During an amazing, almost two-hour video interview, Green shares his macro view of the economy, inflation, markets, and the dynamics of today's equity and fixed income markets. In the video titled; The Un-Consensus on Today's Macro & Inflation, Green claims the base effects driving inflation are becoming more challenging and will not allow for it to remain elevated. He also shares his view of how stock markets have become less efficient and more 'inelastic' due to the proliferation of passive index investing, and where that might lead.

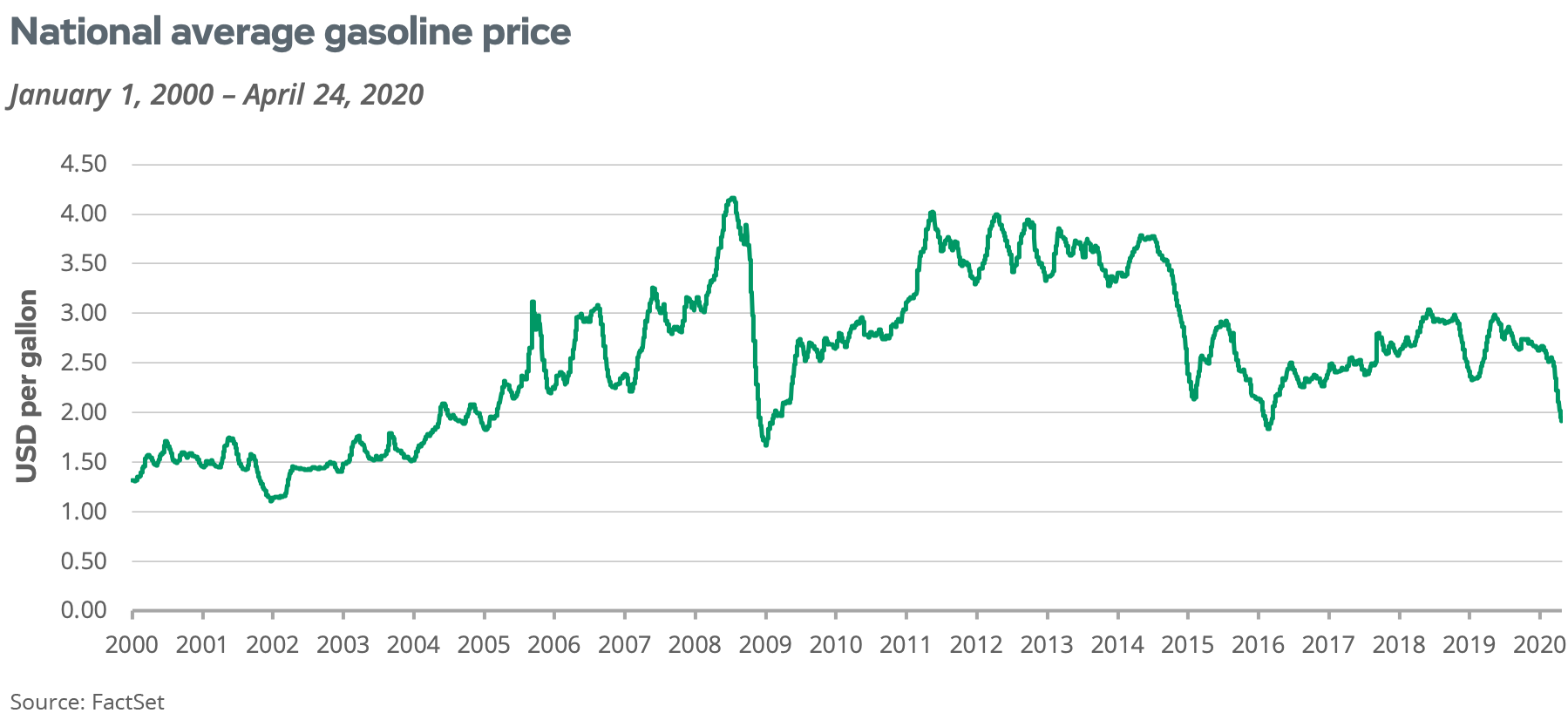

While price is said to be located at the intersection of supply and demand, manipulation and interventions have muddied this picture. Green keys in on the fact that price shocks and distortions have a way of working through the system, when prices rise in the capitalist system, we generally see an increase in the supply of that commodity or service. He also points to the strong role demographics play in the economy. It is important to remember while price hikes can appear inflationary they are not a big issue if they last only a short time. The price of gas from 2000 until today is an example of how wildly prices can swing. In short, if prices do not stay elevated or continue to climb, they do not add to inflation.

