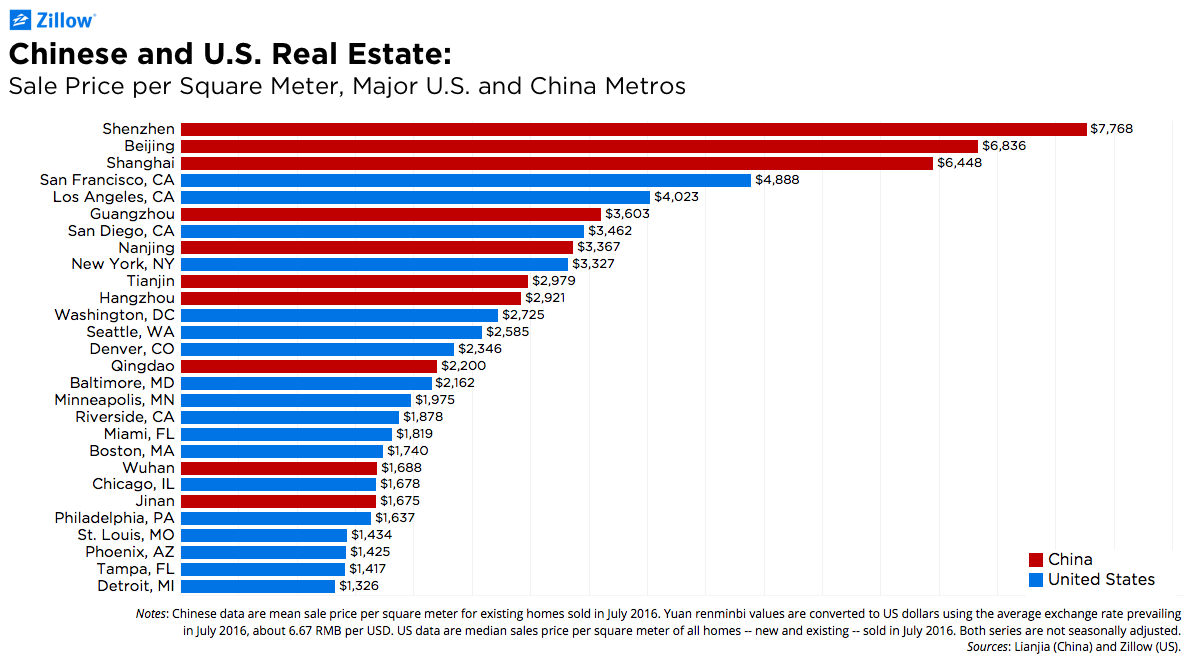

| The Trends Shown In This 2016 Chart Continue |

It could be said cheap housing is something you won't find in China. While many of these units are poorly built, they are not cheap. China's housing market is among the most expensive in the world when compared to per capita income. To be honest, the numbers I found are all over the board. For example, the average price of housing in New York City is around $1,000 per square foot with an average family income of $76,000 per year. By comparison, the average cost of housing in Shanghai for the year 2021 is around $1,200 a sq. ft. against an average family income of around $10,000. By American standards most apartments are small, no more than 30 percent of all new apartments can be larger than 90 square meters (970 square feet).

|

| China Gives Savers Few Good Options |

On Quora, back in 2015, Mike Lim, who worked in Shanghai reported of colleges that earned around $700 a month selling apartments for around $5,000 a sq. foot and driving to work in a 3 series BMW and carrying LV bags and totting the latest iPhones. He stated, since the late 1990s to early 2000, there have been many forced relocations to free up inner-city locations for development. New apartments are then allocated to these households and often a mid-sized family (e.g. two grandparents, two parents, one kid) could get 3 new apartments. Couples have been known to divorce just to get another apartment! Now with these 3 apartments, they usually occupy one, rent out the second and sell the third.

Aside from the disagreement over the stability of China's housing market, it should be noted that foreigners may only purchase apartments to live in for personal use and not to rent out. Virtually no secondary market exists to sell into if you decide to relocate. When someone in China seeks to buy an apartment few give much consideration to anything but new construction. Still, most bizarre is that for such a large market, legal protections and real estate standards are not yet well-established.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

The you-tube video below is worth taking a look at.

ReplyDeletehttps://www.youtube.com/watch?v=lKbLB_T-IjY

I've been watching that guy document China for many years now.

DeleteThanks for your comment. Taking a look at their videos tells us a great deal about China.

DeleteHere is another,

ReplyDeletehttps://www.youtube.com/watch?v=UPwtUTrwKRI