With every pop upward in the markets, many of us are forced to ask

ourselves, am I too negative and bearish? After a bit of soul searching

logic seems to indicate we are simply being

realistic. There is a reason to be concerned. The sharp stock market rallies we have had are mostly a result of bears with tight stops creating a panic short-covering frenzy when anyone comes in buying. Still, it is an important thing to remember that many of our problems remain hidden below the surface of everyday finance.

|

| Yes, What Is Below The Surface Matters |

Those of us that are

convinced this economy is at the end of its rope and the financial

system is coming apart have been using negative words for a long time. Just

a week ago I heard the top 10 mega-cap stocks make up more than 31% of

the total S&P 500 stock index. If this is true, and I suspect little has

changed. It could be argued that we will need a totally new view of the

market's structure before things will change.

Money continually flows into the stock market

because if it sits on the sidelines or in the bank. inflation

nibbles away at its buying power. This has made the current market system appear more resilient than it is. The problem is that when you eliminate true price

discovery from a market, words such as

bogus, manipulated, and rigged begin to appear. Still, every time it appears the

final knife is about to be thrust into the heart of this market, we see a rally occur that encourages bulls to rush

in and buy the dip.

|

| World's largest Cruise Ship Set To Be Cut Apart |

Considering all that is going on across the world, it seems odd so many people are already asking whether the bottom has

been put in and markets are about to resume an upward path. We can blame this on the lies and economic wisdom that is presented by mass media. Their narrative conveniently forgets that consumers appear to be entering a time of protracted

weakness. This is becoming clear as total consumer credit continues to rise. Data shows it just rose $32.2 billion, well above last month's $26 billion. Meaning, total revolving consumer credit is making new all-time highs at just

over $1.15 trillion at the same time credit card APRs move ever higher.

It is pie in the sky thinking to take the position wages will move up while prices return to normal and all is well. Insane amounts of new debt and wild government spending have brought us to the place where we are now talking about trillions of dollars rather than billions. The idea we can simply bail out every failed pension and enterprise to make everyone whole is problematic. Unfortunately, lurking just below the surface are far more of these troubling situations than most people are willing to admit.

|

| This Is An Indication Of Problems Ahead |

Each of the questions above gives me a reason to be negative. At

the same time as bubble assets deflate, prices of goods and services

may have started an inflationary cycle of a magnitude that the world has never experienced before. While inflation has been a problem in individual countries in the past, what we are seeing today is occurring on a global scale. Please don't throw this article into the doom porn basket but take the time to think about what is lurking below the surface of our financial system unless you can't handle the truth. That truth is staring at you below.

