The Biden Tuition Forgiveness Program should be considered a lie at least until it comes to fruition. The possibility it will never occur remains a solid possibility. While the White House and Democrats have had lots of time to craft the legislation this does not mean it has been done well, it may be full of holes. Granting such a gift to garner political favor is clearly an egregious overreach of power.

Consider the possibility that President Biden is stretching the truth a bit in order to stimulate his party's base. It also allows him to claim he has fulfilled another of the promises he made during the campaign. A recent poll suggests that many Americas are not thrilled with this so-called forgiveness program for a slew of reasons. First and foremost, it is simply unfair.

The student loan forgiveness plan announced on Aug. 24 would eliminate up to $10,000 of federal debt for most borrowers and up to $20,000 for Pell Grant recipients. Following the announcement, Biden indicated that 95% of borrowers, or some 43 million people would benefit from his debt relief plan. Nearly 45% of borrowers, or almost 20 million people, would have their debt fully canceled

Determining who

benefits most from student loan forgiveness, the poor, middle class or

wealthy may sound like a straightforward exercise, but it is not. Data

peculiarities and future financial benefits that would

disproportionately accrue to certain borrowers make an exact accounting

nearly impossible. The relief is also

limited to those who make less than $125,000 per year, or married couples or heads of households earning less than $250,000.

In breaking down the distribution of total dollars forgiven by three income groups the White House shows that 87% of the money would go to those earning less than $75,000 a year. None would flow to individuals earning more than $125,000. Leveraging this data, Biden said the plan would target poor and middle-class people or in his words, the "families who need it the most. Not only does the policy set an income cap for forgiveness, recipients of Pell Grants, a type of financial aid for lower-income families, qualify for double the maximum relief, or $20,000, relative to other borrowers.

The White House's decision to measure income per individual, rather than at the household level skews the data. If each spouse in a married couple earns $70,000 a year, they would have $140,000 of joint household income but would count among the group earning below $75,000 in the White House income analysis. The JPMorgan Chase Institute, in a separate study, found that a smaller share, or around 51% of total debt forgiveness would flow to the bottom 60% of households that earn below $76,000 a year.

It is impossible to be sure about which income groups will get what share of the benefits. Analysts are busy using different data sets that yield different results. Flowing back into the fairness issue is the fact that parents that put themselves into hock to put their children through college get nothing. The same can be said for the millions of people that have worked hard to pay off their student loans.

Also, consider

that the government issued Pell Grants to

students based on parents' income; as long as a borrower's income is

less than $125,000, they'd qualify for the Pell Grant forgiveness

"bonus" based on their parents' lower incomes from years prior. In

short, this general lack of fairness coupled with the idea society is

rewarding those breaking their promise to pay back loans does not set

well with taxpayers that may be forced to pick up the tab, this includes

a lot of Democrats.

A legal challenge to the Biden plan could go on for a long time throwing the fate of these loans into limbo for the foreseeable future. Do not be surprised if this issue finds its way to the Supreme Court. No lawsuit has been filed yet, but Brnovich admitted that waiting too long could create problems. “People’s expectations are starting to get set,” Brnovich said. “And I think that means that if we can file a lawsuit, we should file it sooner rather than later.”

While White House spokesman, Abdullah Hasan, is busy accusing the GOP of double standards that will punish the middle class. The Biden administration has released a 25-page memo by the U.S. Department of Justice making the case that canceling this debt is “appropriate” under the Heroes Act of 2003. That law was passed after the Sept. 11, 2001, terrorist attacks. It permitted the executive branch to forgive student loans during national emergencies. The Trump administration declared the Covid-19 pandemic a national emergency in March 2020, apparently, it never ended.

Those trying to block this program will likely argue that the Heroes Act doesn’t give the president the power to forgive student debt in the broad way he is trying to. Another issue for those bringing a legal challenge against Biden’s plan will be finding a suitable plaintiff. Someone has to make the case that student loan forgiveness causes them “personal injury,” and that may not be easy. This injury is needed to establish what courts call ‘standing.’ No individual or business or state is demonstrably injured the way private lenders would have been if their loans to students had been canceled.

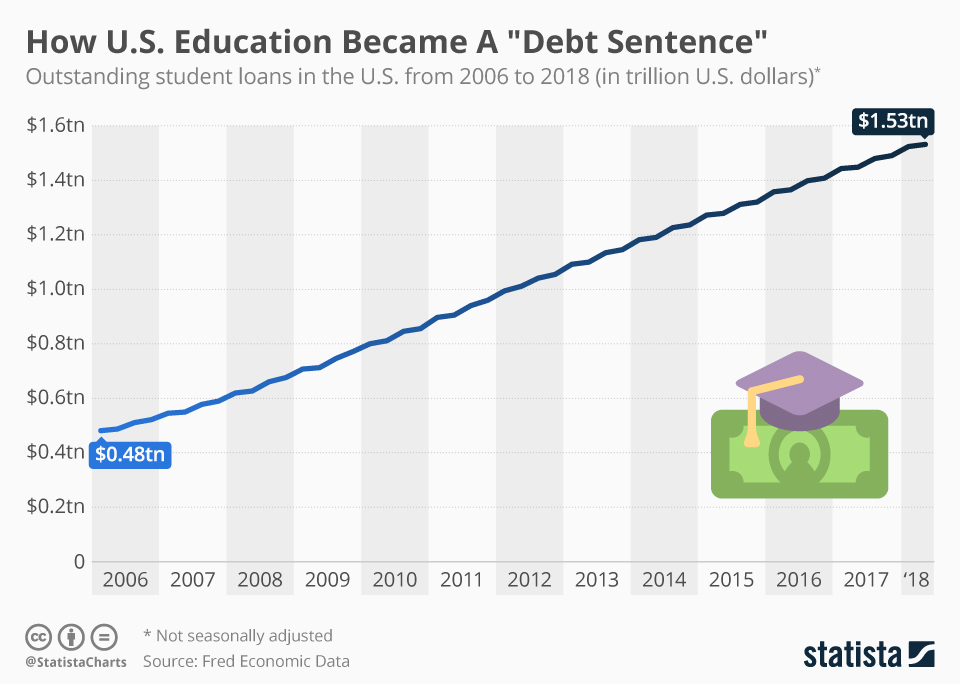

The student loan program became part of our government's legacy of failure during the Obama years. Many of us predicted it was a slippery slope that would lead to defaults and at the same time drive up the cost of higher education. This prediction has come true. Remember much of this money was borrowed under the pretense of being used for education but was used for living expenses such as apartments and cars. One thing that is clear is they will find a plaintiff. This is so big that loan forgiveness will affect states and taxpayers. Clearly, Biden is disingenuous in his effort to promote this as a done deal.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

My goal is not to bash Biden but more to attack the idea of outright forgiving these loans. The next post will center on economics or hopefully a far more interesting subject. Thanks, BW

ReplyDelete"Mid-Term" elections. That's what this is all about. Politicians are great at buying votes especially when they are in trouble and fear losing their seat.

ReplyDelete