Recently the yen has been falling in value and this is gaining the attention of currency watchers. The moment the Japanese stock market

fails to rise enough to offset a falling yen and inflation this will turn into a

tsunami of money fleeing Japan and constitute the end of the line

for those left holding both Japanese government bonds and the yen. In July of 2020, an AdvancingTime article claimed the predictions of the dollar's demise are likely premature and overblown.

I contend that for several years currencies

have been trading in a hyper-manipulated state. It should be noted that

fiat money is often sheltered from the storm of volatility by both

politics and because it exists in a rather closed

system.

Wealth is contained within the system of fiat money by laws and

rules that discourage freedom of movement. The coordinated

collusion of the major central banks have allowed this charade too

exist for far to long. The fact it has not been recognized or acknowledged does not alter or guarantee the system will continue. The failure or major repricing of any of the world's four major

reserve currencies will destroy the myth that major currencies are

immune to the fate that has haunted fiat money throughout

history. When the nations granting these currencies prove unable to

control their budgets history shows their currency is destroyed and crushed under the weight

of debt.

The reason central banks have played this game is because the one thing the global economy doesn't need with all the uncertainty that

is currently floating around is unstable currency markets. When you

consider just how destabilizing currency swings can be it is easy to see

how a strong dollar could obliterate the global economy.

Over the years countries have become

very adept at coordinating economic policy, currency swaps are only one of the

tools they use, this has now even extended to investing in stocks.

When the dollar began to soar back in late 2014, fear began to rise and

concerns grew about the stress it was causing in

countries that owed a great deal of debt that would have to be paid back

in dollars rather than their own currency. This caused Fed Chairman

Powell to attempt to navigate a course that doesn't cause the dollar to

strengthen and devastate emerging markets. By doing so the Fed has created a situation that allows the dollar to be used as a global prop.

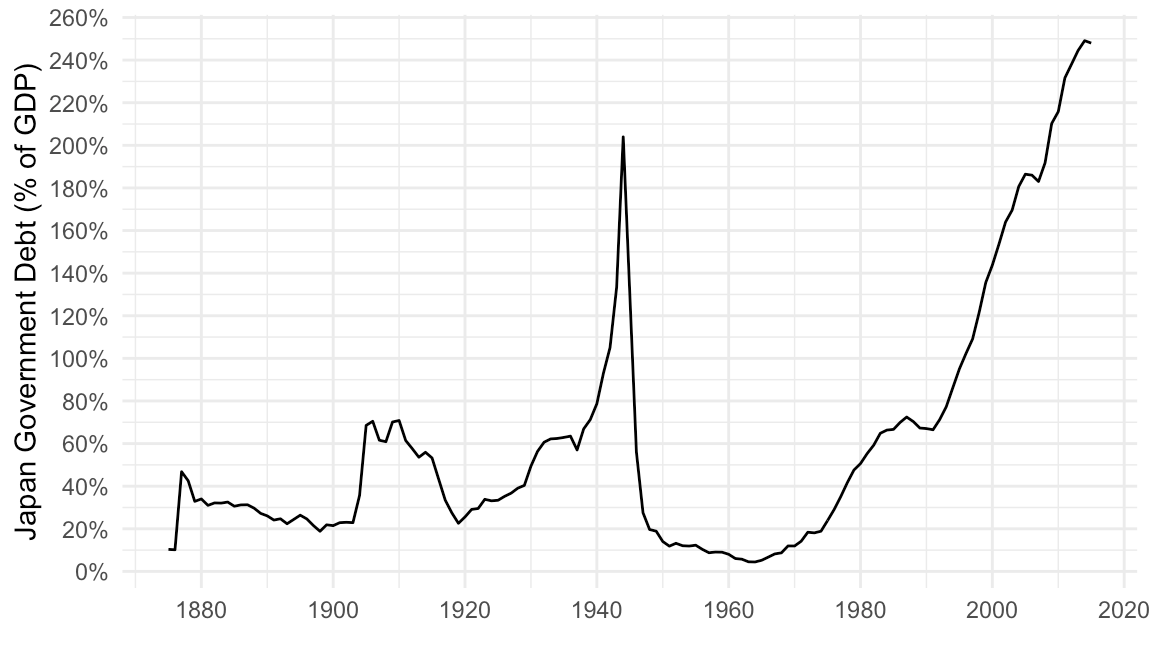

For years, many of us have been astounded by the Japanese yen's failure to fail. To consider the Japanese yen a "safe haven" currency flies in the

