|

| Many Countries Endorse A Single World Currency |

The idea the world would be better served with a single "World Currency" has been

growing and looms as a real possibility in the near future. Many people see this as a major part of the "endgame" or something that will

constitute a needed reset to a global economy and financial system that has gone off track.

Throughout history, before an economic collapse, the masses and

society tend to believe things are financially stable. Only after the economy

goes over the edge of an abyss and is in free-fall does reality set in. It is

not by accident that blinders have been placed upon us but it is the

result of distractions being thrown in our path by those wishing to hold

onto their power over us. It is wise to remember that when things do

become critical, those in power will not be kind to us but that we will

be thrown under the bus without a thought.

Over the last one hundred years, equity markets have been a primary tool

used by the public to measure the economy. In

some ways, the stock markets have become a kind of switch the elites can

push at any given time to energize the masses distracting them from the

dangers lurking in their economic future. When markets rise despite warnings from negative fiscal indicators, the masses become optimistic. During every upswing of

stocks the elites claim they see the "green shoots" of prosperity,

however, these shoots seem to always turn brown and die. We

have been leaping from one recession to another even though central

banks claim they now hold the key to generating true and honest growth. The

truth is the current stock market bolstered by easy money and stock

buybacks is a poor reflection of the real economy and what is happening

in many areas across a broad swath of the world.

History indicates that establishment economists trained and educated in

the ivory towers of academia are perhaps the most useless of all

analysts and perpetually wrong. Only independent analysts have ever been

able to predict anything of value when it comes to our economic future

and that is because they have the advantage of not being blinded by the

propaganda and brainwashed by lies flowing from those in control. Time

and time again it has been proven the appearance of prosperity means

nothing if the fundamentals do not support the optimism. A bullish stock

market, a high dollar index, and low unemployment mean nothing and are

unsustainable if generated by false methods and fiat money. We have seen time and time again throughout history that fundamentals matter.

The markets cannot hide from true price discovery forever.

The stock market with its boom and bust cycles has proven to be a false indicator of what is really unfolding. Manipulation

by the central banks has rendered this indicator of economic

health useless. The problem we face is the horrible options in fiat

money, massive debt, and the growth of international businesses have all

come together in an explosive way. The banking elites are positioning

themselves to avoid blame for this disaster while the rest of us are

being sold on the most elaborate recovery con-game ever conceived and

perpetuated by those with the most to gain.

|

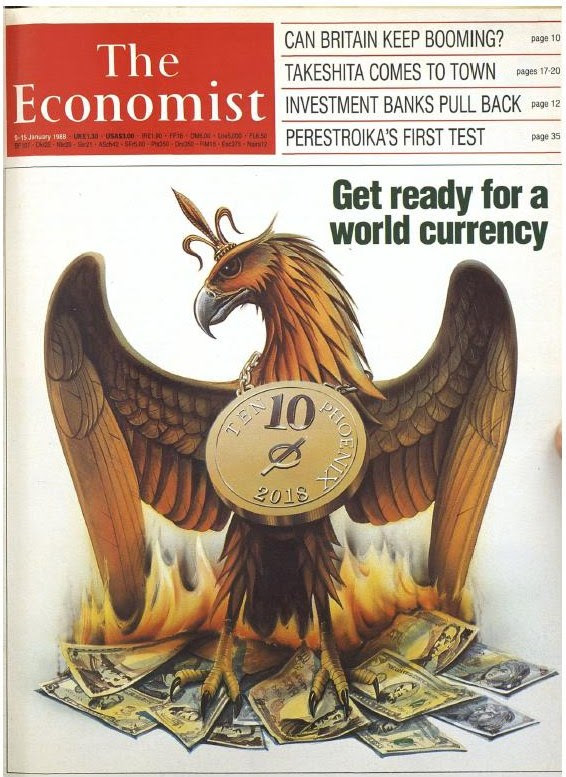

| Magazine Cover Touting World Currency |

Those in charge of our financial machinery have indicated to the public their desire for more power. This means creating a truly global centralized economic system and a highly controlled world currency framework dominated by a select cult of banking oligarchs. This would, in effect makes the rest of the human race their slaves.

Over the years, many articles have referred to a 1988 write-up in the financial magazine 'The Economist' titled “Get ready for a world currency by 2018.” It outlined the framework for a global currency system administered by the International Monetary Fund. This new system was and is floated on the premise that only by erasing all national economic sovereignty can true stability be obtained. It requires governments to borrow from the world central banking authority, rather than printing currency to finance their infrastructure programs.

This dovetails with efforts to create such a

system under the total control of the IMF which should raise the concern

of every American. We are hearing more warnings and witnessing a push to destabilize the dollar as the reserve

currency by China and several other countries. It is also occurring as Orwellian governments float the idea of going cashless as a way to gain further control over our lives.

For years the IMF has been openly discussing the ascension of the SDR

to replace the dollar as the world reserve currency. Many developing

nations that are deep in debt are already asking for help from the IMF

due to volatility across the world and the BRICS are pushing hard to

remove the dollar as the world reserve. This makes it a question of when

such a currency reset will occur and in its wake bury the majority of

the middle-class and poor throughout America. There is no way around it,

the elites are positioned and merely waiting for a geopolitical

disaster or catastrophe so overwhelming that when the time arrives they

can portray themselves as our saviors during the chaos.

|

| American Dollar Constitutes Bulk Of Reserves |

The demise of the dollar harkens back to when President Nixon severed

its tie to gold. First, it’s crucial to understand that at the very core

of our global economy is a financial system dominated by the U.S.

dollar which has been deemed the reserve currency. The USD is unique in

that it grants the U.S. the privilege of having a national currency

which at the same time serves as the global reserve currency. This was

solidified toward the end of World War II with the Bretton Woods

agreement, which was accepted because the U.S. agreed to offer sovereign

nations holding dollars a right to exchange these dollars for gold at a

fixed price, however, with Nixon's action in 1971, the USD became a fiat

currency backed by nothing, the supply of which can be arbitrarily

altered and manipulated by a group of unelected bureaucrats in charge of

the Federal Reserve. This money system represents the most powerful

tool on the planet.

