Inflation is generally viewed as a general increase in the prices of goods and services in an economy because of or coupled with a fall in the purchasing value of money. This is where the peanut gallery and purest generally go berserk and argue fiat currency is not money. The most common reason given for rising prices is that demand is stronger than supply. Still, a lot more factors feed into creating inflation than supply and demand making price stability more than a delicate balancing act.

The "inflation puzzle" is highly complex and includes a slew of related confounding variables. The role productivity and savings play in inflation are often overlooked. Most people, even many economists make the mistake of throwing spending into one big pile with little consideration to the fact not all spending is equal. Please note the following;

- The spending of government often is far different than that of the individual. Unproductive government spending tends to be inflationary.

- Inflation can stem from a growing lack of faith in a currency, or all currencies, rather than just a lack of available goods. Governments that waste and spend do not generate long-term confidence in their currency.

- As inflation takes root the goods available for sale often contract as sellers retreat from the market awaiting higher prices, this can be followed by workers then demanding higher wages which creates a self-feeding loop.

- Also, the velocity of money plays into inflation. When money moves faster it tends to increase demand. What many people fail to consider is why money moves rapidly through the economy or the reason it gets parked in one place.

- The ever-changing economic rules by which we play, include taxation and incentives for saving or not saving. Any "incentive" that steers money into intangible assets may feed the wealth effect but often dampens demand for the things we need that are included in the consumer price index. In short, it can lessen inflation but increase investments that may be risky.

What people spend their money on and where impacts inflation. So does whether they pay cash or charge the purchase and have to pay interest on the goods. When people buy American goods and invest in their community the money moves from business to business creating jobs. When people buy goods made in Asia from a company like Amazon, their money takes the fast track out of the country and weakens our country.

Productivity is another huge part of the inflation puzzle. An example of an institution that has not been able to adjust and stay relevant in our changing world is the United States Postal service. It is an example of poor spending on the part of our government and could not exist if it were not for continued financial infusions. Years ago the USPS delivered important materials and correspondence, today it delivers the junk mail that fills our landfills. The main reason the USPS exists today is to employ people. It employs not only carriers but those that build and maintain its vehicles as well as those that create and send the junk mail we hate to get.