face of reason. For years many economists have looked at Japan's economic

path and predicted an economic crisis brought on by the growing debt of

its government. The myth promoted by the central banks that a major

currency cannot fail is accepted as fact by many people however, the

rapid demise of either the yen or the euro is all that will be needed to

reveal the truth and remind people everywhere that our system of fiat

money is held together only by faith in the system and a prayer.

In mid 2016, another AdvancingTime article dove into the subject of how over recent decades because of its size in the global economy the

current Bank of Japan policy has

quietly and systematically distorted financial markets across the

planet. With super-low interest rates, it has become a key player in the

carry trade. In recent years investors and the mega-banks have

drastically

reduced their Japan Government Bond (JGB) holdings.

|

| 2016 Chart Of Japan's Huge Debt - Click For Larger Chart |

Much of the

risk of who gets hurt in the case of a falling yen or a default has shifted from the

private sector to the Japanese public since the BOJ has continued splurging on JGBs. As Japan continues down this path it is only a

matter of time before the credibility

of the BOJ is lost and the yen plunges. For a long time I along with

many economists have taken a dim view of

the yen and its value in coming years, however, the timing as to when it will

succumb to economic reality has been interfered with due to how it is

insulated and intertwined in world markets.

Demographics paint a bleak picture going forward because Japan is stuck with an aging and shrinking population that is increasingly expensive for the government to provide for. Adding to its woes the Fukushima nuclear disaster shuttered its nuclear power plants and forced the country to import more expensive energy alternatives. All in all neither monetary nor fiscal policy will adequately solve Japan's problems. Continuing to run fiscal deficits only means that government debt is pushed onward and upwards. Simply put, the fundamentals for Japan are lousy.

Demographics paint a bleak picture going forward because Japan is stuck with an aging and shrinking population that is increasingly expensive for the government to provide for. Adding to its woes the Fukushima nuclear disaster shuttered its nuclear power plants and forced the country to import more expensive energy alternatives. All in all neither monetary nor fiscal policy will adequately solve Japan's problems. Continuing to run fiscal deficits only means that government debt is pushed onward and upwards. Simply put, the fundamentals for Japan are lousy.

It should be noted that Japan would be sitting in far worse shape if it were not for the wealth currently shifted from America to the small island nation each year. America spends billions each year defending Japan and puts much of this money directly into the economy. Another way America supports Japan is by purchasing many of the goods the country produces. The massive trade deficit America has with Japan feeds large amounts of money into Japan, without this money, massively indebted Japan would be in even more trouble.

For years it has been noted that a key strength that Japan holds is its ability to control its own economic fate and that it cannot be held hostage to foreigners because the people and institutions of Japan hold its debt. In the past we have seen outside creditors can wield a great deal of sway over a nation that is deeply in debt. Another source of its strength is rooted in the fact Japan has strong economic ties with China, the yen has even been used as a conduit to move wealth out of China.

Unlike many other leading economies, Japan has been battling deflation or falling prices for the best part of the past two decades. At some point expect this to change as reality takes hold. To support their stock market the BOJ has even gone to buying stock. When investors in Japan's government bonds begin to believe that inflation is about to return it would be logical for owners of JGBs to move out of low-yielding securities and buy foreign bonds or equities. This has been a long time coming and I contend the slow cross-border flow of money and wealth leaving Japan is why some other stock markets have remained so resilient in our slow global economy. When Japan crumbles it will be felt across the world and add to doubts about the whole fiat currency system.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

No comments:

Post a Comment