China's strength must be questioned by people without an agenda if we truly wish to understand the world. In the same way, the strength of the Soviet Union was overestimated before its fall in December of 1991 or the Japanese economy from 1986 to 1991, today people tend to exaggerate the strength of China. When Japan's massive bubble burst in early 1992, its real estate and stock market prices crashed causing the "lost decades" and the problems that still haunt them today. It seems Americans tend to supersize anything they can conjure up as a challenge to their supremacy. This is evident in the number of confidence crushing-articles being published with titles such as "The US Keeps Losing In Every Simulated War-Game Against China."

“in the night, imagining some fear, How easy is a bush supposed a bear!” ― William Shakespeare, A Midsummer Night's …

The world's economy has many moving parts, it exists in a fog which makes it difficult to evaluate what is unfolding. Intertwined with the economy is the financial system, which is vast and complex, and broken political systems. This makes it difficult to get a handle on how strong various parts of these systems are, to make matters worse, these systems are held hostage by propaganda machines operating on political agendas that are constantly changing. Much of this is operated by people lurking in the shadows. When all is said and done it would be wise not to believe much of what you read, hear and even see. A few years back, many people marked China's economy as surpassing that of America, but oddly enough, America is still rated as number one.

|

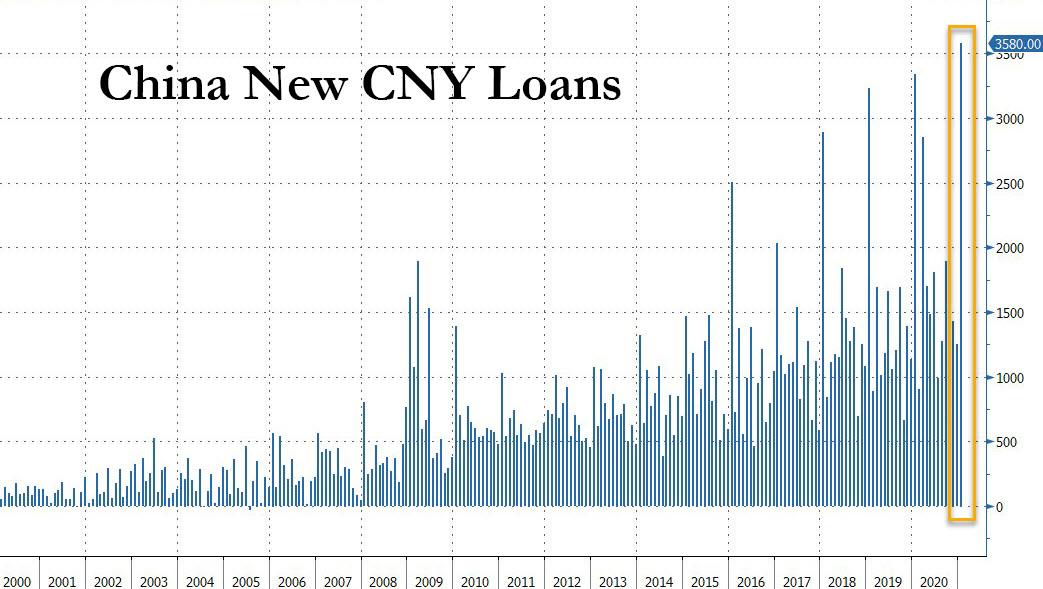

| China Has Created A Record Amount Of New Loans |

China has long been strategically positioning itself to fight what could be viewed as a war to displace America as the world's leading nation. Deeply rooted in its efforts are a number of individuals that stand to profit in the short-term. For this reason, it would be fair to consider China as a far greater threat to America than Russia, however, China does have some major problems.

While China continues to tell the world that it is taking

steps to deleverage its indebted financial system, in January, China created a staggering, record 3.58 trillion in new yuan loans. This surpasses the previous record of 3.340 trillion

set just before the Chinese economy shut down due to covid-19. It could be argued that only gargantuan credit injections have prevented a total economic

collapse in the world's second-largest economy and only

ever greater credit injections are keeping China alive. This underlines the fact that size should never be interpreted as strength.

Guo Shuqing, chairman of the China Banking and Insurance Regulatory

Commission and central bank party secretary, has pointed out that bubbles in U.S.

and European markets could burst because their rallies are heading in

the opposite direction of their underlying economies. This could have been said to divert eyes from China's own

massive financial bubble. By all indications, China's financial system stands at more than twice the size of that in the U.S. This could be why the CBIRC recently capped bank lending

to the property market, slashed shadow banking activities, and unwound a wild expansion in peer-to-peer lending.

|

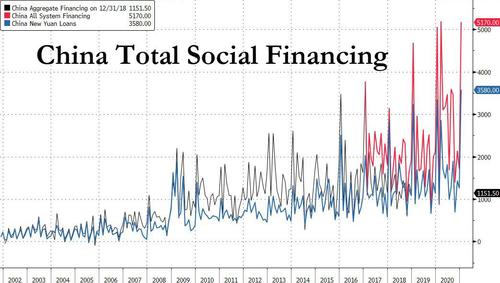

| Money Continues To Be Injected Into Its System |

Of course, it isn't just China's new loans we should be looking at. The broadest Chinese credit aggregate, "Total Social Financing" which includes new loans as well as shadow debt creation and bond issuance has also exploded. Not long ago, a monstrous 5.170 trillion yuan or roughly $800 billion was injected into China's economy in just one month.