|

| We Have Witnessed Wild Price Swings In Gas Prices Over The Years |

In my mind, what happens to the value of the dollar

and the three other major fiat currencies remains the wild card. As of

yet, their fate is still up in the air. Fiat currencies have the potential to play a much larger part in the "end game" than most people imagine. A shift in preferred consumption or investment choices matter and how

people react if and when they lose faith in fiat currencies is a major

deal. The order in which currencies fail is also important, being the last to fail will yield huge benefits to those that hold it.

One place where I strongly agree with Green occurs about 126.15 minutes into the conversation. This is where he paints the case a stock or the market could suddenly fall like a stone. He does an excellent job of questioning the notion of the "efficient market" hypotenuses. Price insensitive buying and selling has destroyed true price discovery. Of particular concern is the area of passive investments. The distortions we are witnessing today are explained by some of his thoughts on this subject.

|

| Uncharted Territory Equals Danger |

When all is said and done, Green and I agree on several important issues. Baby boomers lulled into thinking that current trends will continue are taking on massive end-of-life risks. While young traders may have time to build a new nest egg for retirement the older generation does not have such a luxury. While I disagree with some of Green's conclusions, overall I give him a thumbs up for his video and many of the points he raises.

Below is the link to Green's YouTube video; https://www.youtube.com/watch?v=WqZ9Ii_F7a0

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

There are so many 'confounding variables' on what can cause inflation in an incredibly 'more macro-' global economic system than it was in the 1970's stagflation episode, that you may as well try to guess which room the carbon dioxide from a particular exhalation of your breath will end up in.

ReplyDeleteToo many manipulations/ interferences and random variables to reach a definitive conclusion.

I would put energy (fossil fuels)- the entity that enabled this incredibly intertwined financial complexity to exist - as a crucial aspect.

And as the cost of the supply of this energy increases, prices will increase, and perhaps de-growth will be forced(it is highly unlikely to ever be voluntarily accepted) by de-complexification and de-layering... big,big changes are on the way and the 'entitlements and expectations' of many will be SEVERELY challenged

Thanks for the comment. The, as you called them, many 'confounding variables' do indeed make the future difficult to predict and increase the risks before us.

DeleteAGREE. both with complexity (why didn't consumer price inflation really take off till now? I don't buy the pat 'direct subsidies made all the difference; argument - what exactly were the deflationary winds preventing this from expanding sooner?)

Deleteand with a possible large portion of the answer lying in energy. bravo.

Four other things have helped keep inflation in check until now other than increased oil production due to fracking. First improvements in production that lowered unit cost, this was seen mostly in imported goods. People are willing to invest in intangible goods rather than hard assets. Lower interest rates have also played into this. Last but not least, there is a 'lag time' between inflation and increased government spending.

DeleteFor an idea of how government debt feeds into the economy see the video listed below. It is a piece by Professor Antony Davies where he explains 10 myths or many misunderstandings about Government Debt.

ReplyDeletehttps://www.youtube.com/watch?v=EPjrFjAxwlw

i enjoyed this.

ReplyDeleteit was shared as a comment on ZH.

The graphs used by Antony Davies- Milton Friedman Distinguished Fellow at the Foundation for Economic Education- epitomise the simplistic, cherry-picked,strictly controlled parameters, childlike analyses, that reminds me of the the egregious, possibly criminal, abuse of graphs and statistics and 'data' during this whole sorry SARS-CoV-2 escapade.

ReplyDelete'10 myths Libertarians have reason to propagate' would be a more apt title.

I like interviews with Mike Green. That was excellent. I am from the camp that nobody can predict the future but if he just half right there will be a lot of people screwed.

ReplyDelete