|

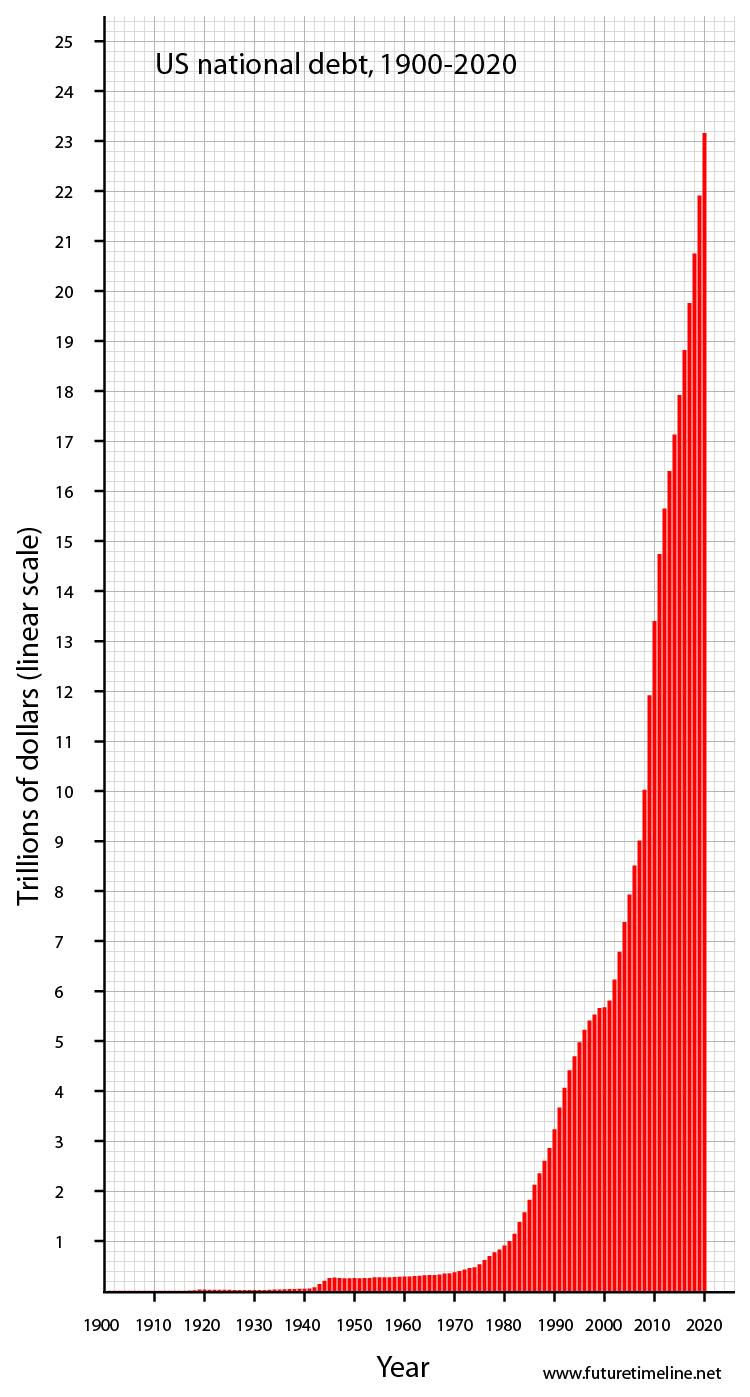

| Now Over 30 Trillion And growing |

It seems our government is out of control and simply cannot stop spending. With the Secretary of the Treasury having been the former head of the Fed, and the current Fed chairman both hellbent on spending to boost the economy, our government has embarked on an unsustainable spending spree. This has enabled the global financial system to do the same with few ramifications.

Circling back to the idea inflation is an orphan, this means when inflation hits the average consumer they yell out in pain. When that happens it seems none of the players that helped create the situation want to take credit for their actions. Inflation tends to hammer away at most people eroding their wealth. It acts as a stealth transferer of wealth moving it from the masses and into the hands of the few positioned to benefit

We should not forget what we were told by central bankers until recently. In late 2018 Jean-Claude Trichet, who served as President of the European Central Bank from 2003 to 2011, opined about his outlook for the global economy and monetary policy by repeating the line declaring 2% inflation the desirable goal of intelligent central bankers.

Yes, the central bankers were fast to tell us we needed some inflation and everything is "data-dependent." This translates into the idea central banks have the ability to, and will squash inflation if it begins to run too hot. Well, they better start squashing. The only other option is that we as a society get a great deal more productive or inflation is here to stay. With so many people choosing not to work or unable to find jobs that add substance to the economic pie, that is unlikely.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Agree with all your points. For me the cause of the price inflation we're experiencing is pretty simple:

ReplyDelete1. Fed govt. borrowed trillions and spent it badly during Covid - stimulus payments to millions who didn't need it, excessive unemployment supplement payments paid for far too long, billions in wasted PPP money, etc, etc.

2. Federal reserve keeping rates at zero for far too long, and then creating trillions of dollars and "loaning" them to the fed govt.

3. Covid pandemic caused massive supply disruptions due to layoffs, retirements, shutdowns, and lockdowns.

All this has created the perfect storm - too much money chasing too few goods, supply and demand, economics 101, but our dumb politicians don't understand any of this. Now we have fools in the administration who are exacerbating the problem by reducing the supply of energy and allowing millions of people to flood into the country, creating even more demand because every single one of them needs resources and competes with American citizens for them.

Lastly, with fewer workers and surging demand, workers are demanding higher wages which further worsens inflation, the old wage-price spiral.

The Federal Reserve is trapped because they know that if they raise interest rates too high it will cause a recession, but if they don't raise them high enough the price inflation won't go away.

We have the absolutely worst people in charge in govt. right now, which only makes things worse.

This ain't going to get better for quite some time I'm afraid, like for several years.

Thanks for your articles.

Well said Dave2020, it seems adding 7.5 trillion dollars to the national deficit may just have blown a big hole in the dike allowing inflation to pour forth. We should not be surprised if we see a lot more inflation in the coming years. I suspect we have entered a self-feeding loop.

DeleteMy comments on inefficiency of system (Govt. and Private partners) will solve nothing. It's better, instead of crying foul, I should focus more on benefiting from their incompetence. Things will remain and proceed as it is, It is us who need to change our attitude towards these inevitable problems.

ReplyDelete