The new world order and globalization pushed by many world leaders and the rich elite that tout "larger, more cooperative governments under one financial unit will benefit us all” feeds into the world currency scenario.

Many Americans are oblivious to the fact we gain a great deal by our

status of the dollar being the reserve currency by which all others tend

to be measured. This means we have a great deal to lose if it is

dethroned and stand to suffer the most if the dollar declines in value.

Those who will be crucified are the middle-class Americans whose wealth

is locked into or are holding long-term USD bonds thinking they are a safe investment.

Currently, a huge mismatch exists between the use of the dollar in the global financial system and the U.S. share of the world economy. This is why China,

Russia, and several other countries that are acutely aware of this have

been taking major steps to transition to a more multi-polar currency

world. This is also why we should prepare and expect that in coming

years the world will adopt a completely different global

financial system from the one chaotically birthed in the 1970s and when

this occurs the USD will lose its total dominance on the world stage,

resulting in major implications for America. While many people see this

coming, several opinions exist as to how it will unfold and while we

engage in speculation, nobody really knows what the world financial

system will look like ten or twenty years down the road.

Few of us who continue to cherish freedom can get excited about

transitioning away from the USD and being placed under the thumb of the

IMF or an oppressive nation-state currency controlled by a country like

China. That is why many of us think the dollar will be ripped

from us during a time of crisis when Americans are open to accepting any

solution offered to them as a way to ease their woes. While people

point to cryptocurrencies as an option we should remember politics plays

a massive role in how this all unfolds. To Americans, the fate of dollar-dominated assets and their value when the dust finally settles should be a huge concern but most Americans fail to grasp the implications.

It is my contention the transition to a world currency will take a far greater toll on paper assets than tangible goods. While recognizing the flaws of the dollar and our current system I have come to believe the other fiat currencies such as the euro and yen hold even less merit. This includes cryptocurrencies such as bitcoin. Regardless, in the end, we should expect to be told and not given an option as to what is coming. If events unfold in the way those promoting a one-world currency have planned it will be a dagger in the heart of freedom.

Another excellent article! You have the knowledge and mental clarity to see through the hype and deliver a balanced message.

ReplyDeleteHow could we politically ensure that the super rich take the losses rather than the barely solvent middle class? Can thousands of local currencies be initiated and traded while simply not using the mandated "new" currency? I have been fearful of a 10:1 currency reset that impoverishes the wide swath of the middle class and the slightly well off and leaves the rich with one less zero on their bank balance..Without some rapid political organizing we will have to accept whatever "solution" is meted out.

ReplyDeleteTheir Plandemic, engineered for exactly the purpose you describe has backfired in their face already. Thereby awakening the masses faster than anything else could have. Then there is the Euro Abortion as obvious proof of the utter failure of common currency if that were not enough. So while we should be vigilant this all smacks of ill conceived desperation destined to spawn several alternative "black" currency (even honest money) systems impossible to adequately control on a world scale. The US election will also prove useful in disillusioning people to more control, and if Trump (please) succeeds I am hopeful he will not wear it.

ReplyDeleteNo lefties were harmed while writing this...

glad that Trump lost

DeleteBut more importantly, are you glad Biden won? This may be a case of, "be careful what you wish for."

DeleteI've been reading gloom and doom stories about the collapsing dollar and/or loss of reserve currency status, for 15 years now. Look at the UK- they still have their pound sterling and they're not starving. The Swiss still have their francs, the Canadians and Australians have their dollar, and they're getting by OK. The fact is that almost every govt. on this planet has an extreme amount of debt that it will never repay. The central banks do their bidding and keep rates near zero or even negative to bail out these govts. They will keep printing money forever to keep the scam going, thereby causing constant price inflation. The middle class will never get ahead as prices will always rise just a bit faster than wages. Barring some truly deadly global pandemic that kills hundreds of millions, an asteroid impact, or a major war, things will not collapse. Our economic future is this: very little growth with 3-5% annual price inflation - a mild form of stagflation.

ReplyDeleteDave2020, Thanks for the comment. Please don't consider this a "gloom and doom" story. Consider it a warning of where the globalist wish to take us.

ReplyDeleteWhen I started dental school in 1979 I purchased a 25" Zenith TV for $495. I bought my 42" Vizio for $295. I bought my 3 children Honda Civics at graduation: 2008-$17,000(manual), 2010-$19,000(auto), 2019-$19,500. My house is worth twice as much. Inflation(winter) is coming, we are lucky it hasn't been a tsunami.

ReplyDeleteIn 1969 I wrote a term paper in high school on Problems in the International Monetary System. The French wanted gold for their dollars and I was curious about what the problem was. What a rabbit hole I have fallen in to. I was unable to make sense of Keynes "bancor" and the new reserve currency called an SDR. It was like pretend money....

But it hasn't mattered. Nobody cares what money is. The Aladdin's lamp of monetary largesse is held by the Fed and I guess in extremis they will lose the concession. How useful to have a money tree--how sad we will be when Tinkerbell dies. Keep clapping everyone.

The writing is on the wall. One can never be wrong to move out of paper assets to precious metals, working farm land and livestocks.

ReplyDelete