|

| This Image Screams An Ugly Truth |

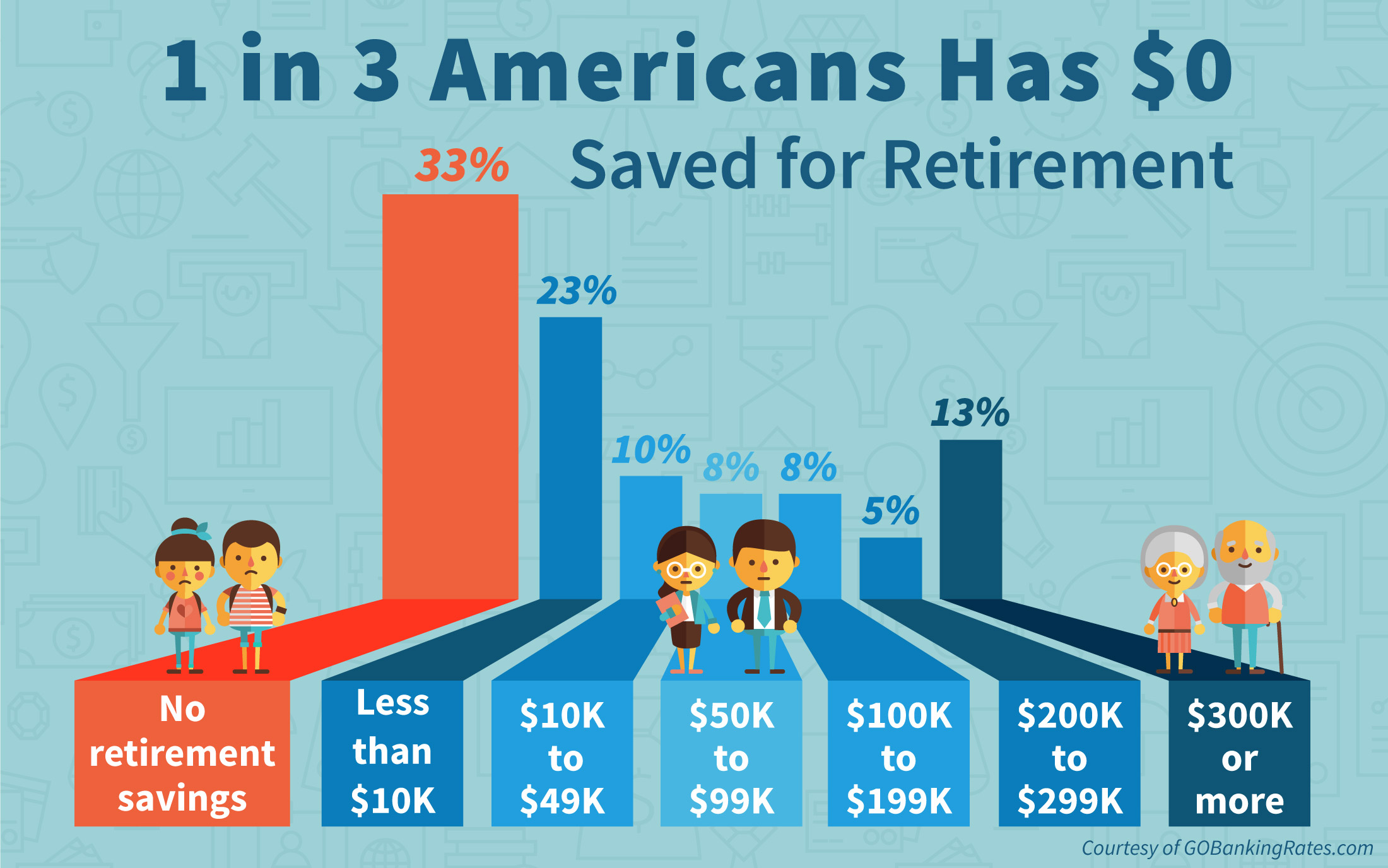

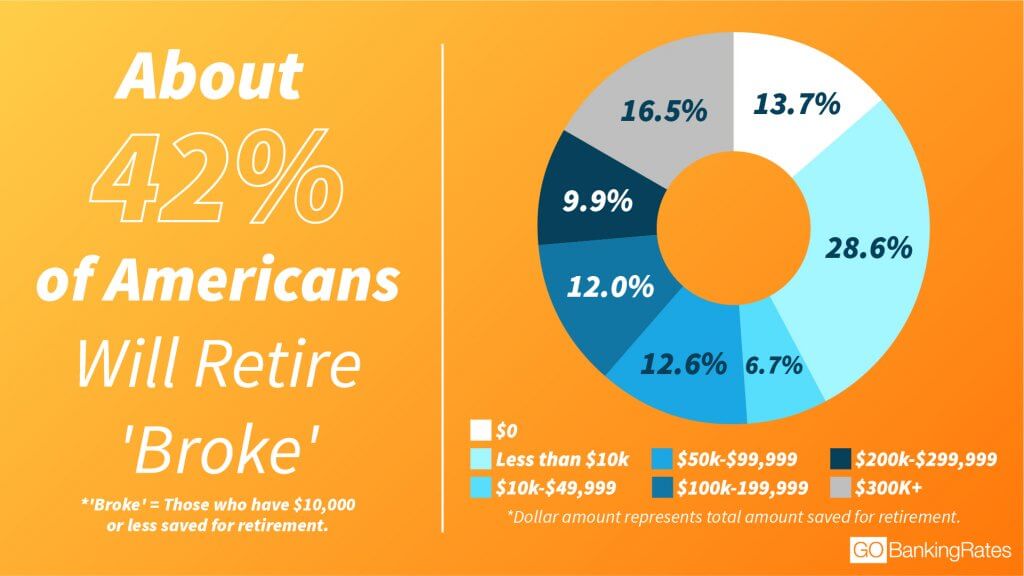

As pointed out above, the data we are seeing indicates retail sales are increasingly being funded by soaring credit card debt. This is a sign that consumers are struggling to maintain their standard of living. This is the reality we must face. When people retire poor society becomes their backstop and will find it has to carry them on its back. The national debt of the United States just passed 31 trillion dollars. The growing burden of providing for those in poverty bodes poorly for the national deficit going forward.

In the first minute of a just-released video about the economy, Jeremy Grantham carves away the illusion the underpinnings of this market are strong. ( https://www.youtube.com/watch?v=h07nuoflQMU ) There are so many holes in our financial system that it is only being held up by air. Don't expect things to suddenly improve. What lurks below the surface of our financial system is a reason for concern and indicates our troubles have just begun. We ain't seen nothing yet.

| Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog |

The Western world is no longer what it appears to be, with US as superpower looking after us all.

ReplyDeleteThe BRIICS and their growing influence in the Global South are creating a new power epicentre characterised by over 50% of the worlds population (West 15%), many with low/no debt and trade surpluses, producing most manufactures and commodities the West needs.

US sanctions and poor US foreign policy choices over many years are driving this epicentre away from US influence.

What we in the West feel is wrong is that US hegemony and Western standard of living is rapidly failing in a world where we have to pay real money or gold for commodities or consumables, not printed money backed by debt and deficits.

Worse, our Western media have not recognised this acelerating shift, and are still trying to convince us it is all not happening.

Andy, thanks for the comment, its to hear from you. I also think America's influence in many countries is being replaced by China coming in and offering to work with governments on improving infrastructure. This is a major component of China's One Road One Belt project.

Deletejust when it looks like all the woke folk on the same side of the boat that won't float in their moat, the Bernak is awarded an eCONomic prize, lol.

ReplyDeleteWe're in for MMT from the Magic Money Tree before this baby burns!

Pray for the best, Prepare for the worst

Expect either sooner verses later...