Weeks ago, Economist, Daniel Lacalle noted in a video that much of the bullish talk about 2021 is linked to a recovery in China which is supported by very optimistic estimates of growth in services and exports. Lacalle then goes on to point out the details in the official February Purchasing Managers’ Index (PMI) show a different picture. The data coming out, especially in services and exports, is inconsistent with the 6% GDP growth most analysts expect for 2021.

One of the takeaways from the recent annual National People’s Congress in Beijing is a conservative growth goal, with tighter fiscal-deficit targets and restrained monetary settings. That’s a big contrast with Washington, where President Joe Biden is already preparing another major fiscal package after just signing into law his giant $1.9 trillion relief package. The Chinese and all export geared nations are most likely giddy at the prospect of American consumers about to buy the products they manufacture and the boost it will bring to their economy.

Other issues cloud this complicated picture, these include such things as the strength of a country's political structure, institutions, money flows, the quality of its underlying assets. Also, how dependent its economy is upon other nations. These feed into the idea of resilience when put under pressure. Money flows have become massively important in our modern where huge amounts of wealth can flow across porous borders and flee a country in the blink of an eye. This is where corruption, a free press, and a strong legal system show how important they are in our lives.

It is difficult to ignore that both China and Japan for years have been busy supporting zombie companies and not allowing them to fail in an effort to convince the world all is well. These countries are strongly linked and both very big players in the global economy, their unsustainable path forward, means if either falters, the other will be pressured. A case could be made that artificially low-interest rates in Europe and America are also allowing companies in those regions to remain standing long after they should cease to exist. China also is rapidly losing its edge as a low-cost producer.

Many foreign companies that once relied on China’s cheap labor to produce their goods have moved their factories to Southeast Asian countries such as Vietnam, Bangladesh, and India, where operating costs are lower. While claims that higher U.S. productivity and rising operating costs in China will close the cost gap between manufacturing in China versus the United States the idea American firms will bring jobs back to America are far too optimistic. Even if major multinationals like Nike Inc., Adidas AG, Nikon Corp., and Microsoft Corp. have closed down their Chinese factories due to rising costs, America is not where these factories and jobs are going. Many are slated to move to countries linked to China by its OROB.

In an effort to keep this article from growing too lengthy, I will immediately address a few other key points. One is about how rapidly expanding credit in China is spilling over into the global market and driving up the price of assets and commodities. Another has to do with human rights and how for decades China has been pushing its people towards a more "homogeneous way of thinking."This includes totalitarian efforts to make its people march in line. The ruling Communist Party in China has built "re-education camps" in an attempt to bring these people into the “modern, civilized” world promote what the government calls “ethnic unity.”

In simpler terms, the apparent goal is to force detainees to embrace the Chinese communist party and an effort to fully control the hearts and minds of its population. Whether what could be called "group think" strengthens or weakens a country is up for debate. Understanding the core nature of China is important to comprehend the lack of flexibility ingrained in their system. This comes in the ideology that directs its actions. China is still very much a communist country, and the Chinese Communist Party (CCP) controls everything. From indoctrinating children with Party slogans to requiring companies with more than 50 employees to have Party liaisons, the military and other areas of the country have similar programs.

|

| China Is Building A Slew Of Cutting-Edge Weaponry |

China has no intention of being locked into producing low-end manufacturing of basic goods but is determined to move into high-tech products. China's plan centers around both state-owned and private firms investing in and acquiring foreign companies to steal their technological innovations. Subsidizing those companies working within its system in a multitude of ways helps China achieve this goal. Countries that export goods at slightly below cost in exchange for manufacturing jobs are not stupid they are predatory and America and the rest of the world are their prey.

Footnote; The articles below also explore modern China.

https://brucewilds.blogspot.com/2020/09/chinas-rapidly-expanding-credit-affects.html https://brucewilds.blogspot.com/2020/11/china-has-plan-and-we-are-not-in-it.html https://brucewilds.blogspot.com/2020/01/chinas-cultural-group-think-is-worth.html

"...From indoctrinating children with Party slogans to requiring companies with more than 50 employees to have Party liaisons"...

ReplyDeleteI prefer my child be indoctrinated with ethnocentric incantations rather than be subjected to anti-white rhetoric....

One interesting current Chinese initiative is to stop the "sissification" of the country by encouraging male role models. This is better than the constant denigration of masculinity which has come to prevail here in the West.

China has still a long way to go before its GDP per capita equals that of USA (as of 2019.... 10,261.68 USD compared with 65,297.52 USD)and indeed, as the author points out, might never get there. But, i am so glad that a counter-weight to the US exists.

While they certainly face their challenges, I agree with the previous commenter that there are some advantages to creating a cohesive national narrative. If only we can create the right multi-polar narrative and bring it into being, a bit of healthy competition in trade and production could reverse many of the woes that we currently face.

ReplyDeleteEspecially thinking about agroforestry upgrades to the current monoculture ag systems, I think that drones and robo-dogs are going to be used a lot more - there is a lot of potential improvements to think about!

I agree entirely with the author's truthful description of what China (it's ruling omnipotent party) is, does and doesn't.

ReplyDeleteThe two commenters prior to me are at least borderline pro-China propagandists, adding to deceptions/misconceptions actively promoted from "the top" (the non-democratic CCP).

At and from this time in history, ALL countries benefit from ABANDONING all kinds of engagement with non-democratic "forces", and sooner or later suffers from not doing so - China INCLUDED!